EULAV Asset Management increased its holdings in shares of Roku, Inc. (NASDAQ:ROKU - Free Report) by 59.1% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 183,000 shares of the company's stock after purchasing an additional 68,000 shares during the period. EULAV Asset Management owned 0.13% of Roku worth $13,663,000 as of its most recent filing with the Securities and Exchange Commission.

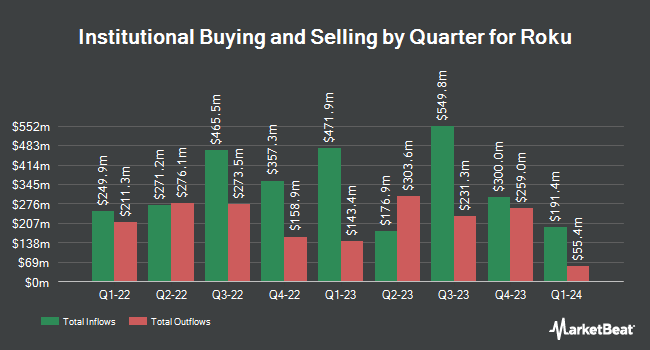

Several other hedge funds have also modified their holdings of ROKU. Swedbank AB bought a new position in shares of Roku during the first quarter worth about $1,180,000. SG Americas Securities LLC boosted its holdings in Roku by 238.6% in the second quarter. SG Americas Securities LLC now owns 73,528 shares of the company's stock worth $4,407,000 after purchasing an additional 51,815 shares during the period. Kessler Investment Group LLC boosted its holdings in Roku by 21.8% in the third quarter. Kessler Investment Group LLC now owns 75,968 shares of the company's stock worth $5,672,000 after purchasing an additional 13,590 shares during the period. Vanguard Group Inc. increased its stake in Roku by 0.8% during the first quarter. Vanguard Group Inc. now owns 11,946,605 shares of the company's stock valued at $778,560,000 after purchasing an additional 92,658 shares during the last quarter. Finally, CANADA LIFE ASSURANCE Co raised its holdings in shares of Roku by 127.2% during the first quarter. CANADA LIFE ASSURANCE Co now owns 49,912 shares of the company's stock worth $3,255,000 after purchasing an additional 27,940 shares during the period. 86.30% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several research firms have recently commented on ROKU. Rosenblatt Securities upped their target price on Roku from $61.00 to $86.00 and gave the company a "neutral" rating in a report on Thursday, October 31st. Jefferies Financial Group reduced their price target on shares of Roku from $60.00 to $55.00 and set an "underperform" rating for the company in a report on Friday, November 1st. JPMorgan Chase & Co. increased their price objective on shares of Roku from $90.00 to $92.00 and gave the stock an "overweight" rating in a report on Thursday, October 10th. Wells Fargo & Company boosted their target price on shares of Roku from $72.00 to $74.00 and gave the company an "equal weight" rating in a research note on Thursday, October 31st. Finally, Needham & Company LLC restated a "buy" rating and issued a $100.00 price target on shares of Roku in a research note on Thursday, October 31st. Two equities research analysts have rated the stock with a sell rating, eight have issued a hold rating, thirteen have issued a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $84.67.

Check Out Our Latest Research Report on Roku

Insider Buying and Selling at Roku

In related news, CFO Dan Jedda sold 1,000 shares of the company's stock in a transaction on Tuesday, November 19th. The stock was sold at an average price of $75.00, for a total value of $75,000.00. Following the completion of the transaction, the chief financial officer now directly owns 65,555 shares in the company, valued at approximately $4,916,625. This represents a 1.50 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CAO Matthew C. Banks sold 8,693 shares of the business's stock in a transaction on Monday, November 18th. The shares were sold at an average price of $71.44, for a total transaction of $621,027.92. Following the completion of the sale, the chief accounting officer now directly owns 7,264 shares in the company, valued at $518,940.16. This trade represents a 54.48 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 90,240 shares of company stock valued at $6,729,582 in the last 90 days. 13.98% of the stock is currently owned by insiders.

Roku Stock Down 6.7 %

ROKU stock traded down $4.90 during midday trading on Wednesday, hitting $68.71. 8,619,331 shares of the company traded hands, compared to its average volume of 4,432,100. Roku, Inc. has a twelve month low of $48.33 and a twelve month high of $108.84. The stock has a market capitalization of $9.98 billion, a price-to-earnings ratio of -56.64 and a beta of 2.07. The business has a 50 day simple moving average of $74.69 and a 200-day simple moving average of $64.94.

Roku (NASDAQ:ROKU - Get Free Report) last posted its earnings results on Wednesday, October 30th. The company reported ($0.06) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.35) by $0.29. The business had revenue of $1.06 billion for the quarter, compared to analyst estimates of $1.02 billion. Roku had a negative net margin of 4.42% and a negative return on equity of 7.22%. Roku's revenue was up 16.5% compared to the same quarter last year. During the same period last year, the business posted ($2.33) EPS. Equities research analysts forecast that Roku, Inc. will post -1.1 EPS for the current year.

Roku Profile

(

Free Report)

Roku, Inc, together with its subsidiaries, operates a TV streaming platform in the United states and internationally. The company operates in two segments, Platform and Devices. Its streaming platform allows users to find and access TV shows, movies, news, sports, and others. The Platform segment offers digital advertising, including direct and programmatic video advertising, media and entertainment promotional spending, and related services; and streaming services distribution, such as subscription and transaction revenue shares, and sale of premium subscriptions and branded app buttons on remote controls.

Read More

Before you consider Roku, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Roku wasn't on the list.

While Roku currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.