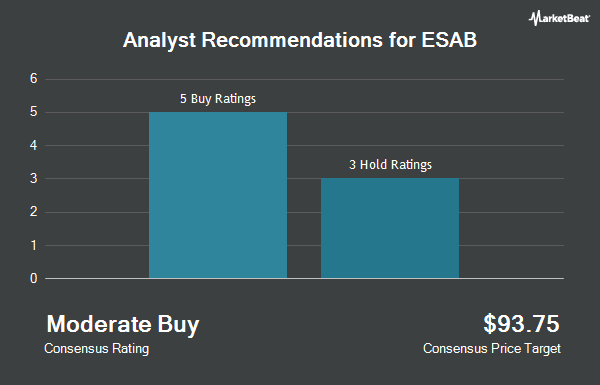

ESAB Co. (NYSE:ESAB - Get Free Report) has earned an average recommendation of "Hold" from the seven brokerages that are covering the firm, MarketBeat.com reports. One investment analyst has rated the stock with a sell rating, two have given a hold rating and four have assigned a buy rating to the company. The average twelve-month price objective among brokers that have updated their coverage on the stock in the last year is $124.14.

Several analysts have recently weighed in on ESAB shares. Bank of America upped their price objective on ESAB from $115.00 to $130.00 and gave the company a "buy" rating in a report on Monday, August 5th. Loop Capital raised their price objective on shares of ESAB from $105.00 to $120.00 and gave the company a "hold" rating in a research report on Wednesday, October 30th. Oppenheimer reissued an "outperform" rating and set a $144.00 target price (up from $138.00) on shares of ESAB in a research note on Friday, November 8th. JPMorgan Chase & Co. lifted their price target on shares of ESAB from $120.00 to $128.00 and gave the stock an "overweight" rating in a research report on Monday, September 30th. Finally, Evercore ISI lowered ESAB from an "in-line" rating to an "underperform" rating and raised their price objective for the stock from $102.00 to $122.00 in a research note on Wednesday, November 13th.

Get Our Latest Stock Analysis on ESAB

ESAB Stock Up 1.2 %

Shares of NYSE:ESAB traded up $1.58 during midday trading on Monday, reaching $129.12. The company had a trading volume of 285,788 shares, compared to its average volume of 255,292. The stock's fifty day moving average price is $114.48 and its 200-day moving average price is $104.31. The stock has a market capitalization of $7.81 billion, a P/E ratio of 30.59, a PEG ratio of 2.23 and a beta of 1.37. ESAB has a one year low of $76.08 and a one year high of $135.97. The company has a debt-to-equity ratio of 0.58, a current ratio of 1.92 and a quick ratio of 1.25.

ESAB (NYSE:ESAB - Get Free Report) last issued its earnings results on Tuesday, October 29th. The company reported $1.25 EPS for the quarter, beating analysts' consensus estimates of $1.12 by $0.13. The company had revenue of $673.00 million during the quarter, compared to the consensus estimate of $620.50 million. ESAB had a return on equity of 17.27% and a net margin of 9.47%. ESAB's quarterly revenue was down 1.2% compared to the same quarter last year. During the same period in the previous year, the firm posted $1.08 earnings per share. Equities research analysts expect that ESAB will post 4.94 earnings per share for the current fiscal year.

ESAB Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, October 11th. Investors of record on Friday, September 27th were issued a dividend of $0.08 per share. This represents a $0.32 annualized dividend and a yield of 0.25%. The ex-dividend date of this dividend was Friday, September 27th. ESAB's dividend payout ratio is currently 7.49%.

Insider Buying and Selling at ESAB

In other news, CEO Shyam Kambeyanda sold 59,120 shares of the company's stock in a transaction dated Tuesday, October 29th. The stock was sold at an average price of $122.96, for a total value of $7,269,395.20. Following the completion of the sale, the chief executive officer now directly owns 53,902 shares of the company's stock, valued at $6,627,789.92. This represents a 52.31 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, CFO Kevin J. Johnson sold 5,044 shares of the company's stock in a transaction that occurred on Tuesday, October 29th. The shares were sold at an average price of $125.00, for a total transaction of $630,500.00. Following the completion of the sale, the chief financial officer now directly owns 11,433 shares of the company's stock, valued at $1,429,125. The trade was a 30.61 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 68,418 shares of company stock worth $8,431,773. 7.20% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

A number of institutional investors have recently bought and sold shares of ESAB. Champlain Investment Partners LLC raised its position in ESAB by 33.5% in the 3rd quarter. Champlain Investment Partners LLC now owns 1,081,639 shares of the company's stock valued at $114,989,000 after buying an additional 271,459 shares during the last quarter. Geode Capital Management LLC boosted its position in ESAB by 19.7% during the third quarter. Geode Capital Management LLC now owns 1,160,056 shares of the company's stock valued at $123,353,000 after purchasing an additional 190,583 shares during the last quarter. International Assets Investment Management LLC bought a new position in ESAB in the third quarter valued at approximately $15,110,000. FMR LLC increased its position in shares of ESAB by 6.2% during the 3rd quarter. FMR LLC now owns 2,196,522 shares of the company's stock worth $233,512,000 after purchasing an additional 127,714 shares during the last quarter. Finally, Cubist Systematic Strategies LLC bought a new stake in shares of ESAB during the 2nd quarter worth approximately $8,277,000. Institutional investors own 91.13% of the company's stock.

About ESAB

(

Get Free ReportESAB Corporation engages in the formulation, development, manufacture, and supply of consumable products and equipment for use in cutting, joining, automated welding, and gas control equipment. Its comprehensive range of welding consumables includes electrodes, cored and solid wires, and fluxes using a range of specialty and other materials; and cutting consumables comprising electrodes, nozzles, shields, and tips.

Further Reading

Before you consider ESAB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ESAB wasn't on the list.

While ESAB currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.