Erste Asset Management GmbH purchased a new position in shares of CF Industries Holdings, Inc. (NYSE:CF - Free Report) during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor purchased 6,000 shares of the basic materials company's stock, valued at approximately $514,000.

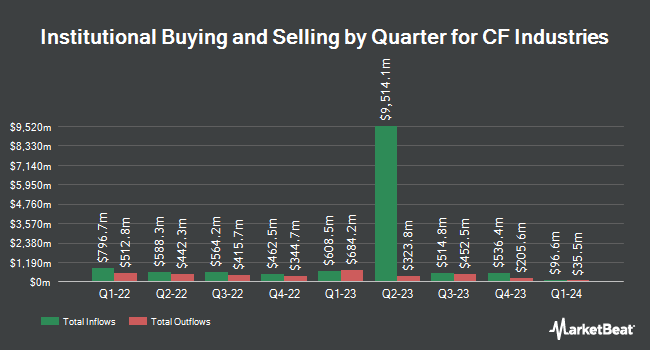

Other large investors have also recently added to or reduced their stakes in the company. FMR LLC lifted its holdings in shares of CF Industries by 3.8% during the 3rd quarter. FMR LLC now owns 8,286,745 shares of the basic materials company's stock worth $711,003,000 after acquiring an additional 300,050 shares during the period. Charles Schwab Investment Management Inc. raised its position in CF Industries by 0.4% in the third quarter. Charles Schwab Investment Management Inc. now owns 5,567,230 shares of the basic materials company's stock worth $477,668,000 after acquiring an additional 22,392 shares in the last quarter. Victory Capital Management Inc. raised its position in CF Industries by 15.1% in the third quarter. Victory Capital Management Inc. now owns 4,188,648 shares of the basic materials company's stock worth $359,386,000 after acquiring an additional 549,569 shares in the last quarter. Dimensional Fund Advisors LP raised its position in CF Industries by 7.4% in the second quarter. Dimensional Fund Advisors LP now owns 2,871,116 shares of the basic materials company's stock worth $212,823,000 after acquiring an additional 198,246 shares in the last quarter. Finally, Earnest Partners LLC raised its position in CF Industries by 2.8% in the second quarter. Earnest Partners LLC now owns 2,193,528 shares of the basic materials company's stock worth $162,584,000 after acquiring an additional 59,674 shares in the last quarter. 93.06% of the stock is owned by institutional investors and hedge funds.

CF Industries Price Performance

Shares of CF stock traded down $2.13 during trading hours on Thursday, hitting $89.37. 1,906,538 shares of the company's stock were exchanged, compared to its average volume of 2,062,689. The company has a debt-to-equity ratio of 0.38, a current ratio of 2.81 and a quick ratio of 2.52. CF Industries Holdings, Inc. has a 52 week low of $69.13 and a 52 week high of $94.46. The stock has a market cap of $15.55 billion, a price-to-earnings ratio of 14.48, a price-to-earnings-growth ratio of 2.48 and a beta of 0.98. The stock's 50-day moving average is $86.45 and its 200-day moving average is $80.18.

CF Industries (NYSE:CF - Get Free Report) last issued its quarterly earnings results on Wednesday, October 30th. The basic materials company reported $1.55 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.05 by $0.50. CF Industries had a return on equity of 14.57% and a net margin of 19.45%. The business had revenue of $1.37 billion for the quarter, compared to analyst estimates of $1.28 billion. During the same quarter in the prior year, the firm posted $0.85 earnings per share. The firm's revenue for the quarter was up 7.6% compared to the same quarter last year. As a group, research analysts forecast that CF Industries Holdings, Inc. will post 6.32 EPS for the current year.

CF Industries Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, November 29th. Shareholders of record on Friday, November 15th were paid a $0.50 dividend. This represents a $2.00 annualized dividend and a yield of 2.24%. The ex-dividend date of this dividend was Friday, November 15th. CF Industries's payout ratio is 31.65%.

Analyst Ratings Changes

CF has been the topic of several research reports. Mizuho boosted their price target on shares of CF Industries from $76.00 to $93.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 9th. Bank of America cut CF Industries from a "neutral" rating to an "underperform" rating and set a $83.00 price target on the stock. in a research note on Wednesday, October 16th. Scotiabank lifted their price target on CF Industries from $80.00 to $88.00 and gave the stock a "sector perform" rating in a research note on Monday, August 12th. Redburn Atlantic assumed coverage on CF Industries in a research note on Friday, October 18th. They issued a "neutral" rating and a $77.00 price target on the stock. Finally, UBS Group lifted their price target on CF Industries from $80.00 to $85.00 and gave the stock a "neutral" rating in a research note on Monday, August 26th. Two investment analysts have rated the stock with a sell rating, five have issued a hold rating and five have issued a buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Hold" and a consensus target price of $88.42.

Read Our Latest Analysis on CF

Insider Buying and Selling at CF Industries

In related news, EVP Bert A. Frost sold 3,000 shares of the stock in a transaction dated Wednesday, November 20th. The stock was sold at an average price of $88.00, for a total transaction of $264,000.00. Following the completion of the transaction, the executive vice president now directly owns 103,155 shares in the company, valued at approximately $9,077,640. This trade represents a 2.83 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, EVP Susan L. Menzel sold 3,500 shares of the stock in a transaction dated Tuesday, December 3rd. The stock was sold at an average price of $92.86, for a total value of $325,010.00. Following the transaction, the executive vice president now owns 62,768 shares of the company's stock, valued at approximately $5,828,636.48. The trade was a 5.28 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 22,701 shares of company stock valued at $2,052,704. 0.42% of the stock is currently owned by company insiders.

About CF Industries

(

Free Report)

CF Industries Holdings, Inc, together with its subsidiaries, engages in the manufacture and sale of hydrogen and nitrogen products for energy, fertilizer, emissions abatement, and other industrial activities in North America, Europe, and internationally. It operates through Ammonia, Granular Urea, UAN, AN, and Other segments.

Featured Stories

Before you consider CF Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CF Industries wasn't on the list.

While CF Industries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report