Erste Asset Management GmbH purchased a new stake in T. Rowe Price Group, Inc. (NASDAQ:TROW - Free Report) during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor purchased 52,700 shares of the asset manager's stock, valued at approximately $5,771,000.

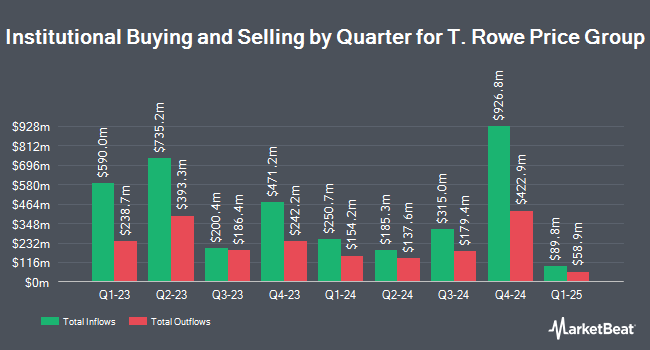

A number of other large investors have also added to or reduced their stakes in TROW. International Assets Investment Management LLC raised its position in shares of T. Rowe Price Group by 7,992.0% in the third quarter. International Assets Investment Management LLC now owns 1,067,655 shares of the asset manager's stock valued at $116,300,000 after purchasing an additional 1,054,461 shares during the period. Caisse DE Depot ET Placement DU Quebec raised its holdings in T. Rowe Price Group by 382.1% in the 3rd quarter. Caisse DE Depot ET Placement DU Quebec now owns 398,175 shares of the asset manager's stock valued at $43,373,000 after acquiring an additional 315,581 shares during the period. Charles Schwab Investment Management Inc. raised its holdings in T. Rowe Price Group by 3.5% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 6,840,807 shares of the asset manager's stock valued at $745,169,000 after acquiring an additional 231,286 shares during the period. Dimensional Fund Advisors LP lifted its position in T. Rowe Price Group by 15.8% during the second quarter. Dimensional Fund Advisors LP now owns 1,611,307 shares of the asset manager's stock worth $185,810,000 after acquiring an additional 220,105 shares during the last quarter. Finally, AQR Capital Management LLC boosted its holdings in shares of T. Rowe Price Group by 77.2% during the second quarter. AQR Capital Management LLC now owns 451,237 shares of the asset manager's stock worth $52,032,000 after acquiring an additional 196,565 shares during the period. Institutional investors own 73.39% of the company's stock.

Analyst Upgrades and Downgrades

TROW has been the subject of several research reports. TD Cowen dropped their price target on T. Rowe Price Group from $120.00 to $116.00 and set a "hold" rating for the company in a report on Monday, November 4th. Wells Fargo & Company lifted their target price on T. Rowe Price Group from $109.00 to $112.00 and gave the stock an "equal weight" rating in a report on Wednesday, October 9th. Morgan Stanley upped their price target on shares of T. Rowe Price Group from $127.00 to $129.00 and gave the company an "equal weight" rating in a research note on Monday, November 4th. Deutsche Bank Aktiengesellschaft lifted their price objective on shares of T. Rowe Price Group from $115.00 to $120.00 and gave the stock a "hold" rating in a research note on Monday, November 11th. Finally, Evercore ISI increased their target price on shares of T. Rowe Price Group from $112.00 to $113.00 and gave the stock an "in-line" rating in a research report on Thursday, November 7th. Four equities research analysts have rated the stock with a sell rating and eight have given a hold rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Hold" and an average price target of $115.55.

Read Our Latest Analysis on T. Rowe Price Group

T. Rowe Price Group Price Performance

NASDAQ:TROW traded down $0.22 during trading hours on Tuesday, hitting $123.43. The company's stock had a trading volume of 1,287,551 shares, compared to its average volume of 1,267,909. The company has a market capitalization of $27.42 billion, a P/E ratio of 13.50, a PEG ratio of 1.74 and a beta of 1.42. T. Rowe Price Group, Inc. has a twelve month low of $97.50 and a twelve month high of $124.83. The stock has a fifty day simple moving average of $114.35 and a 200-day simple moving average of $112.92.

T. Rowe Price Group (NASDAQ:TROW - Get Free Report) last released its quarterly earnings data on Friday, November 1st. The asset manager reported $2.57 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.36 by $0.21. T. Rowe Price Group had a net margin of 30.35% and a return on equity of 20.35%. The business had revenue of $1.79 billion during the quarter, compared to analysts' expectations of $1.84 billion. During the same period in the prior year, the company earned $2.17 EPS. The firm's quarterly revenue was up 6.9% compared to the same quarter last year. On average, equities analysts predict that T. Rowe Price Group, Inc. will post 9.39 EPS for the current fiscal year.

T. Rowe Price Group Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Friday, December 27th. Investors of record on Friday, December 13th will be issued a dividend of $1.24 per share. This represents a $4.96 annualized dividend and a dividend yield of 4.02%. The ex-dividend date is Friday, December 13th. T. Rowe Price Group's dividend payout ratio (DPR) is 54.27%.

Insider Buying and Selling

In other T. Rowe Price Group news, insider Jessica M. Hiebler sold 484 shares of the business's stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $104.73, for a total transaction of $50,689.32. Following the sale, the insider now directly owns 13,939 shares of the company's stock, valued at $1,459,831.47. The trade was a 3.36 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, VP Andrew Justin Mackenzi Thomson sold 11,969 shares of the firm's stock in a transaction on Friday, September 6th. The shares were sold at an average price of $102.83, for a total transaction of $1,230,772.27. Following the transaction, the vice president now directly owns 123,624 shares of the company's stock, valued at $12,712,255.92. The trade was a 8.83 % decrease in their position. The disclosure for this sale can be found here. 2.00% of the stock is currently owned by corporate insiders.

T. Rowe Price Group Company Profile

(

Free Report)

T. Rowe Price Group, Inc is a publicly owned investment manager. The firm provides its services to individuals, institutional investors, retirement plans, financial intermediaries, and institutions. It launches and manages equity and fixed income mutual funds. The firm invests in the public equity and fixed income markets across the globe.

Featured Articles

Before you consider T. Rowe Price Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and T. Rowe Price Group wasn't on the list.

While T. Rowe Price Group currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.