Evercore ISI upgraded shares of FOX (NASDAQ:FOXA - Free Report) to a hold rating in a research note published on Tuesday,Zacks.com reports.

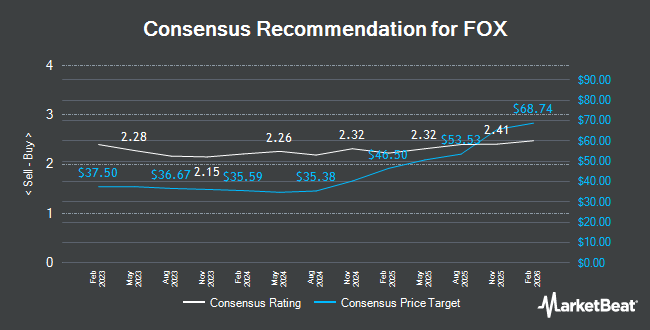

Several other equities research analysts also recently issued reports on the company. Cfra restated a "sell" rating on shares of FOX in a research report on Wednesday, September 25th. Seaport Res Ptn downgraded FOX from a "strong-buy" rating to a "hold" rating in a research note on Monday, September 9th. JPMorgan Chase & Co. lifted their target price on FOX from $41.00 to $42.00 and gave the company a "neutral" rating in a report on Tuesday. Loop Capital increased their price target on shares of FOX from $43.00 to $46.00 and gave the stock a "buy" rating in a report on Tuesday, October 8th. Finally, Morgan Stanley boosted their price objective on shares of FOX from $38.00 to $40.00 and gave the company an "equal weight" rating in a research note on Friday, November 1st. One research analyst has rated the stock with a sell rating, nine have assigned a hold rating and eight have issued a buy rating to the company's stock. Based on data from MarketBeat.com, FOX has an average rating of "Hold" and a consensus target price of $44.00.

Get Our Latest Research Report on FOX

FOX Stock Performance

Shares of NASDAQ FOXA traded down $0.81 during trading on Tuesday, reaching $44.67. 3,742,336 shares of the stock traded hands, compared to its average volume of 3,003,167. The company has a 50-day moving average of $41.53 and a 200-day moving average of $37.48. FOX has a 52-week low of $28.28 and a 52-week high of $45.82. The stock has a market capitalization of $20.56 billion, a P/E ratio of 10.92, a price-to-earnings-growth ratio of 1.95 and a beta of 0.76. The company has a debt-to-equity ratio of 0.58, a current ratio of 2.59 and a quick ratio of 2.33.

FOX (NASDAQ:FOXA - Get Free Report) last issued its earnings results on Monday, November 4th. The company reported $1.45 earnings per share for the quarter, topping analysts' consensus estimates of $1.12 by $0.33. The firm had revenue of $3.56 billion during the quarter, compared to analyst estimates of $3.38 billion. FOX had a net margin of 13.40% and a return on equity of 16.49%. The company's quarterly revenue was up 11.1% on a year-over-year basis. During the same quarter last year, the business earned $1.09 earnings per share. Analysts forecast that FOX will post 3.7 EPS for the current fiscal year.

Insider Activity at FOX

In other FOX news, COO John Nallen sold 182,481 shares of FOX stock in a transaction dated Tuesday, November 5th. The stock was sold at an average price of $43.73, for a total transaction of $7,979,894.13. Following the completion of the sale, the chief operating officer now owns 249,424 shares of the company's stock, valued at $10,907,311.52. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. In related news, Chairman Keith Rupert Murdoch sold 100,000 shares of the stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $42.05, for a total transaction of $4,205,000.00. Following the transaction, the chairman now owns 1,258,862 shares of the company's stock, valued at approximately $52,935,147.10. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, COO John Nallen sold 182,481 shares of the business's stock in a transaction on Tuesday, November 5th. The stock was sold at an average price of $43.73, for a total transaction of $7,979,894.13. Following the completion of the sale, the chief operating officer now directly owns 249,424 shares of the company's stock, valued at $10,907,311.52. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 335,355 shares of company stock valued at $14,244,865 over the last 90 days. 21.77% of the stock is owned by insiders.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently modified their holdings of the stock. Mitsubishi UFJ Trust & Banking Corp grew its stake in shares of FOX by 31.1% in the 1st quarter. Mitsubishi UFJ Trust & Banking Corp now owns 495,488 shares of the company's stock worth $15,523,000 after buying an additional 117,458 shares during the last quarter. Jane Street Group LLC increased its holdings in shares of FOX by 25.2% during the first quarter. Jane Street Group LLC now owns 139,502 shares of the company's stock valued at $4,362,000 after acquiring an additional 28,072 shares in the last quarter. UniSuper Management Pty Ltd boosted its stake in FOX by 565.6% in the 1st quarter. UniSuper Management Pty Ltd now owns 23,830 shares of the company's stock worth $745,000 after purchasing an additional 20,250 shares in the last quarter. CreativeOne Wealth LLC purchased a new stake in FOX during the 1st quarter valued at about $609,000. Finally, SG Americas Securities LLC increased its stake in FOX by 89.6% during the 1st quarter. SG Americas Securities LLC now owns 50,354 shares of the company's stock valued at $1,575,000 after purchasing an additional 23,791 shares in the last quarter. 52.52% of the stock is owned by institutional investors.

About FOX

(

Get Free Report)

Fox Corporation operates as a news, sports, and entertainment company in the United States (U.S.). The company operates through four segments: Cable Network Programming, Television, Credible, and The FOX Studio Lot. The Cable Network Programming segment produces and licenses news and sports content for distribution through traditional cable television systems, direct broadcast satellite operators and telecommunication companies, virtual multi-channel video programming distributors, and other digital platforms primarily in the U.S.

Featured Articles

Before you consider FOX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FOX wasn't on the list.

While FOX currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.