Erste Asset Management GmbH purchased a new position in shares of Block, Inc. (NYSE:SQ - Free Report) in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm purchased 264,360 shares of the technology company's stock, valued at approximately $17,746,000.

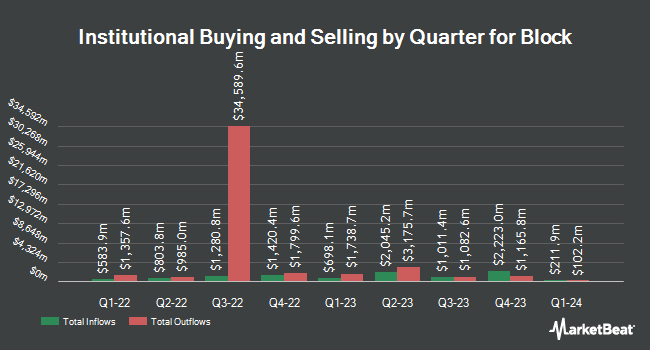

Other hedge funds also recently made changes to their positions in the company. Swiss National Bank increased its position in shares of Block by 0.5% in the third quarter. Swiss National Bank now owns 1,651,886 shares of the technology company's stock valued at $110,891,000 after acquiring an additional 8,200 shares during the last quarter. National Pension Service grew its stake in Block by 13.5% in the third quarter. National Pension Service now owns 1,083,113 shares of the technology company's stock valued at $72,709,000 after purchasing an additional 128,832 shares in the last quarter. Baillie Gifford & Co. grew its stake in Block by 1.5% in the third quarter. Baillie Gifford & Co. now owns 10,233,102 shares of the technology company's stock valued at $686,948,000 after purchasing an additional 147,873 shares in the last quarter. Lone Pine Capital LLC increased its position in shares of Block by 13.9% during the 2nd quarter. Lone Pine Capital LLC now owns 7,670,523 shares of the technology company's stock worth $494,672,000 after purchasing an additional 934,588 shares during the last quarter. Finally, DekaBank Deutsche Girozentrale raised its stake in shares of Block by 2.7% during the 3rd quarter. DekaBank Deutsche Girozentrale now owns 541,204 shares of the technology company's stock worth $35,969,000 after purchasing an additional 14,163 shares in the last quarter. 70.44% of the stock is owned by institutional investors.

Block Price Performance

Shares of NYSE SQ traded up $4.22 during midday trading on Monday, reaching $92.77. 14,013,830 shares of the company were exchanged, compared to its average volume of 8,247,938. The stock's 50-day moving average price is $76.53 and its 200-day moving average price is $68.85. The stock has a market cap of $57.50 billion, a P/E ratio of 52.12, a PEG ratio of 1.19 and a beta of 2.48. The company has a quick ratio of 2.07, a current ratio of 2.07 and a debt-to-equity ratio of 0.26. Block, Inc. has a one year low of $55.00 and a one year high of $95.95.

Wall Street Analyst Weigh In

A number of equities analysts recently commented on the company. Royal Bank of Canada reissued an "outperform" rating and set a $88.00 price target on shares of Block in a research report on Monday, October 21st. BNP Paribas downgraded shares of Block from an "outperform" rating to a "neutral" rating and set a $88.00 price objective on the stock. in a report on Wednesday, November 20th. Canaccord Genuity Group raised their target price on shares of Block from $95.00 to $120.00 and gave the stock a "buy" rating in a research note on Tuesday, November 12th. The Goldman Sachs Group lifted their target price on shares of Block from $87.00 to $102.00 and gave the stock a "buy" rating in a report on Monday. Finally, BMO Capital Markets cut shares of Block from an "outperform" rating to a "market perform" rating and increased their price target for the company from $94.00 to $100.00 in a report on Monday, November 25th. One research analyst has rated the stock with a sell rating, seven have assigned a hold rating and twenty-four have given a buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $93.21.

Read Our Latest Research Report on SQ

Insider Activity at Block

In other Block news, CFO Amrita Ahuja sold 6,661 shares of the stock in a transaction that occurred on Thursday, November 21st. The shares were sold at an average price of $91.43, for a total transaction of $609,015.23. Following the completion of the sale, the chief financial officer now owns 246,967 shares of the company's stock, valued at approximately $22,580,192.81. This represents a 2.63 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CAO Ajmere Dale sold 500 shares of the stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $67.00, for a total transaction of $33,500.00. Following the sale, the chief accounting officer now owns 90,460 shares of the company's stock, valued at approximately $6,060,820. This trade represents a 0.55 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 29,053 shares of company stock worth $2,393,972 in the last quarter. 10.49% of the stock is owned by insiders.

Block Profile

(

Free Report)

Square, Inc provides payment and point-of-sale solutions in the United States and internationally. The company's commerce ecosystem includes point-of-sale software and hardware that enables sellers to turn mobile and computing devices into payment and point-of-sale solutions. It offers hardware products, including Magstripe reader, which enables swiped transactions of magnetic stripe cards; Contactless and chip reader that accepts EMV® chip cards and Near Field Communication payments; Chip card reader, which accepts EMV® chip cards and enables swiped transactions of magnetic stripe cards; Square Stand, which enables an iPad to be used as a payment terminal or full point of sale solution; and Square Register that combines its hardware, point-of-sale software, and payments technology, as well as managed payments solutions.

Recommended Stories

Before you consider Block, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Block wasn't on the list.

While Block currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.