Erste Asset Management GmbH bought a new position in Kinross Gold Co. (NYSE:KGC - Free Report) TSE: K in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund bought 105,000 shares of the mining company's stock, valued at approximately $992,000.

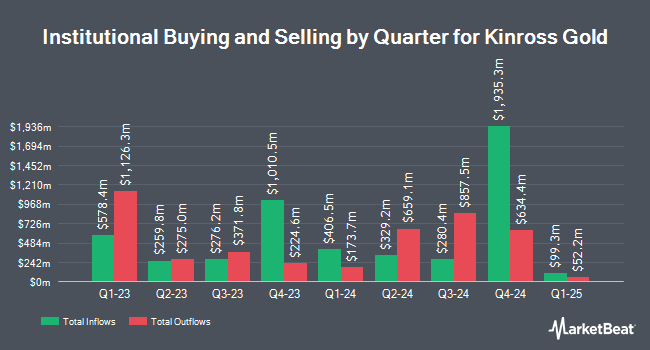

Other hedge funds and other institutional investors also recently modified their holdings of the company. Cetera Advisors LLC boosted its holdings in shares of Kinross Gold by 10.1% in the 1st quarter. Cetera Advisors LLC now owns 19,873 shares of the mining company's stock valued at $122,000 after buying an additional 1,828 shares during the period. First Hawaiian Bank acquired a new position in shares of Kinross Gold in the 2nd quarter valued at about $129,000. Fulton Bank N.A. acquired a new position in shares of Kinross Gold in the 2nd quarter valued at about $144,000. OLD National Bancorp IN acquired a new position in shares of Kinross Gold in the 2nd quarter valued at about $95,000. Finally, Artemis Investment Management LLP boosted its holdings in shares of Kinross Gold by 321.5% in the 2nd quarter. Artemis Investment Management LLP now owns 6,695,496 shares of the mining company's stock valued at $55,707,000 after buying an additional 5,107,120 shares during the period. Institutional investors own 63.69% of the company's stock.

Kinross Gold Stock Performance

Kinross Gold stock traded up $0.02 during midday trading on Wednesday, reaching $9.94. 15,056,592 shares of the stock traded hands, compared to its average volume of 15,505,691. The company has a current ratio of 1.61, a quick ratio of 0.63 and a debt-to-equity ratio of 0.18. The firm has a fifty day moving average price of $9.93 and a two-hundred day moving average price of $9.05. The firm has a market cap of $12.22 billion, a price-to-earnings ratio of 16.30, a PEG ratio of 0.43 and a beta of 1.21. Kinross Gold Co. has a fifty-two week low of $4.75 and a fifty-two week high of $10.82.

Kinross Gold (NYSE:KGC - Get Free Report) TSE: K last issued its quarterly earnings results on Tuesday, November 5th. The mining company reported $0.24 earnings per share for the quarter, topping analysts' consensus estimates of $0.19 by $0.05. The company had revenue of $1.43 billion during the quarter, compared to analyst estimates of $1.32 billion. Kinross Gold had a net margin of 15.23% and a return on equity of 11.49%. The business's revenue for the quarter was up 29.9% compared to the same quarter last year. During the same period in the prior year, the business posted $0.12 EPS. On average, equities research analysts forecast that Kinross Gold Co. will post 0.7 earnings per share for the current year.

Kinross Gold Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Thursday, December 12th. Stockholders of record on Thursday, November 28th will be paid a $0.03 dividend. This represents a $0.12 dividend on an annualized basis and a dividend yield of 1.21%. The ex-dividend date is Wednesday, November 27th. Kinross Gold's dividend payout ratio is currently 19.67%.

Wall Street Analysts Forecast Growth

Several research analysts have recently commented on KGC shares. StockNews.com raised shares of Kinross Gold from a "buy" rating to a "strong-buy" rating in a report on Saturday, November 9th. Scotiabank lifted their price target on shares of Kinross Gold from $9.50 to $11.00 and gave the company a "sector outperform" rating in a report on Monday, August 19th. Finally, Jefferies Financial Group boosted their target price on shares of Kinross Gold from $9.00 to $10.00 and gave the company a "hold" rating in a research note on Friday, October 4th. One equities research analyst has rated the stock with a hold rating, two have given a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, Kinross Gold presently has a consensus rating of "Buy" and a consensus target price of $11.13.

Get Our Latest Research Report on Kinross Gold

Kinross Gold Company Profile

(

Free Report)

Kinross Gold Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of gold properties principally in the United States, Brazil, Chile, Canada, and Mauritania. The company operates the Fort Knox mine and the Manh Choh project in Alaska, as well as the Round Mountain and the Bald Mountain mines in Nevada, the United States; the Paracatu mine in Brazil; the La Coipa and the Lobo-Marte project in Chile; the Tasiast mine in Mauritania; and the Great Bear project in Canada.

Featured Articles

Before you consider Kinross Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kinross Gold wasn't on the list.

While Kinross Gold currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.