Erste Asset Management GmbH lessened its holdings in shares of Hannon Armstrong Sustainable Infrastructure Capital, Inc. (NYSE:HASI - Free Report) by 1.5% in the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 2,117,480 shares of the real estate investment trust's stock after selling 32,803 shares during the quarter. Erste Asset Management GmbH owned 1.79% of Hannon Armstrong Sustainable Infrastructure Capital worth $58,029,000 at the end of the most recent quarter.

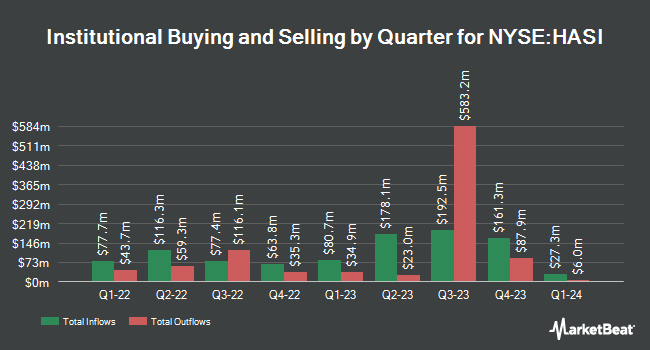

Other hedge funds have also recently bought and sold shares of the company. JPMorgan Chase & Co. lifted its holdings in Hannon Armstrong Sustainable Infrastructure Capital by 42.1% during the 3rd quarter. JPMorgan Chase & Co. now owns 300,587 shares of the real estate investment trust's stock worth $10,361,000 after buying an additional 89,126 shares during the last quarter. Pallas Capital Advisors LLC bought a new position in Hannon Armstrong Sustainable Infrastructure Capital during the 4th quarter worth approximately $2,451,000. Harbor Capital Advisors Inc. lifted its holdings in Hannon Armstrong Sustainable Infrastructure Capital by 42.4% during the 4th quarter. Harbor Capital Advisors Inc. now owns 71,995 shares of the real estate investment trust's stock worth $1,932,000 after buying an additional 21,446 shares during the last quarter. Oppenheimer & Co. Inc. lifted its holdings in Hannon Armstrong Sustainable Infrastructure Capital by 16.2% during the 3rd quarter. Oppenheimer & Co. Inc. now owns 197,921 shares of the real estate investment trust's stock worth $6,822,000 after buying an additional 27,529 shares during the last quarter. Finally, Nisa Investment Advisors LLC lifted its holdings in Hannon Armstrong Sustainable Infrastructure Capital by 23.9% during the 4th quarter. Nisa Investment Advisors LLC now owns 36,208 shares of the real estate investment trust's stock worth $986,000 after buying an additional 6,990 shares during the last quarter. Institutional investors and hedge funds own 96.14% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms have commented on HASI. Wells Fargo & Company began coverage on Hannon Armstrong Sustainable Infrastructure Capital in a report on Thursday, February 27th. They set an "overweight" rating and a $33.00 target price on the stock. Bank of America initiated coverage on Hannon Armstrong Sustainable Infrastructure Capital in a report on Monday, November 25th. They set a "buy" rating and a $40.00 target price on the stock. Citigroup raised Hannon Armstrong Sustainable Infrastructure Capital from a "neutral" rating to a "buy" rating and set a $36.00 price target on the stock in a report on Wednesday, January 8th. JPMorgan Chase & Co. cut their price target on Hannon Armstrong Sustainable Infrastructure Capital from $42.00 to $39.00 and set an "overweight" rating on the stock in a report on Thursday, January 23rd. Finally, The Goldman Sachs Group cut their price target on Hannon Armstrong Sustainable Infrastructure Capital from $32.00 to $31.00 and set a "neutral" rating on the stock in a report on Tuesday, December 17th. One equities research analyst has rated the stock with a sell rating, one has issued a hold rating, twelve have issued a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $39.71.

Read Our Latest Analysis on Hannon Armstrong Sustainable Infrastructure Capital

Hannon Armstrong Sustainable Infrastructure Capital Stock Performance

HASI traded up $0.57 during trading hours on Friday, hitting $29.07. The company's stock had a trading volume of 881,663 shares, compared to its average volume of 1,064,910. Hannon Armstrong Sustainable Infrastructure Capital, Inc. has a fifty-two week low of $24.00 and a fifty-two week high of $36.56. The company has a current ratio of 11.25, a quick ratio of 13.55 and a debt-to-equity ratio of 1.83. The firm has a market capitalization of $3.47 billion, a PE ratio of 18.40, a PEG ratio of 1.06 and a beta of 2.04. The company has a 50-day simple moving average of $28.08 and a 200 day simple moving average of $30.45.

Hannon Armstrong Sustainable Infrastructure Capital (NYSE:HASI - Get Free Report) last posted its earnings results on Thursday, February 13th. The real estate investment trust reported $0.57 EPS for the quarter, missing the consensus estimate of $0.59 by ($0.02). Hannon Armstrong Sustainable Infrastructure Capital had a net margin of 52.15% and a return on equity of 11.84%. The business had revenue of $37.74 million during the quarter, compared to analyst estimates of $25.93 million. As a group, sell-side analysts expect that Hannon Armstrong Sustainable Infrastructure Capital, Inc. will post 2.45 EPS for the current year.

Hannon Armstrong Sustainable Infrastructure Capital Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, April 18th. Stockholders of record on Friday, April 4th will be given a dividend of $0.42 per share. The ex-dividend date is Friday, April 4th. This is a boost from Hannon Armstrong Sustainable Infrastructure Capital's previous quarterly dividend of $0.42. This represents a $1.68 annualized dividend and a dividend yield of 5.78%. Hannon Armstrong Sustainable Infrastructure Capital's dividend payout ratio (DPR) is 106.33%.

About Hannon Armstrong Sustainable Infrastructure Capital

(

Free Report)

Hannon Armstrong Sustainable Infrastructure Capital, Inc, through its subsidiaries, engages in the investment in energy efficiency, renewable energy, and sustainable infrastructure markets in the United States. The company's portfolio includes equity investments, commercial and government receivables, real estate, and debt securities.

See Also

Before you consider HA Sustainable Infrastructure Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HA Sustainable Infrastructure Capital wasn't on the list.

While HA Sustainable Infrastructure Capital currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.