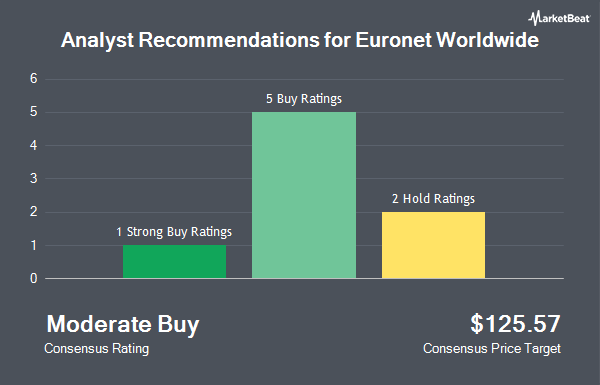

Euronet Worldwide, Inc. (NASDAQ:EEFT - Get Free Report) has earned an average rating of "Moderate Buy" from the ten brokerages that are currently covering the firm, MarketBeat reports. Three research analysts have rated the stock with a hold rating, six have given a buy rating and one has given a strong buy rating to the company. The average 1 year target price among brokerages that have covered the stock in the last year is $125.38.

Several analysts have weighed in on EEFT shares. Monness Crespi & Hardt raised shares of Euronet Worldwide from a "hold" rating to a "strong-buy" rating in a research note on Thursday, October 24th. StockNews.com raised shares of Euronet Worldwide from a "hold" rating to a "buy" rating in a research note on Tuesday. Oppenheimer started coverage on shares of Euronet Worldwide in a research note on Tuesday, October 1st. They set an "outperform" rating and a $121.00 price objective on the stock. DA Davidson reaffirmed a "buy" rating and set a $136.00 price objective on shares of Euronet Worldwide in a research note on Tuesday, October 8th. Finally, Citigroup cut shares of Euronet Worldwide from a "buy" rating to a "neutral" rating and decreased their price objective for the stock from $118.00 to $110.00 in a research note on Friday, October 18th.

Check Out Our Latest Analysis on EEFT

Insider Activity at Euronet Worldwide

In related news, CEO Juan Bianchi sold 4,000 shares of the stock in a transaction that occurred on Thursday, September 5th. The shares were sold at an average price of $102.58, for a total value of $410,320.00. Following the transaction, the chief executive officer now directly owns 12,440 shares in the company, valued at $1,276,095.20. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. 10.50% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

A number of institutional investors have recently bought and sold shares of the company. Los Angeles Capital Management LLC acquired a new position in shares of Euronet Worldwide in the third quarter valued at approximately $15,258,000. Lazard Asset Management LLC raised its stake in shares of Euronet Worldwide by 6,250.4% in the 1st quarter. Lazard Asset Management LLC now owns 141,932 shares of the business services provider's stock valued at $15,602,000 after purchasing an additional 139,697 shares during the period. Kodai Capital Management LP raised its stake in shares of Euronet Worldwide by 57.9% in the 1st quarter. Kodai Capital Management LP now owns 369,209 shares of the business services provider's stock valued at $40,587,000 after purchasing an additional 135,416 shares during the period. Dimensional Fund Advisors LP raised its stake in shares of Euronet Worldwide by 17.7% in the 2nd quarter. Dimensional Fund Advisors LP now owns 755,190 shares of the business services provider's stock valued at $78,172,000 after purchasing an additional 113,685 shares during the period. Finally, Marshall Wace LLP acquired a new stake in shares of Euronet Worldwide in the 2nd quarter valued at about $9,047,000. Institutional investors and hedge funds own 91.60% of the company's stock.

Euronet Worldwide Price Performance

Euronet Worldwide stock traded down $0.79 during mid-day trading on Thursday, hitting $102.99. 74,549 shares of the company were exchanged, compared to its average volume of 303,708. Euronet Worldwide has a 1-year low of $81.99 and a 1-year high of $117.66. The company has a quick ratio of 1.26, a current ratio of 1.26 and a debt-to-equity ratio of 0.88. The business has a fifty day moving average of $99.39 and a 200 day moving average of $103.99. The company has a market capitalization of $4.52 billion, a PE ratio of 15.00 and a beta of 1.46.

Euronet Worldwide (NASDAQ:EEFT - Get Free Report) last announced its quarterly earnings results on Wednesday, October 23rd. The business services provider reported $3.03 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.92 by $0.11. The firm had revenue of $1.11 billion during the quarter, compared to the consensus estimate of $1.04 billion. Euronet Worldwide had a net margin of 8.49% and a return on equity of 26.86%. During the same period last year, the firm posted $2.53 EPS. As a group, sell-side analysts expect that Euronet Worldwide will post 7.87 earnings per share for the current year.

About Euronet Worldwide

(

Get Free ReportEuronet Worldwide, Inc provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide. It operates through three segments: Electronic Fund Transfer Processing, epay, and Money Transfer. The Electronic Fund Transfer Processing segment provides electronic payment solutions, including automated teller machine (ATM) cash withdrawal and deposit services, ATM network participation, outsourced ATM and point-of-sale (POS) management solutions, credit and debit and prepaid card outsourcing, card issuing, and merchant acquiring services.

Recommended Stories

Before you consider Euronet Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Euronet Worldwide wasn't on the list.

While Euronet Worldwide currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.