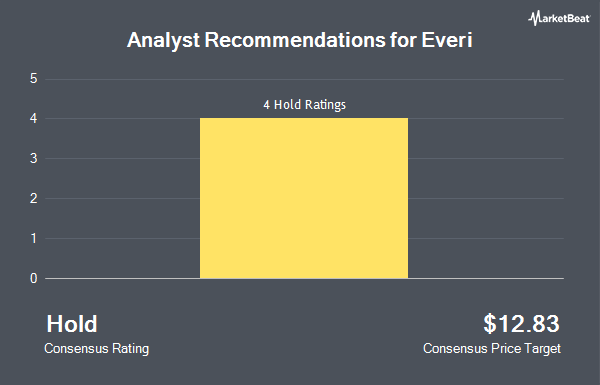

StockNews.com assumed coverage on shares of Everi (NYSE:EVRI - Free Report) in a research note issued to investors on Thursday morning. The brokerage issued a hold rating on the credit services provider's stock.

Everi Stock Down 0.1 %

EVRI traded down $0.02 during trading on Thursday, hitting $13.46. 422,074 shares of the company's stock traded hands, compared to its average volume of 1,328,582. Everi has a 12-month low of $6.37 and a 12-month high of $13.50. The company's 50 day simple moving average is $13.36 and its two-hundred day simple moving average is $11.64. The stock has a market capitalization of $1.16 billion, a price-to-earnings ratio of 89.73 and a beta of 2.07. The company has a current ratio of 1.06, a quick ratio of 0.97 and a debt-to-equity ratio of 3.84.

Insider Transactions at Everi

In related news, EVP David Lucchese sold 45,476 shares of the stock in a transaction dated Monday, December 9th. The shares were sold at an average price of $13.48, for a total value of $613,016.48. Following the completion of the transaction, the executive vice president now owns 542,928 shares of the company's stock, valued at approximately $7,318,669.44. This trade represents a 7.73 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CFO Mark F. Labay sold 50,000 shares of the business's stock in a transaction that occurred on Monday, November 25th. The stock was sold at an average price of $13.38, for a total value of $669,000.00. Following the sale, the chief financial officer now directly owns 142,426 shares in the company, valued at $1,905,659.88. The trade was a 25.98 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 205,476 shares of company stock valued at $2,762,636 over the last 90 days. Company insiders own 6.40% of the company's stock.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently bought and sold shares of the company. Signaturefd LLC raised its holdings in shares of Everi by 2,428.6% in the second quarter. Signaturefd LLC now owns 3,186 shares of the credit services provider's stock worth $27,000 after buying an additional 3,060 shares during the period. CWM LLC increased its stake in Everi by 117.5% in the 2nd quarter. CWM LLC now owns 3,512 shares of the credit services provider's stock worth $30,000 after buying an additional 1,897 shares during the period. Huntington National Bank grew its stake in Everi by 1,296.2% in the third quarter. Huntington National Bank now owns 5,892 shares of the credit services provider's stock worth $77,000 after purchasing an additional 5,470 shares in the last quarter. Quarry LP raised its position in Everi by 38.9% during the 2nd quarter. Quarry LP now owns 10,230 shares of the credit services provider's stock valued at $86,000 after purchasing an additional 2,864 shares in the last quarter. Finally, Magnetar Financial LLC purchased a new stake in shares of Everi in the 2nd quarter worth $104,000. 95.47% of the stock is owned by hedge funds and other institutional investors.

About Everi

(

Get Free Report)

Everi Holdings Inc develops and supplies entertaining game content, gaming machines, and gaming systems and services for land-based and iGaming operators in the United States, Canada, and internationally. It operates in Games and Financial Technology Solutions segments. The company offers classic mechanical reel games and video reel games, as well as TournEvent of Champions, a national slot tournament; and sells gaming equipment and player terminals, licenses, game content, and ancillary equipment, such as signage and lighting packages.

Featured Stories

Before you consider Everi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Everi wasn't on the list.

While Everi currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.