Eventide Asset Management LLC boosted its holdings in shares of Mettler-Toledo International Inc. (NYSE:MTD - Free Report) by 7.5% in the third quarter, according to its most recent filing with the SEC. The firm owned 79,129 shares of the medical instruments supplier's stock after acquiring an additional 5,504 shares during the period. Mettler-Toledo International accounts for 2.0% of Eventide Asset Management LLC's portfolio, making the stock its 7th largest position. Eventide Asset Management LLC owned 0.38% of Mettler-Toledo International worth $118,670,000 as of its most recent SEC filing.

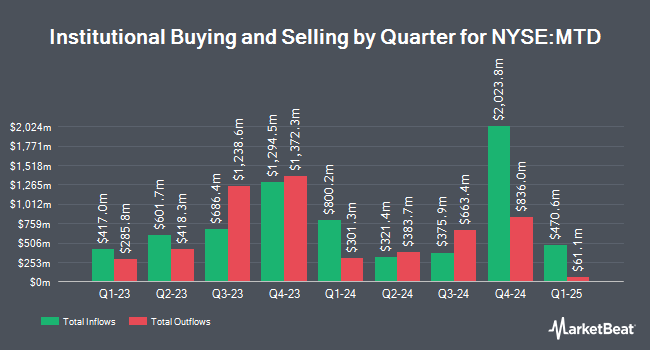

Other institutional investors have also recently bought and sold shares of the company. PineStone Asset Management Inc. increased its stake in shares of Mettler-Toledo International by 127.4% in the 2nd quarter. PineStone Asset Management Inc. now owns 259,629 shares of the medical instruments supplier's stock valued at $362,855,000 after acquiring an additional 145,453 shares during the last quarter. Loomis Sayles & Co. L P grew its holdings in Mettler-Toledo International by 1.8% during the third quarter. Loomis Sayles & Co. L P now owns 209,902 shares of the medical instruments supplier's stock valued at $314,790,000 after purchasing an additional 3,644 shares during the period. TD Asset Management Inc increased its stake in Mettler-Toledo International by 1.9% in the second quarter. TD Asset Management Inc now owns 157,247 shares of the medical instruments supplier's stock valued at $219,767,000 after purchasing an additional 2,866 shares in the last quarter. Massachusetts Financial Services Co. MA raised its holdings in Mettler-Toledo International by 32.5% in the second quarter. Massachusetts Financial Services Co. MA now owns 142,944 shares of the medical instruments supplier's stock worth $199,777,000 after purchasing an additional 35,048 shares during the period. Finally, International Assets Investment Management LLC raised its holdings in Mettler-Toledo International by 149,870.0% in the third quarter. International Assets Investment Management LLC now owns 89,982 shares of the medical instruments supplier's stock worth $134,946,000 after purchasing an additional 89,922 shares during the period. Institutional investors and hedge funds own 95.07% of the company's stock.

Analyst Ratings Changes

A number of research firms recently commented on MTD. JPMorgan Chase & Co. upped their price objective on shares of Mettler-Toledo International from $1,300.00 to $1,400.00 and gave the company a "neutral" rating in a research report on Monday, August 5th. Stifel Nicolaus decreased their target price on Mettler-Toledo International from $1,550.00 to $1,450.00 and set a "buy" rating for the company in a research note on Monday, November 11th. Evercore ISI raised their price target on Mettler-Toledo International from $1,375.00 to $1,450.00 and gave the stock an "in-line" rating in a research report on Tuesday, October 1st. Robert W. Baird decreased their price objective on Mettler-Toledo International from $1,375.00 to $1,310.00 and set a "neutral" rating for the company in a research report on Monday, November 11th. Finally, Wells Fargo & Company lowered their target price on Mettler-Toledo International from $1,400.00 to $1,350.00 and set an "equal weight" rating for the company in a research note on Monday, November 11th. Two research analysts have rated the stock with a sell rating, five have issued a hold rating and two have assigned a buy rating to the stock. According to MarketBeat.com, Mettler-Toledo International has a consensus rating of "Hold" and a consensus price target of $1,338.75.

View Our Latest Research Report on Mettler-Toledo International

Insiders Place Their Bets

In other Mettler-Toledo International news, Director Elisha W. Finney sold 76 shares of the business's stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of $1,311.75, for a total transaction of $99,693.00. Following the transaction, the director now owns 240 shares of the company's stock, valued at $314,820. The trade was a 24.05 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Insiders own 1.94% of the company's stock.

Mettler-Toledo International Stock Performance

Mettler-Toledo International stock traded up $7.80 during midday trading on Friday, reaching $1,251.20. The stock had a trading volume of 74,430 shares, compared to its average volume of 136,894. The stock has a market capitalization of $26.40 billion, a P/E ratio of 33.73, a price-to-earnings-growth ratio of 4.10 and a beta of 1.16. The firm's fifty day simple moving average is $1,345.17 and its 200-day simple moving average is $1,393.26. Mettler-Toledo International Inc. has a 1-year low of $1,068.33 and a 1-year high of $1,546.93.

Mettler-Toledo International (NYSE:MTD - Get Free Report) last posted its quarterly earnings data on Thursday, November 7th. The medical instruments supplier reported $10.21 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $10.00 by $0.21. Mettler-Toledo International had a net margin of 21.15% and a negative return on equity of 531.78%. The company had revenue of $954.54 million for the quarter, compared to the consensus estimate of $941.93 million. On average, sell-side analysts anticipate that Mettler-Toledo International Inc. will post 40.39 earnings per share for the current fiscal year.

Mettler-Toledo International Company Profile

(

Free Report)

Mettler-Toledo International Inc manufactures and supplies precision instruments and services in the Americas, Europe, Asia, and internationally. It operates through five segments: U.S. Operations, Swiss Operations, Western European Operations, Chinese Operations, and Other. The company's laboratory instruments include laboratory balances, liquid pipetting solutions, automated laboratory reactors, real-time analytics, titrators, pH meters, process analytics sensors and analyzer technologies, physical value analyzers, density and refractometry, thermal analysis systems, and other analytical instruments; and LabX, a laboratory software platform to manage and analyze data generated from its instruments.

Featured Articles

Before you consider Mettler-Toledo International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mettler-Toledo International wasn't on the list.

While Mettler-Toledo International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.