Hotchkis & Wiley Capital Management LLC trimmed its holdings in Essent Group Ltd. (NYSE:ESNT - Free Report) by 4.9% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 207,055 shares of the financial services provider's stock after selling 10,640 shares during the quarter. Hotchkis & Wiley Capital Management LLC owned approximately 0.19% of Essent Group worth $13,312,000 as of its most recent SEC filing.

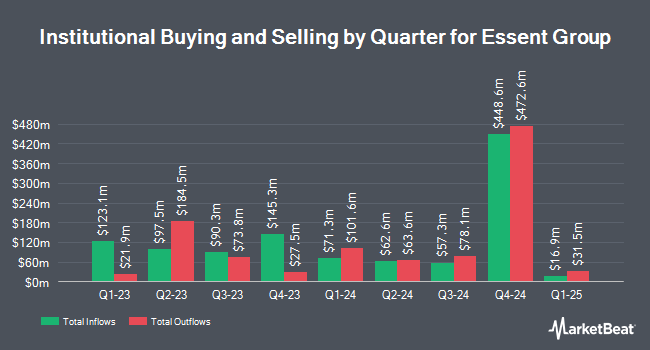

Several other hedge funds and other institutional investors have also added to or reduced their stakes in ESNT. Diversified Trust Co bought a new stake in Essent Group in the second quarter worth $725,000. Dimensional Fund Advisors LP lifted its position in Essent Group by 10.5% in the second quarter. Dimensional Fund Advisors LP now owns 4,680,074 shares of the financial services provider's stock worth $262,973,000 after buying an additional 445,853 shares during the last quarter. SG Americas Securities LLC lifted its position in Essent Group by 147.5% in the second quarter. SG Americas Securities LLC now owns 33,597 shares of the financial services provider's stock worth $1,888,000 after buying an additional 20,023 shares during the last quarter. Algert Global LLC bought a new stake in Essent Group in the second quarter worth $605,000. Finally, Raymond James & Associates lifted its position in Essent Group by 163.4% in the third quarter. Raymond James & Associates now owns 44,676 shares of the financial services provider's stock worth $2,872,000 after buying an additional 27,717 shares during the last quarter. 93.00% of the stock is currently owned by institutional investors.

Insider Activity

In other Essent Group news, CFO David B. Weinstock sold 2,000 shares of the company's stock in a transaction dated Wednesday, September 18th. The stock was sold at an average price of $63.59, for a total transaction of $127,180.00. Following the sale, the chief financial officer now owns 25,416 shares in the company, valued at $1,616,203.44. This represents a 7.30 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Corporate insiders own 2.90% of the company's stock.

Wall Street Analyst Weigh In

A number of research firms have weighed in on ESNT. The Goldman Sachs Group reduced their target price on Essent Group from $68.00 to $60.00 and set a "neutral" rating on the stock in a research note on Tuesday, November 5th. Royal Bank of Canada reduced their target price on Essent Group from $73.00 to $67.00 and set an "outperform" rating on the stock in a research note on Monday, November 4th. JPMorgan Chase & Co. cut their price target on Essent Group from $68.00 to $67.00 and set a "neutral" rating on the stock in a research note on Monday, November 4th. Finally, Barclays cut their price target on Essent Group from $72.00 to $69.00 and set an "overweight" rating on the stock in a research note on Monday, November 4th. Four equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. According to data from MarketBeat, Essent Group has a consensus rating of "Moderate Buy" and a consensus target price of $65.00.

Read Our Latest Analysis on ESNT

Essent Group Stock Performance

Shares of ESNT traded down $0.57 during trading hours on Wednesday, hitting $56.29. 528,236 shares of the stock were exchanged, compared to its average volume of 533,186. Essent Group Ltd. has a 12-month low of $48.08 and a 12-month high of $65.33. The company has a market cap of $5.98 billion, a price-to-earnings ratio of 8.16, a price-to-earnings-growth ratio of 2.66 and a beta of 1.09. The stock's 50-day moving average price is $59.65 and its two-hundred day moving average price is $59.54.

Essent Group (NYSE:ESNT - Get Free Report) last released its quarterly earnings data on Friday, November 1st. The financial services provider reported $1.65 earnings per share for the quarter, missing analysts' consensus estimates of $1.73 by ($0.08). The company had revenue of $3.17 billion for the quarter, compared to analyst estimates of $316.80 million. Essent Group had a return on equity of 13.81% and a net margin of 60.15%. The business's quarterly revenue was up 969.2% on a year-over-year basis. During the same period last year, the firm posted $1.66 EPS. On average, research analysts expect that Essent Group Ltd. will post 6.95 earnings per share for the current year.

Essent Group Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, December 11th. Stockholders of record on Monday, December 2nd will be paid a $0.28 dividend. This represents a $1.12 annualized dividend and a dividend yield of 1.99%. The ex-dividend date of this dividend is Monday, December 2nd. Essent Group's dividend payout ratio (DPR) is presently 16.23%.

Essent Group Profile

(

Free Report)

Essent Group Ltd., through its subsidiaries, provides private mortgage insurance and reinsurance for mortgages secured by residential properties located in the United States. Its mortgage insurance products include primary, pool, and master policy. The company also provides information technology maintenance and development services; customer support-related services; underwriting consulting; and contract underwriting services, as well as risk management products and title insurance and settlement services.

Featured Stories

Before you consider Essent Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Essent Group wasn't on the list.

While Essent Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.