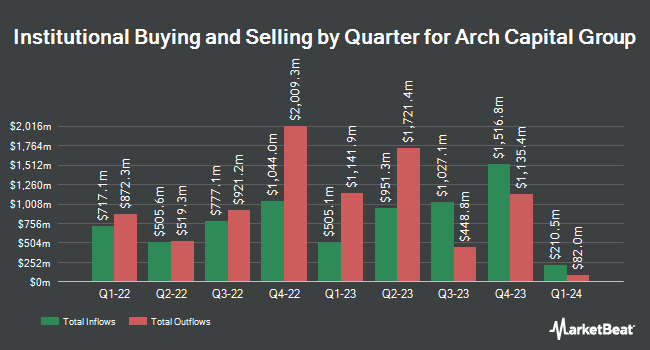

Erste Asset Management GmbH bought a new position in Arch Capital Group Ltd. (NASDAQ:ACGL - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm bought 736,030 shares of the insurance provider's stock, valued at approximately $82,748,000. Arch Capital Group accounts for about 1.0% of Erste Asset Management GmbH's holdings, making the stock its 19th largest holding. Erste Asset Management GmbH owned about 0.20% of Arch Capital Group as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also modified their holdings of ACGL. Principal Financial Group Inc. boosted its position in Arch Capital Group by 4.8% during the 3rd quarter. Principal Financial Group Inc. now owns 7,438,738 shares of the insurance provider's stock worth $832,246,000 after acquiring an additional 337,786 shares during the period. Allspring Global Investments Holdings LLC boosted its holdings in shares of Arch Capital Group by 1.0% during the third quarter. Allspring Global Investments Holdings LLC now owns 5,124,251 shares of the insurance provider's stock worth $573,301,000 after purchasing an additional 49,426 shares during the period. Dimensional Fund Advisors LP boosted its holdings in shares of Arch Capital Group by 6.6% during the second quarter. Dimensional Fund Advisors LP now owns 3,925,288 shares of the insurance provider's stock worth $396,026,000 after purchasing an additional 244,285 shares during the period. Legal & General Group Plc grew its position in Arch Capital Group by 10.1% during the second quarter. Legal & General Group Plc now owns 3,455,949 shares of the insurance provider's stock valued at $348,671,000 after purchasing an additional 316,070 shares in the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its stake in Arch Capital Group by 245.1% in the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 3,053,739 shares of the insurance provider's stock valued at $341,652,000 after buying an additional 2,168,897 shares during the period. Hedge funds and other institutional investors own 89.07% of the company's stock.

Arch Capital Group Stock Performance

Shares of NASDAQ ACGL traded down $0.02 during mid-day trading on Friday, hitting $100.72. The company had a trading volume of 797,236 shares, compared to its average volume of 2,154,699. Arch Capital Group Ltd. has a 12 month low of $72.85 and a 12 month high of $116.47. The firm has a market cap of $37.89 billion, a P/E ratio of 6.76, a PEG ratio of 1.60 and a beta of 0.61. The business's 50-day simple moving average is $105.40 and its 200-day simple moving average is $103.41. The company has a debt-to-equity ratio of 0.17, a current ratio of 0.58 and a quick ratio of 0.58.

Arch Capital Group (NASDAQ:ACGL - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The insurance provider reported $1.99 EPS for the quarter, topping analysts' consensus estimates of $1.94 by $0.05. Arch Capital Group had a return on equity of 18.94% and a net margin of 33.86%. The company had revenue of $4.72 billion during the quarter, compared to the consensus estimate of $4.05 billion. During the same quarter last year, the company earned $2.31 EPS. As a group, analysts predict that Arch Capital Group Ltd. will post 8.99 earnings per share for the current fiscal year.

Arch Capital Group Announces Dividend

The firm also recently announced a special dividend, which will be paid on Wednesday, December 4th. Stockholders of record on Monday, November 18th will be given a dividend of $5.00 per share. The ex-dividend date of this dividend is Monday, November 18th.

Wall Street Analyst Weigh In

A number of equities analysts have recently weighed in on ACGL shares. BMO Capital Markets upped their price target on shares of Arch Capital Group from $98.00 to $104.00 and gave the stock a "market perform" rating in a research note on Wednesday, November 6th. Keefe, Bruyette & Woods increased their price objective on Arch Capital Group from $120.00 to $121.00 and gave the stock an "outperform" rating in a report on Wednesday, August 7th. JMP Securities lifted their target price on shares of Arch Capital Group from $115.00 to $125.00 and gave the company a "market outperform" rating in a research note on Tuesday, October 15th. Citigroup increased their price target on shares of Arch Capital Group from $105.00 to $114.00 and gave the stock a "neutral" rating in a research note on Tuesday, September 10th. Finally, Jefferies Financial Group lifted their price objective on shares of Arch Capital Group from $114.00 to $134.00 and gave the company a "buy" rating in a research note on Wednesday, October 9th. Six research analysts have rated the stock with a hold rating and eleven have issued a buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $118.38.

View Our Latest Stock Analysis on ACGL

Arch Capital Group Profile

(

Free Report)

Arch Capital Group Ltd., together with its subsidiaries, provides insurance, reinsurance, and mortgage insurance products worldwide. The company's Insurance segment offers primary and excess casualty coverages; loss sensitive primary casualty insurance programs; directors' and officers' liability, errors and omissions liability, employment practices and fiduciary liability, crime, professional indemnity, and other financial related coverages; medical professional and general liability insurance coverages; and workers' compensation and umbrella liability, as well as commercial automobile and inland marine products.

See Also

Before you consider Arch Capital Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arch Capital Group wasn't on the list.

While Arch Capital Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.