ESCO Technologies (NYSE:ESE - Get Free Report) is scheduled to be issuing its quarterly earnings data after the market closes on Thursday, November 14th. Parties interested in listening to the company's conference call can do so using this link.

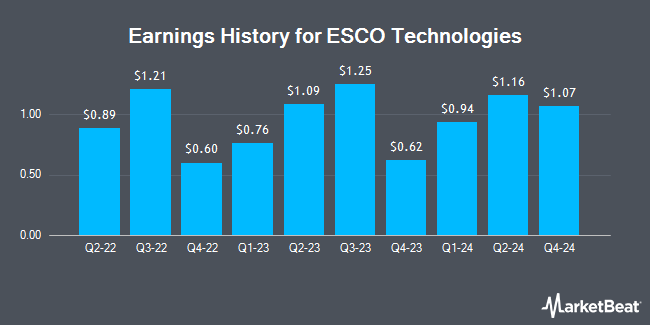

ESCO Technologies (NYSE:ESE - Get Free Report) last posted its earnings results on Wednesday, August 7th. The scientific and technical instruments company reported $1.16 EPS for the quarter, missing the consensus estimate of $1.19 by ($0.03). ESCO Technologies had a net margin of 9.95% and a return on equity of 8.82%. The business had revenue of $260.78 million during the quarter. On average, analysts expect ESCO Technologies to post $4 EPS for the current fiscal year and $5 EPS for the next fiscal year.

ESCO Technologies Stock Down 1.9 %

ESCO Technologies stock traded down $2.65 during midday trading on Thursday, reaching $140.00. The company's stock had a trading volume of 64,755 shares, compared to its average volume of 123,956. The business has a 50-day simple moving average of $124.31 and a 200-day simple moving average of $115.57. The company has a market cap of $3.61 billion, a P/E ratio of 36.96 and a beta of 1.08. ESCO Technologies has a fifty-two week low of $96.69 and a fifty-two week high of $147.80. The company has a quick ratio of 1.39, a current ratio of 2.10 and a debt-to-equity ratio of 0.13.

Analyst Ratings Changes

A number of analysts recently issued reports on the company. Stephens upped their target price on ESCO Technologies from $135.00 to $145.00 and gave the company an "overweight" rating in a research report on Friday, September 27th. Benchmark reiterated a "buy" rating and issued a $150.00 price objective on shares of ESCO Technologies in a research report on Tuesday.

Read Our Latest Report on ESE

About ESCO Technologies

(

Get Free Report)

ESCO Technologies Inc produces and supplies engineered products and systems for industrial and commercial markets worldwide. It operates through three segments: Aerospace & Defense, Utility Solutions Group, and RF Test & Measurement. The Aerospace & Defense segment designs and manufactures filtration products, including hydraulic filter elements and fluid control devices used in commercial aerospace applications; filter mechanisms used in micro-propulsion devices for satellites; and custom designed filters for manned aircraft and submarines.

Featured Articles

Before you consider ESCO Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ESCO Technologies wasn't on the list.

While ESCO Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.