Erste Asset Management GmbH acquired a new stake in Lowe's Companies, Inc. (NYSE:LOW - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 22,371 shares of the home improvement retailer's stock, valued at approximately $5,976,000.

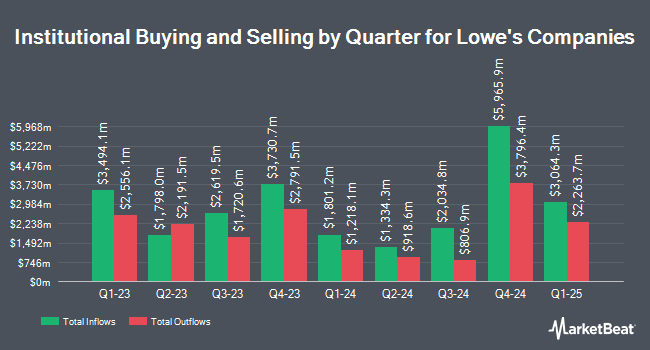

Several other hedge funds have also recently modified their holdings of the business. FMR LLC lifted its position in shares of Lowe's Companies by 10.2% in the 3rd quarter. FMR LLC now owns 26,010,730 shares of the home improvement retailer's stock worth $7,045,006,000 after purchasing an additional 2,399,897 shares during the period. Legal & General Group Plc lifted its position in shares of Lowe's Companies by 1.6% in the 2nd quarter. Legal & General Group Plc now owns 5,205,491 shares of the home improvement retailer's stock worth $1,147,603,000 after purchasing an additional 82,978 shares during the period. Charles Schwab Investment Management Inc. raised its stake in shares of Lowe's Companies by 1.2% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 3,369,052 shares of the home improvement retailer's stock worth $912,508,000 after acquiring an additional 39,953 shares in the last quarter. Ontario Teachers Pension Plan Board raised its stake in shares of Lowe's Companies by 1.6% during the 3rd quarter. Ontario Teachers Pension Plan Board now owns 2,343,365 shares of the home improvement retailer's stock worth $634,700,000 after acquiring an additional 36,054 shares in the last quarter. Finally, International Assets Investment Management LLC raised its stake in shares of Lowe's Companies by 1,889.7% during the 3rd quarter. International Assets Investment Management LLC now owns 2,134,969 shares of the home improvement retailer's stock worth $578,256,000 after acquiring an additional 2,027,668 shares in the last quarter. Hedge funds and other institutional investors own 74.06% of the company's stock.

Insider Activity

In related news, EVP Quonta D. Vance sold 7,198 shares of the firm's stock in a transaction dated Wednesday, November 27th. The shares were sold at an average price of $274.37, for a total transaction of $1,974,915.26. Following the completion of the sale, the executive vice president now directly owns 16,703 shares in the company, valued at approximately $4,582,802.11. This trade represents a 30.12 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CAO Dan Clayton Griggs, Jr. sold 6,769 shares of the firm's stock in a transaction dated Thursday, September 12th. The stock was sold at an average price of $248.82, for a total transaction of $1,684,262.58. Following the sale, the chief accounting officer now owns 9,383 shares of the company's stock, valued at approximately $2,334,678.06. The trade was a 41.91 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 19,697 shares of company stock worth $5,214,586 over the last three months. Insiders own 0.26% of the company's stock.

Analysts Set New Price Targets

A number of research analysts have issued reports on LOW shares. Wells Fargo & Company upped their price target on shares of Lowe's Companies from $280.00 to $295.00 and gave the company an "overweight" rating in a research note on Wednesday, November 6th. Wedbush reiterated a "neutral" rating and issued a $250.00 price objective on shares of Lowe's Companies in a research note on Wednesday, August 21st. Barclays increased their price objective on shares of Lowe's Companies from $229.00 to $245.00 and gave the stock an "equal weight" rating in a research note on Wednesday, November 20th. Gordon Haskett cut their price objective on shares of Lowe's Companies from $245.00 to $240.00 and set a "hold" rating on the stock in a research note on Wednesday, August 21st. Finally, Mizuho increased their price objective on shares of Lowe's Companies from $280.00 to $282.00 and gave the stock an "outperform" rating in a research note on Wednesday, November 20th. Ten equities research analysts have rated the stock with a hold rating and sixteen have given a buy rating to the stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $277.92.

View Our Latest Stock Analysis on LOW

Lowe's Companies Stock Performance

Shares of NYSE LOW traded up $2.29 during mid-day trading on Tuesday, reaching $274.34. The company's stock had a trading volume of 2,459,123 shares, compared to its average volume of 2,447,090. The stock has a 50-day moving average of $270.64 and a two-hundred day moving average of $246.88. The stock has a market capitalization of $154.91 billion, a P/E ratio of 22.88, a P/E/G ratio of 2.28 and a beta of 1.09. Lowe's Companies, Inc. has a 1-year low of $203.72 and a 1-year high of $287.01.

About Lowe's Companies

(

Free Report)

Lowe's Companies, Inc, together with its subsidiaries, operates as a home improvement retailer in the United States. The company offers a line of products for construction, maintenance, repair, remodeling, and decorating. It also provides home improvement products, such as appliances, seasonal and outdoor living, lawn and garden, lumber, kitchens and bath, tools, paint, millwork, hardware, flooring, rough plumbing, building materials, décor, and electrical.

See Also

Before you consider Lowe's Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lowe's Companies wasn't on the list.

While Lowe's Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report