Royal Bank of Canada reiterated their outperform rating on shares of Evolent Health (NYSE:EVH - Free Report) in a research note issued to investors on Tuesday,Benzinga reports. Royal Bank of Canada currently has a $20.00 target price on the technology company's stock.

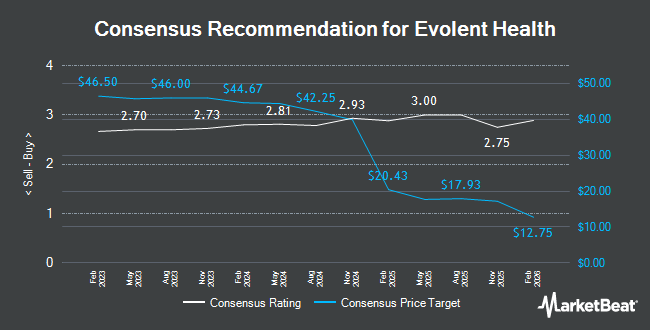

EVH has been the topic of a number of other reports. Stephens lowered shares of Evolent Health from an "overweight" rating to an "equal weight" rating and reduced their target price for the company from $38.00 to $16.00 in a report on Friday. Citigroup dropped their target price on Evolent Health from $35.00 to $33.00 and set a "buy" rating for the company in a research note on Tuesday, October 29th. Oppenheimer decreased their price target on Evolent Health from $45.00 to $34.00 and set an "outperform" rating on the stock in a research note on Friday. JMP Securities cut their price objective on shares of Evolent Health from $34.00 to $31.00 and set a "market outperform" rating on the stock in a report on Friday, August 9th. Finally, KeyCorp assumed coverage on shares of Evolent Health in a report on Friday, October 11th. They issued an "overweight" rating and a $35.00 target price for the company. One investment analyst has rated the stock with a hold rating, ten have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, Evolent Health currently has a consensus rating of "Buy" and a consensus target price of $30.70.

Get Our Latest Stock Report on EVH

Evolent Health Price Performance

Shares of EVH traded down $0.69 during mid-day trading on Tuesday, reaching $14.44. 3,727,089 shares of the company's stock were exchanged, compared to its average volume of 1,746,201. The company has a quick ratio of 1.08, a current ratio of 1.08 and a debt-to-equity ratio of 0.57. Evolent Health has a 52-week low of $13.31 and a 52-week high of $35.00. The company has a market cap of $1.68 billion, a price-to-earnings ratio of -16.27 and a beta of 1.58. The company has a 50-day simple moving average of $26.50 and a two-hundred day simple moving average of $24.70.

Insider Activity

In other Evolent Health news, CEO Seth Blackley sold 187,904 shares of Evolent Health stock in a transaction that occurred on Thursday, August 22nd. The stock was sold at an average price of $30.00, for a total transaction of $5,637,120.00. Following the sale, the chief executive officer now directly owns 411,924 shares in the company, valued at $12,357,720. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. In other Evolent Health news, CEO Seth Blackley sold 187,904 shares of Evolent Health stock in a transaction that occurred on Thursday, August 22nd. The stock was sold at an average price of $30.00, for a total value of $5,637,120.00. Following the completion of the transaction, the chief executive officer now directly owns 411,924 shares in the company, valued at $12,357,720. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, COO Emily Ann Rafferty sold 8,861 shares of the company's stock in a transaction that occurred on Thursday, August 22nd. The stock was sold at an average price of $30.00, for a total transaction of $265,830.00. Following the completion of the sale, the chief operating officer now directly owns 63,408 shares of the company's stock, valued at approximately $1,902,240. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 307,291 shares of company stock worth $9,290,385. 1.60% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On Evolent Health

Institutional investors and hedge funds have recently modified their holdings of the stock. Algert Global LLC raised its position in shares of Evolent Health by 120.2% during the third quarter. Algert Global LLC now owns 23,025 shares of the technology company's stock worth $651,000 after purchasing an additional 12,570 shares during the period. Foundry Partners LLC purchased a new stake in Evolent Health during the third quarter valued at about $10,042,000. Intech Investment Management LLC acquired a new position in shares of Evolent Health in the third quarter worth about $989,000. Jennison Associates LLC increased its position in shares of Evolent Health by 5.7% in the third quarter. Jennison Associates LLC now owns 646,806 shares of the technology company's stock worth $18,292,000 after acquiring an additional 34,990 shares in the last quarter. Finally, Cassaday & Co Wealth Management LLC acquired a new stake in shares of Evolent Health during the third quarter valued at approximately $262,000.

Evolent Health Company Profile

(

Get Free Report)

Evolent Health, Inc, through its subsidiary, Evolent Health LLC, offers specialty care management services in oncology, cardiology, and musculoskeletal markets in the United States. The company provides platform for health plan administration and value-based business infrastructure. It offers administrative services, such as health plan services, pharmacy benefits management, risk management, analytics and reporting, and leadership and management; and Identifi, a proprietary technology system that aggregates and analyzes data, manages care workflows, and engages patients.

See Also

Before you consider Evolent Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Evolent Health wasn't on the list.

While Evolent Health currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.