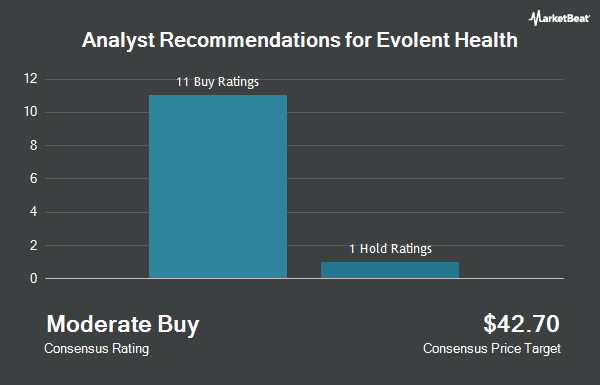

Evolent Health, Inc. (NYSE:EVH - Get Free Report) has received an average rating of "Buy" from the eleven ratings firms that are currently covering the firm, Marketbeat Ratings reports. One analyst has rated the stock with a hold rating, nine have issued a buy rating and one has given a strong buy rating to the company. The average 1-year target price among brokerages that have covered the stock in the last year is $25.90.

Several brokerages have commented on EVH. KeyCorp started coverage on shares of Evolent Health in a research report on Friday, October 11th. They set an "overweight" rating and a $35.00 target price on the stock. Oppenheimer lowered their target price on shares of Evolent Health from $34.00 to $28.00 and set an "outperform" rating on the stock in a research report on Monday, November 18th. Royal Bank of Canada reiterated an "outperform" rating and set a $20.00 price target on shares of Evolent Health in a research report on Tuesday, November 12th. Stephens cut Evolent Health from an "overweight" rating to an "equal weight" rating and lowered their price target for the stock from $38.00 to $16.00 in a report on Friday, November 8th. Finally, Citigroup reduced their price objective on Evolent Health from $33.00 to $21.00 and set a "buy" rating for the company in a report on Wednesday, November 13th.

Check Out Our Latest Stock Analysis on Evolent Health

Institutional Trading of Evolent Health

Several institutional investors and hedge funds have recently made changes to their positions in the stock. Quarry LP purchased a new position in Evolent Health in the 2nd quarter valued at about $32,000. Covestor Ltd lifted its stake in shares of Evolent Health by 138.1% during the third quarter. Covestor Ltd now owns 1,424 shares of the technology company's stock valued at $40,000 after buying an additional 826 shares during the period. GAMMA Investing LLC lifted its stake in shares of Evolent Health by 5,365.5% during the third quarter. GAMMA Investing LLC now owns 1,585 shares of the technology company's stock valued at $45,000 after buying an additional 1,556 shares during the period. Canada Pension Plan Investment Board purchased a new stake in Evolent Health in the 2nd quarter worth approximately $61,000. Finally, Quest Partners LLC acquired a new position in Evolent Health in the 2nd quarter valued at $87,000.

Evolent Health Stock Performance

Shares of Evolent Health stock traded down $0.01 on Friday, reaching $12.92. 1,102,713 shares of the stock were exchanged, compared to its average volume of 3,654,132. The firm has a market capitalization of $1.51 billion, a PE ratio of -14.20 and a beta of 1.58. Evolent Health has a 1-year low of $11.17 and a 1-year high of $35.00. The business has a fifty day moving average price of $21.47 and a two-hundred day moving average price of $23.33. The company has a current ratio of 1.04, a quick ratio of 1.04 and a debt-to-equity ratio of 0.58.

About Evolent Health

(

Get Free ReportEvolent Health, Inc, through its subsidiary, Evolent Health LLC, offers specialty care management services in oncology, cardiology, and musculoskeletal markets in the United States. The company provides platform for health plan administration and value-based business infrastructure. It offers administrative services, such as health plan services, pharmacy benefits management, risk management, analytics and reporting, and leadership and management; and Identifi, a proprietary technology system that aggregates and analyzes data, manages care workflows, and engages patients.

Featured Stories

Before you consider Evolent Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Evolent Health wasn't on the list.

While Evolent Health currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.