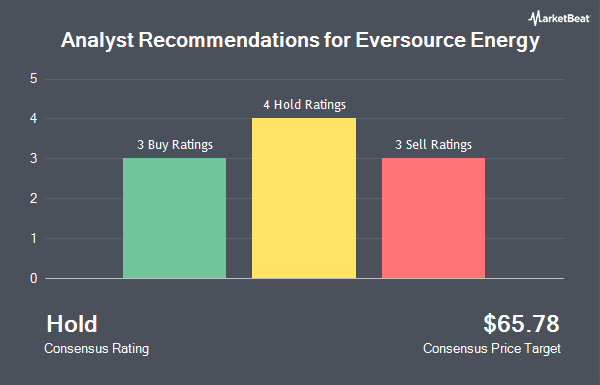

Eversource Energy (NYSE:ES - Get Free Report) has been given an average recommendation of "Hold" by the thirteen analysts that are covering the company, Marketbeat Ratings reports. Two equities research analysts have rated the stock with a sell recommendation, five have given a hold recommendation and six have assigned a buy recommendation to the company. The average 1-year price target among analysts that have issued ratings on the stock in the last year is $68.38.

Several equities research analysts recently issued reports on the stock. BMO Capital Markets cut their price objective on shares of Eversource Energy from $74.00 to $72.00 and set a "market perform" rating for the company in a research report on Tuesday, October 15th. Scotiabank lowered shares of Eversource Energy from a "sector perform" rating to a "sector underperform" rating and lowered their target price for the stock from $66.00 to $56.00 in a research note on Thursday. Barclays lifted their price target on shares of Eversource Energy from $69.00 to $72.00 and gave the company an "equal weight" rating in a research report on Tuesday, October 15th. StockNews.com cut shares of Eversource Energy from a "hold" rating to a "sell" rating in a research report on Friday. Finally, Mizuho lifted their price target on shares of Eversource Energy from $62.00 to $73.00 and gave the company an "outperform" rating in a research report on Wednesday, October 2nd.

Check Out Our Latest Stock Report on Eversource Energy

Institutional Inflows and Outflows

Large investors have recently modified their holdings of the stock. Brown Brothers Harriman & Co. raised its holdings in Eversource Energy by 2.8% in the third quarter. Brown Brothers Harriman & Co. now owns 6,147 shares of the utilities provider's stock valued at $418,000 after buying an additional 166 shares during the period. Massmutual Trust Co. FSB ADV raised its holdings in Eversource Energy by 14.7% in the third quarter. Massmutual Trust Co. FSB ADV now owns 1,316 shares of the utilities provider's stock valued at $90,000 after buying an additional 169 shares during the period. Addison Advisors LLC raised its holdings in Eversource Energy by 27.4% in the second quarter. Addison Advisors LLC now owns 860 shares of the utilities provider's stock valued at $49,000 after buying an additional 185 shares during the period. UMB Bank n.a. grew its position in Eversource Energy by 62.9% in the third quarter. UMB Bank n.a. now owns 513 shares of the utilities provider's stock valued at $35,000 after acquiring an additional 198 shares in the last quarter. Finally, Louisiana State Employees Retirement System grew its position in Eversource Energy by 1.0% in the third quarter. Louisiana State Employees Retirement System now owns 20,100 shares of the utilities provider's stock valued at $1,368,000 after acquiring an additional 200 shares in the last quarter. 79.99% of the stock is currently owned by hedge funds and other institutional investors.

Eversource Energy Stock Performance

Shares of ES stock traded down $0.27 during trading hours on Friday, hitting $59.52. The company's stock had a trading volume of 1,495,073 shares, compared to its average volume of 2,366,158. The company has a 50 day moving average of $63.17 and a 200 day moving average of $63.12. Eversource Energy has a 12-month low of $52.09 and a 12-month high of $69.01. The stock has a market cap of $21.81 billion, a PE ratio of -37.91, a price-to-earnings-growth ratio of 2.40 and a beta of 0.60. The company has a current ratio of 0.86, a quick ratio of 0.76 and a debt-to-equity ratio of 1.73.

Eversource Energy (NYSE:ES - Get Free Report) last posted its quarterly earnings data on Monday, November 4th. The utilities provider reported $1.13 earnings per share for the quarter, topping analysts' consensus estimates of $1.08 by $0.05. The company had revenue of $3.06 billion during the quarter, compared to analysts' expectations of $3.06 billion. Eversource Energy had a negative net margin of 4.73% and a positive return on equity of 10.90%. The firm's revenue for the quarter was up 9.7% on a year-over-year basis. During the same period in the prior year, the business posted $0.97 earnings per share. On average, sell-side analysts forecast that Eversource Energy will post 4.56 EPS for the current fiscal year.

Eversource Energy Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Wednesday, December 18th will be issued a dividend of $0.715 per share. The ex-dividend date is Wednesday, December 18th. This represents a $2.86 annualized dividend and a dividend yield of 4.81%. Eversource Energy's payout ratio is currently -182.17%.

Eversource Energy Company Profile

(

Get Free ReportEversource Energy, a public utility holding company, engages in the energy delivery business. The company operates through Electric Distribution, Electric Transmission, Natural Gas Distribution, and Water Distribution segments. It is involved in the transmission and distribution of electricity; solar power facilities; and distribution of natural gas.

Further Reading

Before you consider Eversource Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eversource Energy wasn't on the list.

While Eversource Energy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.