EverSource Wealth Advisors LLC boosted its stake in Pampa Energía S.A. (NYSE:PAM - Free Report) by 306.1% in the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 5,369 shares of the utilities provider's stock after purchasing an additional 4,047 shares during the quarter. EverSource Wealth Advisors LLC's holdings in Pampa Energía were worth $472,000 at the end of the most recent reporting period.

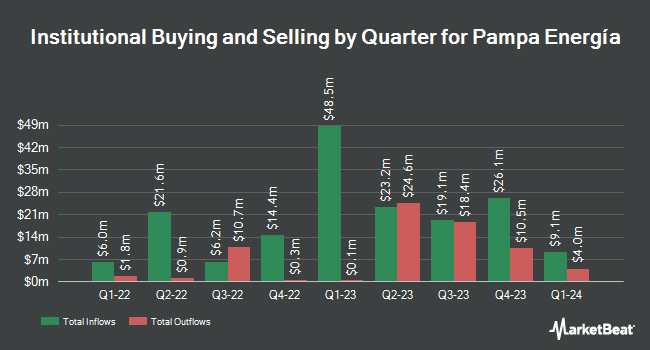

Other hedge funds and other institutional investors have also bought and sold shares of the company. Advisors Preferred LLC acquired a new position in Pampa Energía in the fourth quarter valued at about $26,000. Mirae Asset Global Investments Co. Ltd. acquired a new position in Pampa Energía in the fourth quarter valued at about $49,000. Blue Trust Inc. raised its stake in Pampa Energía by 62.7% in the fourth quarter. Blue Trust Inc. now owns 672 shares of the utilities provider's stock valued at $59,000 after purchasing an additional 259 shares in the last quarter. QRG Capital Management Inc. acquired a new position in Pampa Energía in the fourth quarter valued at about $210,000. Finally, GAMMA Investing LLC raised its stake in Pampa Energía by 75.9% in the fourth quarter. GAMMA Investing LLC now owns 2,464 shares of the utilities provider's stock valued at $217,000 after purchasing an additional 1,063 shares in the last quarter. Institutional investors and hedge funds own 12.77% of the company's stock.

Analysts Set New Price Targets

Separately, JPMorgan Chase & Co. boosted their price target on Pampa Energía from $59.00 to $93.50 and gave the company a "neutral" rating in a research note on Friday, January 10th. Three research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $71.63.

Get Our Latest Report on PAM

Pampa Energía Trading Up 5.3 %

Shares of Pampa Energía stock traded up $4.01 on Wednesday, hitting $79.91. The stock had a trading volume of 215,213 shares, compared to its average volume of 282,108. The stock has a 50 day moving average of $82.75 and a 200 day moving average of $76.52. Pampa Energía S.A. has a twelve month low of $38.58 and a twelve month high of $97.55. The company has a debt-to-equity ratio of 0.44, a quick ratio of 2.13 and a current ratio of 2.41. The firm has a market capitalization of $4.36 billion, a P/E ratio of 12.29 and a beta of 0.92.

Pampa Energía (NYSE:PAM - Get Free Report) last released its quarterly earnings data on Wednesday, March 5th. The utilities provider reported $1.90 earnings per share (EPS) for the quarter. Pampa Energía had a return on equity of 12.15% and a net margin of 19.86%. The company had revenue of $435.00 million during the quarter, compared to the consensus estimate of $454.61 million. Sell-side analysts expect that Pampa Energía S.A. will post 9.33 earnings per share for the current fiscal year.

Pampa Energía Company Profile

(

Free Report)

Pampa Energía SA operates as an integrated power company in Argentina. The company operates through Electricity Generation, Oil and Gas, Petrochemicals, and Holding and Other Business segments. It generates electricity through thermal plants, hydroelectric plants, and wind farms with a 5,332 megawatt (MW) installed capacity.

Recommended Stories

Before you consider Pampa Energía, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pampa Energía wasn't on the list.

While Pampa Energía currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.