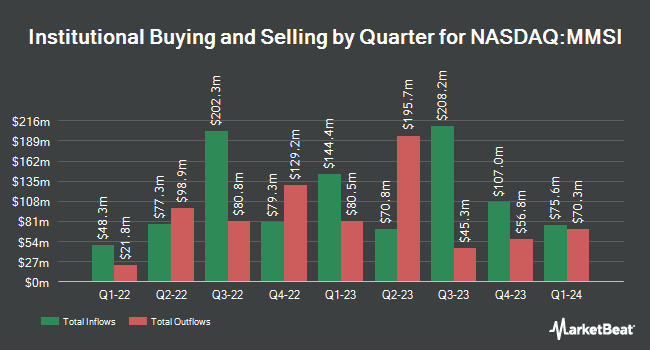

EULAV Asset Management bought a new stake in shares of Merit Medical Systems, Inc. (NASDAQ:MMSI - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm bought 23,000 shares of the medical instruments supplier's stock, valued at approximately $2,273,000.

A number of other institutional investors also recently made changes to their positions in the business. Opal Wealth Advisors LLC bought a new stake in shares of Merit Medical Systems during the 2nd quarter valued at about $29,000. DekaBank Deutsche Girozentrale acquired a new stake in shares of Merit Medical Systems in the 1st quarter worth approximately $44,000. USA Financial Formulas bought a new position in Merit Medical Systems during the 3rd quarter valued at $59,000. EntryPoint Capital LLC grew its holdings in Merit Medical Systems by 2,666.7% during the first quarter. EntryPoint Capital LLC now owns 913 shares of the medical instruments supplier's stock worth $69,000 after acquiring an additional 880 shares during the period. Finally, GAMMA Investing LLC lifted its stake in Merit Medical Systems by 142.3% during the second quarter. GAMMA Investing LLC now owns 831 shares of the medical instruments supplier's stock valued at $71,000 after purchasing an additional 488 shares during the last quarter. 99.66% of the stock is owned by institutional investors and hedge funds.

Merit Medical Systems Stock Down 0.6 %

Shares of MMSI stock traded down $0.63 during trading hours on Wednesday, hitting $104.08. 345,173 shares of the company were exchanged, compared to its average volume of 439,698. The company has a market capitalization of $6.07 billion, a PE ratio of 51.01, a PEG ratio of 2.53 and a beta of 0.89. The business has a 50 day moving average of $98.09 and a two-hundred day moving average of $90.46. The company has a current ratio of 5.36, a quick ratio of 3.82 and a debt-to-equity ratio of 0.57. Merit Medical Systems, Inc. has a 52 week low of $65.46 and a 52 week high of $105.46.

Merit Medical Systems (NASDAQ:MMSI - Get Free Report) last posted its quarterly earnings results on Wednesday, October 30th. The medical instruments supplier reported $0.86 EPS for the quarter, topping analysts' consensus estimates of $0.80 by $0.06. Merit Medical Systems had a return on equity of 15.61% and a net margin of 9.05%. The business had revenue of $339.85 million during the quarter, compared to analysts' expectations of $334.60 million. During the same quarter last year, the company posted $0.75 earnings per share. Merit Medical Systems's quarterly revenue was up 7.8% on a year-over-year basis. Analysts anticipate that Merit Medical Systems, Inc. will post 3.36 earnings per share for the current fiscal year.

Insiders Place Their Bets

In related news, CFO Raul Jr. Parra sold 29,646 shares of Merit Medical Systems stock in a transaction that occurred on Tuesday, November 5th. The shares were sold at an average price of $98.02, for a total transaction of $2,905,900.92. Following the sale, the chief financial officer now directly owns 16,361 shares in the company, valued at $1,603,705.22. This trade represents a 64.44 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director F. Ann Millner sold 12,500 shares of the firm's stock in a transaction on Friday, November 15th. The stock was sold at an average price of $101.55, for a total value of $1,269,375.00. Following the transaction, the director now directly owns 32,391 shares of the company's stock, valued at approximately $3,289,306.05. This represents a 27.85 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 3.70% of the company's stock.

Analyst Ratings Changes

A number of equities analysts recently weighed in on MMSI shares. Needham & Company LLC reissued a "buy" rating and issued a $109.00 price target on shares of Merit Medical Systems in a research note on Thursday, October 31st. Bank of America upped their target price on Merit Medical Systems from $92.00 to $103.00 and gave the stock a "neutral" rating in a research report on Monday, September 16th. Barrington Research reissued an "outperform" rating and issued a $114.00 price target on shares of Merit Medical Systems in a report on Thursday, October 31st. Robert W. Baird raised their price target on shares of Merit Medical Systems from $107.00 to $109.00 and gave the stock an "outperform" rating in a research note on Thursday, October 31st. Finally, Piper Sandler reaffirmed an "overweight" rating and set a $110.00 price target (up from $100.00) on shares of Merit Medical Systems in a report on Monday, September 9th. Three investment analysts have rated the stock with a hold rating, nine have issued a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, Merit Medical Systems presently has an average rating of "Moderate Buy" and a consensus target price of $103.36.

Get Our Latest Report on MMSI

Merit Medical Systems Profile

(

Free Report)

Merit Medical Systems, Inc designs, develops, manufactures, and markets single-use medical products for interventional, diagnostic, and therapeutic procedures in the United States and internationally. It operates in two segments, Cardiovascular and Endoscopy. The company provides micropuncture kits, angiographic needles, sheaths, guide wires, and safety products; peripheral intervention, including angiography, drainage, delivery systems, and embolotherapy products; spine products, such as vertebral augmentation, radiofrequency ablation, and bone biopsy systems; oncology products; and cardiac intervention products, such as access, angiography, electrophysiology and cardiac rhythm management, fluid management, hemodynamic monitoring, hemostasis, and intervention to treat various heart conditions.

Read More

Before you consider Merit Medical Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merit Medical Systems wasn't on the list.

While Merit Medical Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.