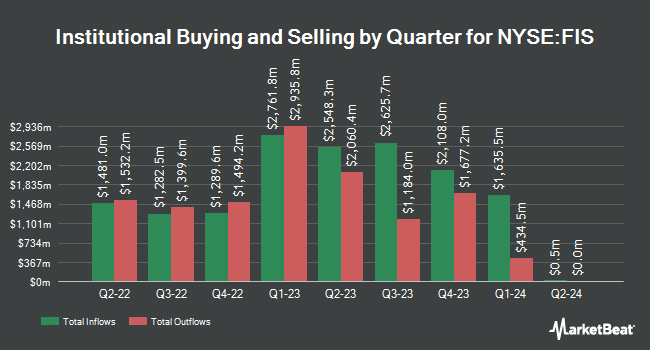

Erste Asset Management GmbH bought a new stake in shares of Fidelity National Information Services, Inc. (NYSE:FIS - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor bought 53,900 shares of the information technology services provider's stock, valued at approximately $4,481,000.

A number of other institutional investors and hedge funds have also recently modified their holdings of the stock. Dimensional Fund Advisors LP grew its position in shares of Fidelity National Information Services by 5.0% during the 2nd quarter. Dimensional Fund Advisors LP now owns 5,251,434 shares of the information technology services provider's stock valued at $395,729,000 after acquiring an additional 249,678 shares during the period. Legal & General Group Plc boosted its holdings in Fidelity National Information Services by 1.6% in the 2nd quarter. Legal & General Group Plc now owns 4,938,091 shares of the information technology services provider's stock worth $372,135,000 after buying an additional 75,429 shares during the period. The Manufacturers Life Insurance Company boosted its holdings in Fidelity National Information Services by 13.8% in the 3rd quarter. The Manufacturers Life Insurance Company now owns 4,433,946 shares of the information technology services provider's stock worth $371,343,000 after buying an additional 538,514 shares during the period. Raymond James & Associates boosted its holdings in Fidelity National Information Services by 449.8% in the 3rd quarter. Raymond James & Associates now owns 4,103,793 shares of the information technology services provider's stock worth $343,693,000 after buying an additional 3,357,329 shares during the period. Finally, FMR LLC boosted its holdings in Fidelity National Information Services by 6.7% in the 3rd quarter. FMR LLC now owns 2,794,215 shares of the information technology services provider's stock worth $234,015,000 after buying an additional 174,673 shares during the period. 96.23% of the stock is owned by institutional investors.

Insiders Place Their Bets

In other news, EVP Lenore D. Williams sold 11,305 shares of Fidelity National Information Services stock in a transaction dated Friday, November 15th. The shares were sold at an average price of $87.97, for a total transaction of $994,500.85. Following the sale, the executive vice president now owns 32,199 shares of the company's stock, valued at approximately $2,832,546.03. The trade was a 25.99 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director Jeffrey A. Goldstein bought 626 shares of the business's stock in a transaction dated Tuesday, October 15th. The shares were bought at an average cost of $88.25 per share, for a total transaction of $55,244.50. Following the purchase, the director now directly owns 10,397 shares in the company, valued at approximately $917,535.25. This represents a 6.41 % increase in their position. The disclosure for this purchase can be found here. Insiders own 0.20% of the company's stock.

Analyst Upgrades and Downgrades

FIS has been the subject of several analyst reports. Susquehanna raised their price objective on shares of Fidelity National Information Services from $88.00 to $103.00 and gave the stock a "positive" rating in a report on Tuesday, November 5th. BNP Paribas downgraded shares of Fidelity National Information Services from a "neutral" rating to an "underperform" rating in a report on Wednesday, November 20th. Compass Point assumed coverage on shares of Fidelity National Information Services in a report on Wednesday, November 20th. They issued a "buy" rating and a $126.00 price objective for the company. Morgan Stanley increased their target price on shares of Fidelity National Information Services from $80.00 to $87.00 and gave the stock an "equal weight" rating in a research note on Tuesday, November 5th. Finally, TD Cowen increased their target price on shares of Fidelity National Information Services from $78.00 to $86.00 and gave the stock a "hold" rating in a research note on Tuesday, November 5th. One research analyst has rated the stock with a sell rating, nine have assigned a hold rating and twelve have issued a buy rating to the company's stock. Based on data from MarketBeat.com, Fidelity National Information Services has an average rating of "Moderate Buy" and an average price target of $91.50.

Check Out Our Latest Report on FIS

Fidelity National Information Services Trading Up 0.2 %

Shares of FIS stock traded up $0.13 on Tuesday, hitting $85.26. 4,191,514 shares of the company's stock traded hands, compared to its average volume of 3,549,338. The company has a debt-to-equity ratio of 0.63, a quick ratio of 1.18 and a current ratio of 1.18. Fidelity National Information Services, Inc. has a one year low of $57.13 and a one year high of $91.98. The company's fifty day simple moving average is $87.06 and its 200 day simple moving average is $81.13. The stock has a market capitalization of $45.90 billion, a price-to-earnings ratio of 33.97, a P/E/G ratio of 0.72 and a beta of 1.03.

Fidelity National Information Services (NYSE:FIS - Get Free Report) last announced its quarterly earnings results on Monday, November 4th. The information technology services provider reported $1.40 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.29 by $0.11. The business had revenue of $2.57 billion for the quarter, compared to analyst estimates of $2.56 billion. Fidelity National Information Services had a net margin of 14.37% and a return on equity of 15.35%. The company's revenue was up 3.1% on a year-over-year basis. During the same quarter last year, the firm earned $0.94 EPS. Equities analysts forecast that Fidelity National Information Services, Inc. will post 5.18 EPS for the current year.

Fidelity National Information Services Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Monday, December 23rd. Shareholders of record on Monday, December 9th will be issued a $0.36 dividend. This represents a $1.44 dividend on an annualized basis and a yield of 1.69%. The ex-dividend date is Monday, December 9th. Fidelity National Information Services's dividend payout ratio (DPR) is presently 57.37%.

About Fidelity National Information Services

(

Free Report)

Fidelity National Information Services, Inc engages in the provision of financial services technology solutions for financial institutions, businesses, and developers worldwide. It operates through Banking Solutions, Capital Market Solutions, and Corporate and Other segments. The company provides core processing and ancillary applications; mobile and online banking; fraud, risk management, and compliance; card and retail payment; electronic funds transfer and network; wealth and retirement; and item processing and output solutions.

Further Reading

Before you consider Fidelity National Information Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fidelity National Information Services wasn't on the list.

While Fidelity National Information Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report