Erste Asset Management GmbH purchased a new position in shares of Itron, Inc. (NASDAQ:ITRI - Free Report) during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 359,229 shares of the scientific and technical instruments company's stock, valued at approximately $38,534,000. Erste Asset Management GmbH owned approximately 0.80% of Itron at the end of the most recent reporting period.

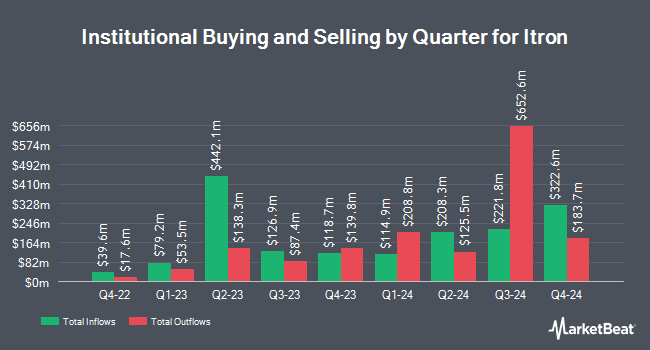

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Price T Rowe Associates Inc. MD lifted its stake in Itron by 6.2% during the first quarter. Price T Rowe Associates Inc. MD now owns 30,298 shares of the scientific and technical instruments company's stock worth $2,804,000 after purchasing an additional 1,765 shares during the period. Tidal Investments LLC bought a new stake in Itron in the first quarter valued at $1,319,000. Swedbank AB bought a new stake in Itron in the first quarter valued at $1,900,000. GAMMA Investing LLC raised its stake in Itron by 46.6% during the second quarter. GAMMA Investing LLC now owns 720 shares of the scientific and technical instruments company's stock worth $71,000 after acquiring an additional 229 shares in the last quarter. Finally, CWM LLC lifted its holdings in shares of Itron by 315.6% during the second quarter. CWM LLC now owns 881 shares of the scientific and technical instruments company's stock valued at $87,000 after acquiring an additional 669 shares during the period. Institutional investors own 96.19% of the company's stock.

Itron Trading Down 0.6 %

Shares of NASDAQ:ITRI traded down $0.76 during trading on Friday, hitting $118.53. 209,181 shares of the company's stock were exchanged, compared to its average volume of 513,149. The company has a current ratio of 3.36, a quick ratio of 2.83 and a debt-to-equity ratio of 0.91. The firm has a market cap of $5.34 billion, a P/E ratio of 24.29, a PEG ratio of 0.89 and a beta of 1.46. The firm has a 50-day moving average price of $110.92 and a two-hundred day moving average price of $105.38. Itron, Inc. has a 1-year low of $65.81 and a 1-year high of $124.90.

Itron (NASDAQ:ITRI - Get Free Report) last released its earnings results on Thursday, October 31st. The scientific and technical instruments company reported $1.84 EPS for the quarter, topping analysts' consensus estimates of $1.13 by $0.71. Itron had a net margin of 9.37% and a return on equity of 19.03%. The firm had revenue of $615.46 million during the quarter, compared to analyst estimates of $596.41 million. During the same quarter in the previous year, the business earned $0.98 EPS. The business's quarterly revenue was up 9.8% compared to the same quarter last year. Equities analysts predict that Itron, Inc. will post 5.33 earnings per share for the current year.

Insider Activity at Itron

In related news, CEO Thomas Deitrich sold 37,500 shares of the business's stock in a transaction that occurred on Tuesday, October 1st. The stock was sold at an average price of $104.83, for a total value of $3,931,125.00. Following the completion of the transaction, the chief executive officer now directly owns 205,276 shares in the company, valued at approximately $21,519,083.08. The trade was a 15.45 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. 1.45% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

A number of equities research analysts recently issued reports on the stock. Oppenheimer increased their target price on shares of Itron from $120.00 to $124.00 and gave the stock an "outperform" rating in a research report on Friday, November 1st. Roth Mkm lifted their target price on shares of Itron from $125.00 to $130.00 and gave the company a "buy" rating in a research note on Friday, November 1st. TD Cowen increased their price target on Itron from $125.00 to $136.00 and gave the stock a "buy" rating in a research report on Friday, November 1st. Robert W. Baird lifted their price objective on Itron from $123.00 to $132.00 and gave the company an "outperform" rating in a research report on Friday, November 1st. Finally, Janney Montgomery Scott initiated coverage on Itron in a research note on Friday, September 27th. They issued a "buy" rating and a $131.00 price objective on the stock. Four research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $123.92.

View Our Latest Stock Report on ITRI

About Itron

(

Free Report)

Itron, Inc, a technology, solutions, and service company, provides end-to-end solutions that help manage energy, water, and smart city operations worldwide. It operates in three segments: Device Solutions, Networked Solutions, and Outcomes. The Device Solutions segment offers hardware products that are used for measurement, control, or sensing, such as standard gas, electricity, water, and communicating meters, as well as heat and allocation products.

Featured Stories

Before you consider Itron, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Itron wasn't on the list.

While Itron currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.