EverCommerce (NASDAQ:EVCM - Get Free Report) had its price target upped by analysts at Oppenheimer from $12.00 to $13.00 in a report released on Wednesday,Benzinga reports. The brokerage currently has an "outperform" rating on the stock. Oppenheimer's price target indicates a potential upside of 16.70% from the stock's previous close.

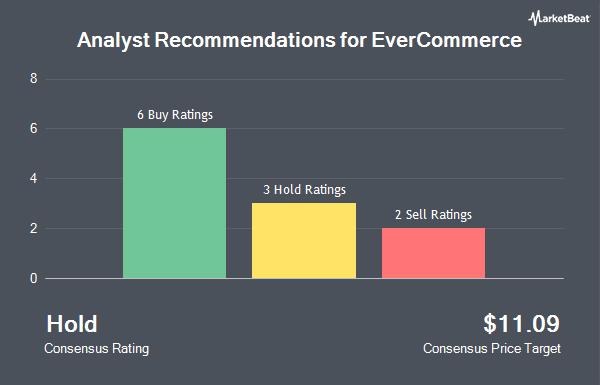

Other analysts also recently issued reports about the company. Piper Sandler raised their target price on EverCommerce from $10.00 to $11.00 and gave the company a "neutral" rating in a research note on Wednesday. Evercore ISI increased their price objective on shares of EverCommerce from $10.00 to $11.00 and gave the stock an "outperform" rating in a report on Wednesday, August 7th. JPMorgan Chase & Co. raised their price target on EverCommerce from $10.00 to $11.00 and gave the company an "underweight" rating in a report on Wednesday, August 7th. Finally, Deutsche Bank Aktiengesellschaft increased their price target on EverCommerce from $12.00 to $13.00 and gave the company a "buy" rating in a research note on Wednesday, August 7th. One investment analyst has rated the stock with a sell rating, two have given a hold rating and six have given a buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $12.56.

Read Our Latest Stock Report on EverCommerce

EverCommerce Price Performance

EVCM stock traded down $0.84 during midday trading on Wednesday, hitting $11.14. 174,729 shares of the stock were exchanged, compared to its average volume of 141,132. EverCommerce has a fifty-two week low of $6.22 and a fifty-two week high of $12.35. The stock's 50-day moving average price is $10.59 and its 200-day moving average price is $10.51. The company has a debt-to-equity ratio of 0.67, a quick ratio of 1.68 and a current ratio of 1.68.

EverCommerce (NASDAQ:EVCM - Get Free Report) last issued its quarterly earnings results on Tuesday, November 12th. The company reported ($0.05) earnings per share for the quarter, missing the consensus estimate of ($0.01) by ($0.04). EverCommerce had a negative net margin of 7.53% and a negative return on equity of 6.49%. The business had revenue of $176.26 million during the quarter, compared to analyst estimates of $174.87 million. The company's revenue was up .9% on a year-over-year basis. As a group, research analysts forecast that EverCommerce will post -0.09 EPS for the current fiscal year.

Insider Activity at EverCommerce

In other EverCommerce news, CEO Eric Richard Remer sold 7,099 shares of the stock in a transaction dated Thursday, September 19th. The stock was sold at an average price of $10.69, for a total transaction of $75,888.31. Following the completion of the transaction, the chief executive officer now owns 8,124,163 shares in the company, valued at approximately $86,847,302.47. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Insiders have sold 89,310 shares of company stock worth $965,566 in the last ninety days. Company insiders own 11.60% of the company's stock.

Institutional Investors Weigh In On EverCommerce

Several hedge funds have recently added to or reduced their stakes in the business. RIA Advisory Group LLC acquired a new position in EverCommerce during the third quarter valued at approximately $241,000. DekaBank Deutsche Girozentrale bought a new position in EverCommerce during the 3rd quarter worth approximately $570,000. SG Americas Securities LLC bought a new stake in EverCommerce during the third quarter valued at $107,000. The Manufacturers Life Insurance Company grew its stake in EverCommerce by 10.6% during the second quarter. The Manufacturers Life Insurance Company now owns 11,360 shares of the company's stock worth $125,000 after purchasing an additional 1,089 shares during the period. Finally, Millennium Management LLC lifted its position in shares of EverCommerce by 673.4% during the 2nd quarter. Millennium Management LLC now owns 323,360 shares of the company's stock valued at $3,550,000 after acquiring an additional 281,551 shares during the period. Institutional investors and hedge funds own 97.91% of the company's stock.

About EverCommerce

(

Get Free Report)

EverCommerce Inc, together with its subsidiaries, provides integrated software-as-a-service solutions for service-based small and medium sized businesses in the United States and internationally. The company's solutions include business management software that offers route-based dispatching, medical practice management, and gym member management solutions; billing and payment solutions comprising e-invoicing, mobile payments, and integrated payment processing; customer experience solution, which include reputation management and messaging solutions; and marketing technology solutions that cover websites, hosting, and digital lead generation.

Featured Stories

Before you consider EverCommerce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EverCommerce wasn't on the list.

While EverCommerce currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.