Erste Asset Management GmbH purchased a new position in shares of SolarEdge Technologies, Inc. (NASDAQ:SEDG - Free Report) during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund purchased 191,205 shares of the semiconductor company's stock, valued at approximately $4,420,000. Erste Asset Management GmbH owned approximately 0.33% of SolarEdge Technologies at the end of the most recent reporting period.

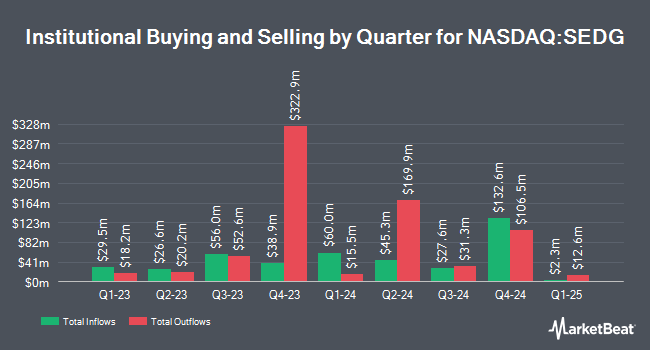

Several other institutional investors have also modified their holdings of SEDG. California State Teachers Retirement System raised its position in shares of SolarEdge Technologies by 1.6% during the 1st quarter. California State Teachers Retirement System now owns 51,728 shares of the semiconductor company's stock worth $3,672,000 after purchasing an additional 827 shares during the last quarter. Teachers Retirement System of The State of Kentucky raised its position in shares of SolarEdge Technologies by 19.5% during the 1st quarter. Teachers Retirement System of The State of Kentucky now owns 19,050 shares of the semiconductor company's stock worth $1,353,000 after purchasing an additional 3,107 shares during the last quarter. DekaBank Deutsche Girozentrale raised its position in shares of SolarEdge Technologies by 3,750.0% during the 1st quarter. DekaBank Deutsche Girozentrale now owns 46,200 shares of the semiconductor company's stock worth $3,243,000 after purchasing an additional 45,000 shares during the last quarter. Cabot Wealth Management Inc. raised its position in shares of SolarEdge Technologies by 7.8% during the 2nd quarter. Cabot Wealth Management Inc. now owns 29,452 shares of the semiconductor company's stock worth $744,000 after purchasing an additional 2,127 shares during the last quarter. Finally, Dnca Finance acquired a new position in shares of SolarEdge Technologies during the 2nd quarter worth approximately $859,000. Hedge funds and other institutional investors own 95.10% of the company's stock.

SolarEdge Technologies Stock Down 7.7 %

SolarEdge Technologies stock traded down $1.23 during trading on Tuesday, reaching $14.66. 3,628,138 shares of the company's stock were exchanged, compared to its average volume of 3,642,354. The company's 50-day moving average is $16.63 and its two-hundred day moving average is $25.64. The company has a quick ratio of 1.46, a current ratio of 2.34 and a debt-to-equity ratio of 0.39. SolarEdge Technologies, Inc. has a 52-week low of $10.24 and a 52-week high of $103.15.

SolarEdge Technologies (NASDAQ:SEDG - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The semiconductor company reported ($15.33) earnings per share for the quarter, missing analysts' consensus estimates of ($1.55) by ($13.78). The business had revenue of $260.90 million for the quarter, compared to analysts' expectations of $272.80 million. SolarEdge Technologies had a negative return on equity of 65.79% and a negative net margin of 158.19%. The firm's revenue for the quarter was down 64.0% on a year-over-year basis. During the same period last year, the company posted ($1.03) earnings per share. As a group, analysts forecast that SolarEdge Technologies, Inc. will post -19.03 EPS for the current fiscal year.

Insider Buying and Selling at SolarEdge Technologies

In other news, Chairman More Avery acquired 156,000 shares of the firm's stock in a transaction on Monday, November 11th. The stock was bought at an average cost of $13.65 per share, with a total value of $2,129,400.00. Following the transaction, the chairman now directly owns 244,478 shares in the company, valued at approximately $3,337,124.70. This represents a 176.32 % increase in their position. The acquisition was disclosed in a legal filing with the SEC, which can be accessed through this link. 0.67% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

SEDG has been the subject of several research reports. The Goldman Sachs Group cut their price objective on SolarEdge Technologies from $19.00 to $10.00 and set a "sell" rating for the company in a research report on Thursday, November 7th. Bank of America downgraded SolarEdge Technologies from a "neutral" rating to an "underperform" rating and cut their price objective for the stock from $21.00 to $14.00 in a research report on Thursday, November 7th. Royal Bank of Canada cut their price target on SolarEdge Technologies from $35.00 to $25.00 and set a "sector perform" rating for the company in a report on Tuesday, October 15th. Morgan Stanley reiterated an "underweight" rating and issued a $9.00 price target (down from $23.00) on shares of SolarEdge Technologies in a report on Friday, November 15th. Finally, Canaccord Genuity Group cut their price target on SolarEdge Technologies from $38.00 to $27.00 and set a "hold" rating for the company in a report on Thursday, August 8th. Nine equities research analysts have rated the stock with a sell rating, nineteen have given a hold rating and two have assigned a buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average price target of $22.04.

Read Our Latest Stock Report on SolarEdge Technologies

SolarEdge Technologies Profile

(

Free Report)

SolarEdge Technologies, Inc, together with its subsidiaries, designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally. It operates in two segments, Solar and Energy Storage.

Further Reading

Before you consider SolarEdge Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SolarEdge Technologies wasn't on the list.

While SolarEdge Technologies currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.