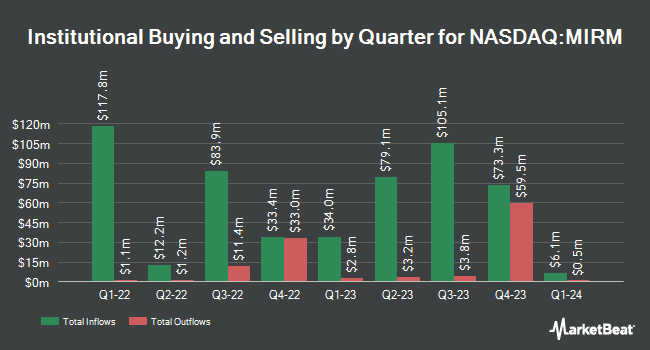

Erste Asset Management GmbH purchased a new position in Mirum Pharmaceuticals, Inc. (NASDAQ:MIRM - Free Report) during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 260,000 shares of the company's stock, valued at approximately $10,136,000. Erste Asset Management GmbH owned about 0.54% of Mirum Pharmaceuticals at the end of the most recent quarter.

A number of other hedge funds have also recently made changes to their positions in MIRM. Quest Partners LLC raised its position in shares of Mirum Pharmaceuticals by 7,513.3% in the 2nd quarter. Quest Partners LLC now owns 1,142 shares of the company's stock valued at $39,000 after purchasing an additional 1,127 shares during the last quarter. Amalgamated Bank raised its holdings in shares of Mirum Pharmaceuticals by 60.8% during the 2nd quarter. Amalgamated Bank now owns 1,357 shares of the company's stock worth $46,000 after acquiring an additional 513 shares during the period. Mirae Asset Global Investments Co. Ltd. raised its holdings in Mirum Pharmaceuticals by 22.6% in the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 1,725 shares of the company's stock valued at $67,000 after buying an additional 318 shares during the period. ProShare Advisors LLC purchased a new stake in Mirum Pharmaceuticals in the 2nd quarter valued at about $213,000. Finally, Creative Planning purchased a new stake in Mirum Pharmaceuticals during the third quarter worth about $249,000.

Wall Street Analysts Forecast Growth

MIRM has been the subject of a number of research analyst reports. Citigroup upped their price target on Mirum Pharmaceuticals from $65.00 to $68.00 and gave the company a "buy" rating in a report on Wednesday, November 13th. Leerink Partners upped their target price on Mirum Pharmaceuticals from $47.00 to $49.00 and gave the company an "outperform" rating in a report on Thursday, October 17th. HC Wainwright reissued a "buy" rating and issued a $66.00 price target on shares of Mirum Pharmaceuticals in a research note on Wednesday, November 13th. Robert W. Baird raised their price objective on Mirum Pharmaceuticals from $44.00 to $50.00 and gave the stock an "outperform" rating in a report on Wednesday, November 13th. Finally, Evercore ISI lifted their target price on Mirum Pharmaceuticals from $62.00 to $66.00 and gave the stock an "outperform" rating in a research report on Thursday, August 8th. Ten investment analysts have rated the stock with a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat.com, Mirum Pharmaceuticals currently has an average rating of "Buy" and an average price target of $57.73.

Get Our Latest Stock Report on Mirum Pharmaceuticals

Insider Activity

In related news, SVP Jolanda Howe sold 2,500 shares of Mirum Pharmaceuticals stock in a transaction that occurred on Thursday, November 14th. The shares were sold at an average price of $47.10, for a total transaction of $117,750.00. Following the transaction, the senior vice president now directly owns 2,426 shares of the company's stock, valued at $114,264.60. This trade represents a 50.75 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through this link. Company insiders own 22.87% of the company's stock.

Mirum Pharmaceuticals Stock Down 1.2 %

MIRM stock traded down $0.57 during trading on Monday, reaching $45.65. 109,564 shares of the stock were exchanged, compared to its average volume of 550,972. The firm has a market cap of $2.19 billion, a P/E ratio of -22.88 and a beta of 1.16. Mirum Pharmaceuticals, Inc. has a twelve month low of $23.14 and a twelve month high of $48.89. The firm's 50 day moving average is $40.93 and its 200 day moving average is $37.49. The company has a current ratio of 3.34, a quick ratio of 3.15 and a debt-to-equity ratio of 1.33.

Mirum Pharmaceuticals (NASDAQ:MIRM - Get Free Report) last posted its earnings results on Tuesday, November 12th. The company reported ($0.30) earnings per share for the quarter, topping analysts' consensus estimates of ($0.45) by $0.15. The firm had revenue of $90.38 million for the quarter, compared to the consensus estimate of $81.99 million. Mirum Pharmaceuticals had a negative return on equity of 41.22% and a negative net margin of 31.69%. The business's revenue for the quarter was up 89.4% on a year-over-year basis. During the same quarter in the prior year, the business earned ($0.57) EPS. As a group, research analysts forecast that Mirum Pharmaceuticals, Inc. will post -1.48 EPS for the current year.

Mirum Pharmaceuticals Profile

(

Free Report)

Mirum Pharmaceuticals, Inc, a biopharmaceutical company, focuses on the development and commercialization of novel therapies for debilitating rare and orphan diseases. Its lead product candidate is LIVMARLI (maralixibat), an orally administered and minimally absorbed ileal bile acid transporter (IBAT) inhibitor that is approved for the treatment of cholestatic pruritus in patients with Alagille syndrome in the United States and internationally.

Read More

Before you consider Mirum Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mirum Pharmaceuticals wasn't on the list.

While Mirum Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.