European Residential Real Estate Investment Trust (TSE:ERE.UN - Free Report) had its price target lowered by Royal Bank of Canada from C$3.90 to C$2.60 in a research note published on Tuesday morning,BayStreet.CA reports.

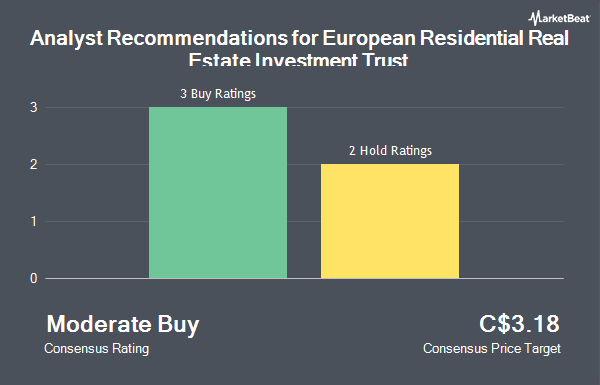

A number of other brokerages have also commented on ERE.UN. Raymond James raised their price target on European Residential Real Estate Investment Trust from C$3.25 to C$4.00 in a research note on Thursday, September 19th. CIBC reduced their price objective on European Residential Real Estate Investment Trust from C$3.50 to C$3.00 and set an "outperform" rating for the company in a report on Wednesday, September 18th. Scotiabank lifted their price objective on European Residential Real Estate Investment Trust from C$2.25 to C$3.75 and gave the company a "sector perform" rating in a research report on Wednesday, September 18th. TD Securities boosted their price target on European Residential Real Estate Investment Trust from C$3.75 to C$4.25 and gave the stock a "buy" rating in a report on Tuesday, November 12th. Finally, Ventum Financial upped their price objective on European Residential Real Estate Investment Trust from C$3.25 to C$4.00 and gave the stock a "buy" rating in a report on Wednesday, September 18th. Two research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of C$3.42.

Check Out Our Latest Research Report on ERE.UN

European Residential Real Estate Investment Trust Price Performance

Shares of ERE.UN traded up C$0.01 during mid-day trading on Tuesday, reaching C$2.48. The company had a trading volume of 821,347 shares, compared to its average volume of 1,263,312. The company's 50 day simple moving average is C$3.51 and its 200 day simple moving average is C$3.04. The company has a debt-to-equity ratio of 256.06, a quick ratio of 0.20 and a current ratio of 0.27. European Residential Real Estate Investment Trust has a 1-year low of C$2.23 and a 1-year high of C$3.99. The company has a market capitalization of C$228.16 million, a price-to-earnings ratio of 13.05 and a beta of 1.28.

About European Residential Real Estate Investment Trust

(

Get Free Report)

European Residential Real Estate Investment Trust - ERES is an unincorporated, open-ended real estate investment trust. ERES's REIT units are listed on the TSX under the symbol ERE.UN. ERES is Canada's only European-focused multi-residential REIT, with a current initial focus on investing in high-quality multi-residential real estate properties in the Netherlands.

See Also

Before you consider European Residential Real Estate Investment Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and European Residential Real Estate Investment Trust wasn't on the list.

While European Residential Real Estate Investment Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.