Erste Asset Management GmbH acquired a new position in shares of Grab Holdings Limited (NASDAQ:GRAB - Free Report) in the third quarter, according to its most recent 13F filing with the SEC. The institutional investor acquired 250,000 shares of the company's stock, valued at approximately $962,000.

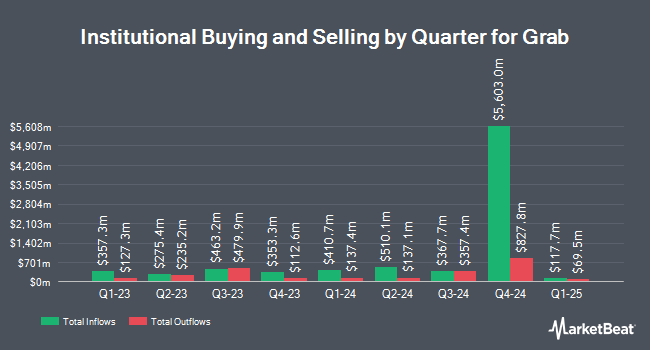

Other institutional investors and hedge funds have also made changes to their positions in the company. Vanguard Group Inc. boosted its position in Grab by 2.3% in the 1st quarter. Vanguard Group Inc. now owns 7,505,636 shares of the company's stock valued at $23,568,000 after buying an additional 166,063 shares during the last quarter. Price T Rowe Associates Inc. MD boosted its position in Grab by 20.1% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 364,983 shares of the company's stock valued at $1,147,000 after buying an additional 61,183 shares during the last quarter. DNB Asset Management AS lifted its position in shares of Grab by 87.6% during the second quarter. DNB Asset Management AS now owns 515,020 shares of the company's stock worth $1,828,000 after purchasing an additional 240,482 shares during the last quarter. SG Americas Securities LLC lifted its position in shares of Grab by 30.1% during the second quarter. SG Americas Securities LLC now owns 3,796,898 shares of the company's stock worth $13,479,000 after purchasing an additional 878,375 shares during the last quarter. Finally, Prospect Financial Services LLC bought a new position in Grab in the second quarter worth about $53,000. 55.52% of the stock is currently owned by institutional investors and hedge funds.

Grab Trading Up 0.4 %

Shares of GRAB traded up $0.02 on Wednesday, reaching $5.31. 44,355,375 shares of the company's stock were exchanged, compared to its average volume of 26,012,191. Grab Holdings Limited has a 12 month low of $2.90 and a 12 month high of $5.72. The company has a current ratio of 2.70, a quick ratio of 2.67 and a debt-to-equity ratio of 0.04. The stock has a market capitalization of $21.38 billion, a P/E ratio of -264.50 and a beta of 0.90. The business has a 50 day moving average price of $4.31 and a two-hundred day moving average price of $3.76.

Grab (NASDAQ:GRAB - Get Free Report) last issued its earnings results on Monday, November 11th. The company reported $0.01 EPS for the quarter. Grab had a negative net margin of 3.57% and a negative return on equity of 1.50%. The firm had revenue of $716.00 million during the quarter, compared to the consensus estimate of $705.40 million. During the same quarter in the prior year, the firm earned ($0.02) earnings per share. Research analysts anticipate that Grab Holdings Limited will post -0.03 earnings per share for the current year.

Analyst Upgrades and Downgrades

GRAB has been the topic of several analyst reports. Mizuho raised their price target on shares of Grab from $5.00 to $6.00 and gave the company an "outperform" rating in a research note on Wednesday, November 13th. JPMorgan Chase & Co. raised their price target on shares of Grab from $5.00 to $5.70 and gave the company an "overweight" rating in a research note on Tuesday, November 12th. China Renaissance lowered shares of Grab from a "buy" rating to a "hold" rating and set a $5.40 price target on the stock. in a research note on Thursday, November 21st. Barclays raised their price target on shares of Grab from $4.70 to $5.50 and gave the company an "overweight" rating in a research note on Wednesday, November 13th. Finally, Daiwa Capital Markets started coverage on shares of Grab in a research note on Wednesday, October 23rd. They set an "outperform" rating and a $4.60 price objective on the stock. One research analyst has rated the stock with a sell rating, one has assigned a hold rating and nine have given a buy rating to the stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $5.42.

View Our Latest Report on GRAB

Grab Company Profile

(

Free Report)

Grab Holdings Limited engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. The company offers its Grab ecosystem, a single platform with superapps for driver- and merchant-partners and consumers, that allows access to mobility, delivery, digital financial services, and enterprise sector offerings.

Read More

Before you consider Grab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grab wasn't on the list.

While Grab currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.