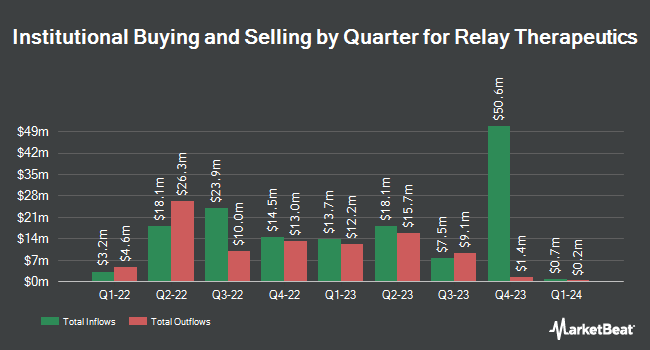

Eventide Asset Management LLC purchased a new stake in Relay Therapeutics, Inc. (NASDAQ:RLAY - Free Report) in the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The fund purchased 2,682,083 shares of the company's stock, valued at approximately $18,989,000. Eventide Asset Management LLC owned approximately 2.00% of Relay Therapeutics as of its most recent filing with the SEC.

A number of other hedge funds have also recently added to or reduced their stakes in RLAY. EverSource Wealth Advisors LLC acquired a new stake in Relay Therapeutics in the second quarter valued at approximately $37,000. Values First Advisors Inc. acquired a new stake in shares of Relay Therapeutics in the 3rd quarter valued at $75,000. Virtu Financial LLC bought a new stake in Relay Therapeutics in the first quarter worth $87,000. China Universal Asset Management Co. Ltd. increased its position in Relay Therapeutics by 65.1% during the third quarter. China Universal Asset Management Co. Ltd. now owns 25,751 shares of the company's stock worth $182,000 after buying an additional 10,157 shares during the last quarter. Finally, Valence8 US LP bought a new position in Relay Therapeutics during the third quarter valued at about $185,000. Institutional investors and hedge funds own 96.98% of the company's stock.

Relay Therapeutics Stock Performance

Shares of RLAY traded down $0.10 during trading hours on Friday, reaching $4.70. 2,250,910 shares of the company traded hands, compared to its average volume of 1,466,012. The stock's fifty day moving average is $6.06 and its 200 day moving average is $6.86. Relay Therapeutics, Inc. has a 1-year low of $4.48 and a 1-year high of $12.14. The stock has a market cap of $786.69 million, a P/E ratio of -1.80 and a beta of 1.67.

Relay Therapeutics (NASDAQ:RLAY - Get Free Report) last posted its quarterly earnings results on Wednesday, November 6th. The company reported ($0.63) EPS for the quarter, beating the consensus estimate of ($0.77) by $0.14. During the same period last year, the firm posted ($0.54) earnings per share. The company's quarterly revenue was down 100.0% compared to the same quarter last year. On average, equities research analysts predict that Relay Therapeutics, Inc. will post -2.61 EPS for the current year.

Analyst Ratings Changes

RLAY has been the subject of several recent analyst reports. Jefferies Financial Group upgraded Relay Therapeutics from a "hold" rating to a "buy" rating and upped their price target for the stock from $10.60 to $16.00 in a research note on Tuesday, September 10th. Barclays lifted their price target on shares of Relay Therapeutics from $14.00 to $17.00 and gave the company an "overweight" rating in a research report on Tuesday, September 10th. Oppenheimer downgraded shares of Relay Therapeutics from an "outperform" rating to a "market perform" rating in a report on Tuesday, September 10th. JPMorgan Chase & Co. dropped their target price on shares of Relay Therapeutics from $23.00 to $21.00 and set an "overweight" rating on the stock in a report on Tuesday, September 10th. Finally, The Goldman Sachs Group assumed coverage on shares of Relay Therapeutics in a research report on Tuesday, September 10th. They set a "buy" rating and a $20.00 target price for the company. One investment analyst has rated the stock with a hold rating and nine have given a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $21.22.

Get Our Latest Analysis on RLAY

Insider Activity at Relay Therapeutics

In related news, CFO Thomas Catinazzo sold 6,802 shares of the stock in a transaction dated Monday, October 28th. The shares were sold at an average price of $6.06, for a total value of $41,220.12. Following the completion of the transaction, the chief financial officer now owns 306,391 shares of the company's stock, valued at $1,856,729.46. This represents a 2.17 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. 4.32% of the stock is currently owned by corporate insiders.

Relay Therapeutics Company Profile

(

Free Report)

Relay Therapeutics, Inc operates as a clinical-stage precision medicines company. It engages in transforming the drug discovery process with an initial focus on enhancing small molecule therapeutic discovery in targeted oncology and genetic disease indications. The company's lead product candidates include RLY-4008, an oral small molecule inhibitor of fibroblast growth factor receptor 2 (FGFR2), which is in a first-in-human clinical trial for patients with advanced or metastatic FGFR2-altered solid tumors; RLY-2608, a lead mutant-PI3Ka inhibitor program that targets phosphoinostide 3 kinase alpha; and Migoprotafib (GDC-1971), an oral, small molecule, potent and selective inhibitor of the protein tyrosine phosphatase SHP2 that binds and stabilizes Src homology region 2 domain-containing phosphatase-2 (SHP2) as a monotherapy in patients with advanced or metastatic solid tumors.

Featured Stories

Before you consider Relay Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Relay Therapeutics wasn't on the list.

While Relay Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.