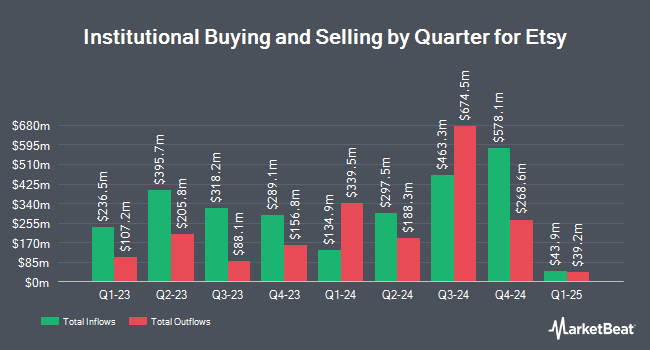

Robeco Institutional Asset Management B.V. trimmed its holdings in shares of Etsy, Inc. (NASDAQ:ETSY - Free Report) by 42.2% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 256,834 shares of the specialty retailer's stock after selling 187,259 shares during the quarter. Robeco Institutional Asset Management B.V. owned 0.22% of Etsy worth $14,262,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also recently bought and sold shares of the stock. Everence Capital Management Inc. purchased a new stake in shares of Etsy in the 3rd quarter valued at approximately $834,000. TD Asset Management Inc boosted its position in shares of Etsy by 16.8% during the first quarter. TD Asset Management Inc now owns 1,540,465 shares of the specialty retailer's stock worth $105,861,000 after buying an additional 221,275 shares during the period. Diversified Trust Co grew its stake in shares of Etsy by 11.5% in the second quarter. Diversified Trust Co now owns 6,459 shares of the specialty retailer's stock valued at $381,000 after buying an additional 668 shares in the last quarter. Advisors Asset Management Inc. raised its holdings in shares of Etsy by 12.6% in the 1st quarter. Advisors Asset Management Inc. now owns 146,865 shares of the specialty retailer's stock valued at $10,093,000 after buying an additional 16,458 shares during the period. Finally, Louisiana State Employees Retirement System boosted its holdings in Etsy by 740.9% during the 3rd quarter. Louisiana State Employees Retirement System now owns 55,500 shares of the specialty retailer's stock valued at $3,082,000 after acquiring an additional 48,900 shares during the period. 99.53% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity

In other Etsy news, insider Nicholas Daniel sold 750 shares of Etsy stock in a transaction that occurred on Tuesday, September 3rd. The stock was sold at an average price of $55.40, for a total transaction of $41,550.00. Following the sale, the insider now directly owns 18,083 shares in the company, valued at $1,001,798.20. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. In related news, insider Toni Thompson Nadal sold 1,443 shares of the company's stock in a transaction on Thursday, October 3rd. The stock was sold at an average price of $51.11, for a total transaction of $73,751.73. Following the completion of the transaction, the insider now directly owns 592 shares in the company, valued at $30,257.12. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, insider Nicholas Daniel sold 750 shares of the firm's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $55.40, for a total value of $41,550.00. Following the completion of the sale, the insider now owns 18,083 shares in the company, valued at $1,001,798.20. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 5,369 shares of company stock worth $280,200 over the last ninety days. Corporate insiders own 2.60% of the company's stock.

Analyst Ratings Changes

Several equities analysts have commented on the stock. Barclays decreased their price target on shares of Etsy from $60.00 to $55.00 and set an "equal weight" rating for the company in a research report on Thursday, October 31st. Truist Financial dropped their price target on Etsy from $76.00 to $70.00 and set a "buy" rating on the stock in a research note on Thursday, October 31st. Stifel Nicolaus reduced their target price on shares of Etsy from $64.00 to $56.00 and set a "hold" rating for the company in a report on Monday, October 28th. UBS Group lowered their price objective on shares of Etsy from $65.00 to $58.00 and set a "neutral" rating on the stock in a research report on Tuesday, October 15th. Finally, Needham & Company LLC reissued a "buy" rating and set a $60.00 price target on shares of Etsy in a report on Thursday, October 31st. Four equities research analysts have rated the stock with a sell rating, twelve have issued a hold rating, seven have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, Etsy currently has an average rating of "Hold" and an average price target of $64.87.

View Our Latest Analysis on ETSY

Etsy Stock Performance

Shares of ETSY stock traded up $0.34 during trading hours on Thursday, reaching $53.42. The company had a trading volume of 1,972,472 shares, compared to its average volume of 3,759,301. The company has a market capitalization of $6.01 billion, a P/E ratio of 27.08, a price-to-earnings-growth ratio of 6.17 and a beta of 1.99. Etsy, Inc. has a twelve month low of $47.10 and a twelve month high of $89.58. The stock's fifty day simple moving average is $52.45 and its 200 day simple moving average is $57.78.

Etsy (NASDAQ:ETSY - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The specialty retailer reported $0.45 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.54 by ($0.09). The firm had revenue of $662.40 million for the quarter, compared to analysts' expectations of $652.47 million. Etsy had a net margin of 9.17% and a negative return on equity of 46.79%. The company's revenue for the quarter was up 4.1% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.64 EPS. As a group, equities analysts expect that Etsy, Inc. will post 2.25 earnings per share for the current year.

Etsy announced that its board has authorized a share buyback plan on Wednesday, October 30th that allows the company to buyback $1.00 billion in outstanding shares. This buyback authorization allows the specialty retailer to reacquire up to 17.8% of its shares through open market purchases. Shares buyback plans are usually an indication that the company's management believes its stock is undervalued.

About Etsy

(

Free Report)

Etsy, Inc, together with its subsidiaries, operates two-sided online marketplaces that connect buyers and sellers in the United States, the United Kingdom, Germany, Canada, Australia, and France. Its primary marketplace is Etsy.com that connects artisans and entrepreneurs with various consumers. The company also offers Reverb, a musical instrument marketplace; Depop, a fashion resale marketplace; and Elo7, a Brazil-based marketplace for handmade and unique items.

See Also

Before you consider Etsy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Etsy wasn't on the list.

While Etsy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report