Erste Asset Management GmbH purchased a new position in shares of AMETEK, Inc. (NYSE:AME - Free Report) in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 87,230 shares of the technology company's stock, valued at approximately $14,981,000.

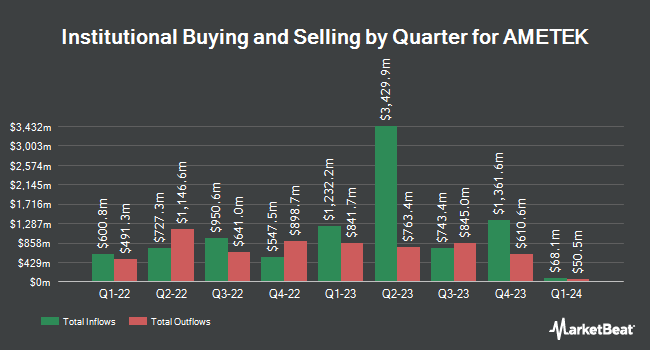

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in AME. Bank of New York Mellon Corp raised its stake in shares of AMETEK by 34.6% in the second quarter. Bank of New York Mellon Corp now owns 3,602,753 shares of the technology company's stock valued at $600,615,000 after acquiring an additional 926,657 shares during the last quarter. Dimensional Fund Advisors LP grew its holdings in AMETEK by 8.6% during the 2nd quarter. Dimensional Fund Advisors LP now owns 1,882,166 shares of the technology company's stock worth $313,777,000 after acquiring an additional 148,447 shares during the period. Principal Financial Group Inc. grew its holdings in AMETEK by 72.0% during the 3rd quarter. Principal Financial Group Inc. now owns 1,680,309 shares of the technology company's stock worth $288,526,000 after acquiring an additional 703,501 shares during the period. Kayne Anderson Rudnick Investment Management LLC grew its holdings in AMETEK by 12.6% during the 2nd quarter. Kayne Anderson Rudnick Investment Management LLC now owns 1,660,133 shares of the technology company's stock worth $276,761,000 after acquiring an additional 186,263 shares during the period. Finally, Charles Schwab Investment Management Inc. grew its holdings in AMETEK by 1.5% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,291,649 shares of the technology company's stock worth $221,789,000 after acquiring an additional 19,435 shares during the period. Institutional investors own 87.43% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages have recently issued reports on AME. KeyCorp boosted their price target on shares of AMETEK from $205.00 to $215.00 and gave the company an "overweight" rating in a report on Friday, November 22nd. Truist Financial upped their target price on shares of AMETEK from $219.00 to $221.00 and gave the stock a "buy" rating in a research note on Friday, November 1st. Wolfe Research raised shares of AMETEK to a "hold" rating in a report on Wednesday, September 18th. Robert W. Baird upped their target price on shares of AMETEK from $166.00 to $186.00 and gave the company a "neutral" rating in a report on Monday, November 4th. Finally, TD Cowen cut shares of AMETEK from a "hold" rating to a "sell" rating in a report on Monday, October 7th. One investment analyst has rated the stock with a sell rating, three have given a hold rating, five have issued a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, AMETEK presently has a consensus rating of "Moderate Buy" and an average target price of $199.29.

Check Out Our Latest Analysis on AME

AMETEK Trading Up 0.3 %

Shares of AME stock traded up $0.66 during trading hours on Monday, hitting $195.04. 200,241 shares of the company's stock traded hands, compared to its average volume of 1,149,844. The stock's 50 day simple moving average is $179.05 and its 200 day simple moving average is $171.63. The stock has a market cap of $45.11 billion, a PE ratio of 33.86, a price-to-earnings-growth ratio of 3.17 and a beta of 1.16. AMETEK, Inc. has a 12 month low of $149.03 and a 12 month high of $198.33. The company has a quick ratio of 0.84, a current ratio of 1.39 and a debt-to-equity ratio of 0.18.

AMETEK (NYSE:AME - Get Free Report) last announced its earnings results on Thursday, October 31st. The technology company reported $1.66 earnings per share for the quarter, topping analysts' consensus estimates of $1.62 by $0.04. AMETEK had a net margin of 19.27% and a return on equity of 16.88%. The business had revenue of $1.71 billion during the quarter, compared to the consensus estimate of $1.71 billion. During the same quarter last year, the firm earned $1.64 earnings per share. AMETEK's quarterly revenue was up 5.3% on a year-over-year basis. On average, sell-side analysts anticipate that AMETEK, Inc. will post 6.8 EPS for the current year.

AMETEK Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, December 20th. Investors of record on Friday, December 6th will be given a dividend of $0.28 per share. This represents a $1.12 dividend on an annualized basis and a dividend yield of 0.57%. The ex-dividend date is Friday, December 6th. AMETEK's payout ratio is currently 19.51%.

Insider Activity at AMETEK

In related news, insider Emanuela Speranza sold 6,747 shares of the business's stock in a transaction that occurred on Tuesday, November 26th. The shares were sold at an average price of $195.90, for a total transaction of $1,321,737.30. Following the completion of the transaction, the insider now owns 30,460 shares of the company's stock, valued at approximately $5,967,114. The trade was a 18.13 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Tony J. Ciampitti sold 16,210 shares of the business's stock in a transaction that occurred on Friday, November 22nd. The shares were sold at an average price of $197.01, for a total transaction of $3,193,532.10. Following the transaction, the insider now directly owns 49,490 shares of the company's stock, valued at approximately $9,750,024.90. This represents a 24.67 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 30,660 shares of company stock valued at $5,958,141 over the last ninety days. Corporate insiders own 0.61% of the company's stock.

About AMETEK

(

Free Report)

AMETEK, Inc manufactures and sells electronic instruments and electromechanical devices in the North America, Europe, Asia, and South America, and internationally. The company's EIG segment offers advanced instruments for the process, aerospace, power, and industrial markets; process and analytical instruments for the oil and gas, petrochemical, pharmaceutical, semiconductor, automation, and food and beverage industries; instruments to the laboratory equipment, ultra-precision manufacturing, medical, and test and measurement markets; power quality monitoring and c devices, uninterruptible power supplies, programmable power and electromagnetic compatibility test equipment, and sensors for gas turbines and dashboard instruments; heavy trucks, instrumentation, and controls for the food and beverage industries; and aircraft and engine sensors, power supplies, embedded computing, monitoring, fuel and fluid measurement, and data acquisition systems for aerospace and defense industry.

See Also

Before you consider AMETEK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AMETEK wasn't on the list.

While AMETEK currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report