Eventide Asset Management LLC lessened its stake in Scholar Rock Holding Co. (NASDAQ:SRRK - Free Report) by 21.6% in the 3rd quarter, according to its most recent filing with the SEC. The fund owned 2,409,207 shares of the company's stock after selling 665,268 shares during the period. Eventide Asset Management LLC owned about 3.01% of Scholar Rock worth $19,298,000 at the end of the most recent quarter.

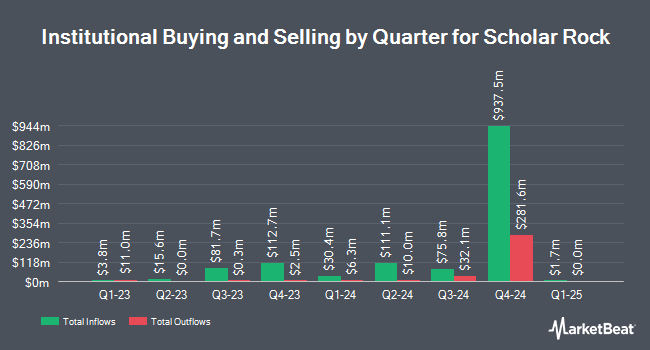

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in SRRK. FMR LLC grew its stake in shares of Scholar Rock by 3.1% in the third quarter. FMR LLC now owns 10,196,046 shares of the company's stock valued at $81,670,000 after buying an additional 308,813 shares in the last quarter. Vanguard Group Inc. grew its position in Scholar Rock by 4.0% in the 1st quarter. Vanguard Group Inc. now owns 2,969,534 shares of the company's stock valued at $52,739,000 after acquiring an additional 114,550 shares in the last quarter. Millennium Management LLC increased its stake in Scholar Rock by 159.2% during the second quarter. Millennium Management LLC now owns 925,584 shares of the company's stock worth $7,710,000 after purchasing an additional 568,512 shares during the period. Hood River Capital Management LLC lifted its position in shares of Scholar Rock by 5.1% during the second quarter. Hood River Capital Management LLC now owns 832,792 shares of the company's stock worth $6,937,000 after purchasing an additional 40,745 shares in the last quarter. Finally, abrdn plc grew its holdings in shares of Scholar Rock by 28.2% in the third quarter. abrdn plc now owns 748,489 shares of the company's stock valued at $5,995,000 after purchasing an additional 164,715 shares in the last quarter. Hedge funds and other institutional investors own 91.08% of the company's stock.

Insider Buying and Selling at Scholar Rock

In other news, major shareholder Public Equities L.P. Invus sold 409,433 shares of the business's stock in a transaction that occurred on Monday, November 25th. The shares were sold at an average price of $38.49, for a total value of $15,759,076.17. Following the completion of the transaction, the insider now owns 10,850,005 shares of the company's stock, valued at $417,616,692.45. The trade was a 3.64 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, insider Tracey Sacco sold 30,000 shares of the firm's stock in a transaction that occurred on Monday, October 7th. The stock was sold at an average price of $25.62, for a total transaction of $768,600.00. Following the sale, the insider now owns 49,285 shares in the company, valued at approximately $1,262,681.70. This trade represents a 37.84 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 1,823,322 shares of company stock worth $56,411,627. 19.20% of the stock is owned by insiders.

Analyst Upgrades and Downgrades

A number of equities research analysts have issued reports on the stock. Piper Sandler increased their target price on shares of Scholar Rock from $28.00 to $42.00 and gave the stock an "overweight" rating in a report on Tuesday, October 15th. Wedbush lifted their target price on Scholar Rock from $40.00 to $47.00 and gave the company an "outperform" rating in a report on Monday, November 25th. BMO Capital Markets upped their price target on Scholar Rock from $34.00 to $38.00 and gave the stock an "outperform" rating in a report on Friday, October 11th. HC Wainwright lifted their price objective on Scholar Rock from $40.00 to $50.00 and gave the company a "buy" rating in a research note on Tuesday. Finally, JPMorgan Chase & Co. upped their target price on shares of Scholar Rock from $18.00 to $31.00 and gave the stock an "overweight" rating in a research note on Monday, October 14th. Six equities research analysts have rated the stock with a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Buy" and an average target price of $40.43.

Get Our Latest Report on SRRK

Scholar Rock Stock Up 4.6 %

Shares of NASDAQ:SRRK traded up $1.75 on Friday, hitting $39.90. 839,720 shares of the company's stock were exchanged, compared to its average volume of 1,150,697. The company has a debt-to-equity ratio of 0.63, a quick ratio of 3.88 and a current ratio of 3.88. Scholar Rock Holding Co. has a 1-year low of $6.76 and a 1-year high of $43.38. The company has a market capitalization of $3.74 billion, a PE ratio of -16.98 and a beta of 0.47. The firm's 50-day moving average is $25.49 and its 200 day moving average is $14.88.

Scholar Rock Company Profile

(

Free Report)

Scholar Rock Holding Corporation, a biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role. The company develops Apitegromab, an inhibitor of the activation of myostatin that is in Phase 3 clinical trial for the treatment of spinal muscular atrophy; and SRK-181, which has completed Phase 1 clinical trials for the treatment of cancers that are resistant to checkpoint inhibitor therapies, such as anti-PD-1 or anti-PD-L1 antibody therapies.

Featured Stories

Before you consider Scholar Rock, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Scholar Rock wasn't on the list.

While Scholar Rock currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.