Everstar Asset Management LLC decreased its position in shares of Veren Inc. (NYSE:VRN - Free Report) by 77.7% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 13,056 shares of the company's stock after selling 45,591 shares during the period. Everstar Asset Management LLC's holdings in Veren were worth $67,000 as of its most recent filing with the Securities and Exchange Commission.

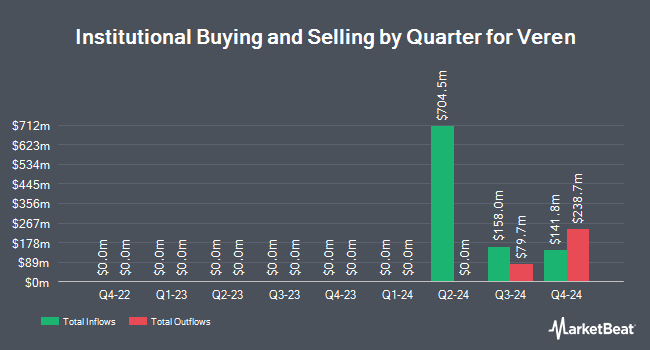

Other hedge funds have also added to or reduced their stakes in the company. EverSource Wealth Advisors LLC boosted its holdings in shares of Veren by 80.6% in the 4th quarter. EverSource Wealth Advisors LLC now owns 5,951 shares of the company's stock valued at $31,000 after purchasing an additional 2,655 shares in the last quarter. Arkadios Wealth Advisors acquired a new stake in Veren in the fourth quarter valued at about $59,000. Orion Portfolio Solutions LLC bought a new position in Veren in the fourth quarter valued at about $71,000. Truist Financial Corp acquired a new position in Veren during the fourth quarter worth about $76,000. Finally, Wilmington Savings Fund Society FSB bought a new position in shares of Veren in the third quarter worth about $108,000. 49.37% of the stock is owned by institutional investors.

Veren Price Performance

Shares of Veren stock traded down $0.74 during midday trading on Friday, hitting $5.54. 27,597,063 shares of the company traded hands, compared to its average volume of 9,344,903. The firm's fifty day moving average price is $5.63 and its 200-day moving average price is $5.57. The stock has a market cap of $3.39 billion, a price-to-earnings ratio of 3.95 and a beta of 2.08. Veren Inc. has a 12 month low of $4.40 and a 12 month high of $9.02. The company has a debt-to-equity ratio of 0.34, a quick ratio of 0.88 and a current ratio of 0.88.

Veren Cuts Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, April 1st. Stockholders of record on Saturday, March 15th were paid a $0.0797 dividend. This represents a $0.32 dividend on an annualized basis and a dividend yield of 5.76%. The ex-dividend date of this dividend was Friday, March 14th. Veren's payout ratio is 100.00%.

Veren Profile

(

Free Report)

Veren Inc explores, develops, and produces oil and gas properties in Canada and the United States. The company focuses on crude oil, tight oil, natural gas liquids, shale gas, and natural gas reserves. Its properties are located in the provinces of Saskatchewan, Alberta, British Columbia, and Manitoba; and the states of North Dakota.

Featured Articles

Before you consider Veren, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veren wasn't on the list.

While Veren currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.