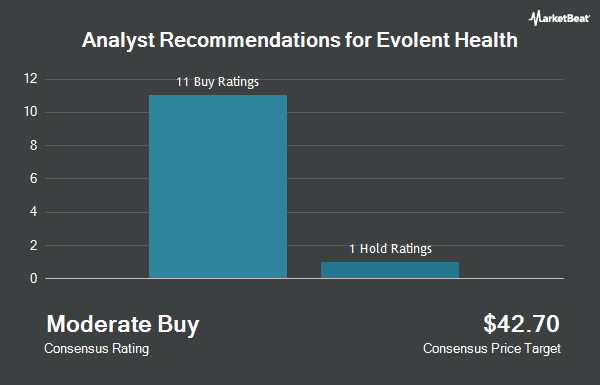

Shares of Evolent Health, Inc. (NYSE:EVH - Get Free Report) have been given a consensus rating of "Buy" by the twelve brokerages that are presently covering the stock, Marketbeat Ratings reports. Eleven analysts have rated the stock with a buy recommendation and one has issued a strong buy recommendation on the company. The average 12-month target price among analysts that have updated their coverage on the stock in the last year is $38.60.

A number of equities research analysts have recently weighed in on the company. Citigroup lowered their price target on Evolent Health from $35.00 to $33.00 and set a "buy" rating for the company in a report on Tuesday, October 29th. Royal Bank of Canada restated an "outperform" rating and set a $42.00 price objective on shares of Evolent Health in a research report on Tuesday, October 8th. KeyCorp began coverage on Evolent Health in a research report on Friday, October 11th. They set an "overweight" rating and a $35.00 price objective for the company. Truist Financial restated a "buy" rating and set a $33.00 price objective on shares of Evolent Health in a research report on Tuesday, August 27th. Finally, JPMorgan Chase & Co. boosted their price objective on Evolent Health from $36.00 to $45.00 and gave the company an "overweight" rating in a research report on Monday, August 19th.

Get Our Latest Stock Report on Evolent Health

Evolent Health Stock Performance

Shares of NYSE EVH traded up $1.21 during trading on Wednesday, reaching $24.78. The stock had a trading volume of 2,035,714 shares, compared to its average volume of 1,615,012. Evolent Health has a one year low of $17.98 and a one year high of $35.00. The company has a debt-to-equity ratio of 0.57, a quick ratio of 1.08 and a current ratio of 1.08. The stock has a market cap of $2.88 billion, a PE ratio of -25.06 and a beta of 1.58. The firm's 50 day moving average price is $27.48 and its two-hundred day moving average price is $24.98.

Evolent Health (NYSE:EVH - Get Free Report) last issued its quarterly earnings results on Thursday, August 8th. The technology company reported $0.30 earnings per share for the quarter, beating analysts' consensus estimates of $0.21 by $0.09. Evolent Health had a positive return on equity of 8.47% and a negative net margin of 3.16%. The business had revenue of $647.10 million during the quarter, compared to the consensus estimate of $636.46 million. During the same period in the previous year, the business earned $0.06 EPS. The business's quarterly revenue was up 37.9% on a year-over-year basis. On average, research analysts forecast that Evolent Health will post 0.84 earnings per share for the current fiscal year.

Insiders Place Their Bets

In other Evolent Health news, General Counsel Jonathan Weinberg sold 42,140 shares of the business's stock in a transaction on Thursday, August 22nd. The stock was sold at an average price of $31.20, for a total transaction of $1,314,768.00. Following the completion of the transaction, the general counsel now owns 167,027 shares in the company, valued at approximately $5,211,242.40. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. In other news, General Counsel Jonathan Weinberg sold 42,140 shares of the company's stock in a transaction on Thursday, August 22nd. The stock was sold at an average price of $31.20, for a total value of $1,314,768.00. Following the completion of the sale, the general counsel now owns 167,027 shares in the company, valued at $5,211,242.40. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through this link. Also, CEO Seth Blackley sold 187,904 shares of the company's stock in a transaction on Thursday, August 22nd. The shares were sold at an average price of $30.00, for a total value of $5,637,120.00. Following the completion of the sale, the chief executive officer now owns 411,924 shares of the company's stock, valued at approximately $12,357,720. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 307,291 shares of company stock worth $9,290,385. 1.60% of the stock is owned by company insiders.

Institutional Trading of Evolent Health

Several institutional investors have recently modified their holdings of EVH. Vanguard Group Inc. raised its position in shares of Evolent Health by 0.9% during the first quarter. Vanguard Group Inc. now owns 10,915,070 shares of the technology company's stock worth $357,905,000 after purchasing an additional 93,739 shares during the period. RA Capital Management L.P. raised its position in shares of Evolent Health by 125.0% during the first quarter. RA Capital Management L.P. now owns 5,736,132 shares of the technology company's stock worth $188,088,000 after purchasing an additional 3,187,000 shares during the period. William Blair Investment Management LLC raised its position in shares of Evolent Health by 35.2% during the second quarter. William Blair Investment Management LLC now owns 5,026,043 shares of the technology company's stock worth $96,098,000 after purchasing an additional 1,308,376 shares during the period. Engaged Capital LLC raised its position in shares of Evolent Health by 26.1% during the second quarter. Engaged Capital LLC now owns 4,111,458 shares of the technology company's stock worth $78,611,000 after purchasing an additional 850,000 shares during the period. Finally, Dimensional Fund Advisors LP raised its position in shares of Evolent Health by 5.4% during the second quarter. Dimensional Fund Advisors LP now owns 2,368,255 shares of the technology company's stock worth $45,286,000 after purchasing an additional 121,770 shares during the period.

About Evolent Health

(

Get Free ReportEvolent Health, Inc, through its subsidiary, Evolent Health LLC, offers specialty care management services in oncology, cardiology, and musculoskeletal markets in the United States. The company provides platform for health plan administration and value-based business infrastructure. It offers administrative services, such as health plan services, pharmacy benefits management, risk management, analytics and reporting, and leadership and management; and Identifi, a proprietary technology system that aggregates and analyzes data, manages care workflows, and engages patients.

Recommended Stories

Before you consider Evolent Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Evolent Health wasn't on the list.

While Evolent Health currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report