EverSource Wealth Advisors LLC boosted its stake in Diamondback Energy, Inc. (NASDAQ:FANG - Free Report) by 36.6% in the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 21,485 shares of the oil and natural gas company's stock after purchasing an additional 5,754 shares during the quarter. EverSource Wealth Advisors LLC's holdings in Diamondback Energy were worth $3,520,000 as of its most recent SEC filing.

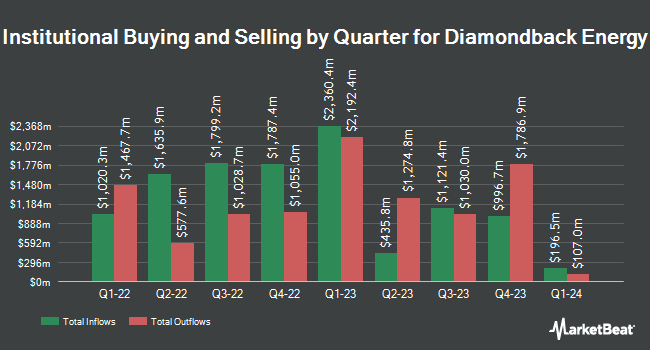

A number of other institutional investors and hedge funds have also bought and sold shares of FANG. Summit Global Investments purchased a new position in shares of Diamondback Energy during the 3rd quarter valued at $202,000. Atria Investments Inc grew its stake in shares of Diamondback Energy by 18.5% in the third quarter. Atria Investments Inc now owns 42,678 shares of the oil and natural gas company's stock worth $7,358,000 after acquiring an additional 6,672 shares during the last quarter. Covestor Ltd increased its holdings in shares of Diamondback Energy by 49.8% in the 3rd quarter. Covestor Ltd now owns 704 shares of the oil and natural gas company's stock worth $122,000 after purchasing an additional 234 shares in the last quarter. Sigma Planning Corp grew its position in Diamondback Energy by 19.4% in the 3rd quarter. Sigma Planning Corp now owns 6,948 shares of the oil and natural gas company's stock worth $1,198,000 after purchasing an additional 1,127 shares during the period. Finally, Ashton Thomas Securities LLC purchased a new position in shares of Diamondback Energy in the third quarter worth approximately $52,000. 90.01% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling

In other Diamondback Energy news, Director Frank D. Tsuru bought 2,000 shares of Diamondback Energy stock in a transaction on Friday, February 28th. The shares were acquired at an average price of $156.51 per share, for a total transaction of $313,020.00. Following the completion of the purchase, the director now directly owns 5,730 shares in the company, valued at approximately $896,802.30. This trade represents a 53.62 % increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. 0.48% of the stock is owned by insiders.

Analysts Set New Price Targets

FANG has been the topic of a number of research reports. Mizuho lifted their price target on shares of Diamondback Energy from $201.00 to $204.00 and gave the company an "outperform" rating in a report on Tuesday, February 25th. UBS Group boosted their price target on Diamondback Energy from $212.00 to $216.00 and gave the stock a "buy" rating in a research note on Thursday, February 13th. The Goldman Sachs Group initiated coverage on shares of Diamondback Energy in a report on Monday, December 2nd. They set a "buy" rating and a $227.00 target price for the company. Wolfe Research upgraded Diamondback Energy from a "peer perform" rating to an "outperform" rating and set a $190.00 price objective for the company in a research report on Friday, January 3rd. Finally, Truist Financial upped their price target on Diamondback Energy from $236.00 to $238.00 and gave the company a "buy" rating in a research report on Wednesday, February 19th. One research analyst has rated the stock with a sell rating, three have issued a hold rating, eighteen have assigned a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $215.00.

Get Our Latest Analysis on FANG

Diamondback Energy Stock Up 2.9 %

FANG stock opened at $144.65 on Wednesday. The company has a quick ratio of 0.42, a current ratio of 0.45 and a debt-to-equity ratio of 0.31. The stock's 50 day moving average is $163.18 and its 200-day moving average is $172.54. Diamondback Energy, Inc. has a twelve month low of $137.09 and a twelve month high of $214.50. The firm has a market capitalization of $41.87 billion, a PE ratio of 8.28, a P/E/G ratio of 1.24 and a beta of 1.84.

Diamondback Energy (NASDAQ:FANG - Get Free Report) last released its quarterly earnings results on Tuesday, February 25th. The oil and natural gas company reported $3.64 earnings per share for the quarter, beating analysts' consensus estimates of $3.57 by $0.07. Diamondback Energy had a return on equity of 13.68% and a net margin of 33.64%. The business had revenue of $3.71 billion for the quarter, compared to the consensus estimate of $3.55 billion. Sell-side analysts expect that Diamondback Energy, Inc. will post 15.49 EPS for the current fiscal year.

Diamondback Energy Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, March 13th. Investors of record on Thursday, March 6th will be issued a $1.00 dividend. The ex-dividend date is Thursday, March 6th. This represents a $4.00 annualized dividend and a dividend yield of 2.77%. This is a positive change from Diamondback Energy's previous quarterly dividend of $0.90. Diamondback Energy's payout ratio is presently 25.32%.

Diamondback Energy Profile

(

Free Report)

Diamondback Energy, Inc, an independent oil and natural gas company, acquires, develops, explores, and exploits unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas. It focuses on the development of the Spraberry and Wolfcamp formations of the Midland basin; and the Wolfcamp and Bone Spring formations of the Delaware basin, which are part of the Permian Basin in West Texas and New Mexico.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Diamondback Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diamondback Energy wasn't on the list.

While Diamondback Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.