Executive Wealth Management LLC purchased a new position in shares of Lululemon Athletica Inc. (NASDAQ:LULU - Free Report) in the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor purchased 5,991 shares of the apparel retailer's stock, valued at approximately $1,626,000.

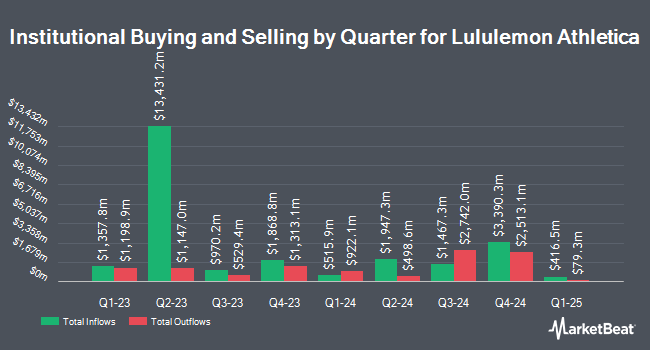

Several other large investors also recently made changes to their positions in the stock. Peloton Wealth Strategists raised its holdings in Lululemon Athletica by 68.5% in the 3rd quarter. Peloton Wealth Strategists now owns 11,945 shares of the apparel retailer's stock valued at $3,241,000 after acquiring an additional 4,856 shares in the last quarter. Public Employees Retirement System of Ohio acquired a new position in Lululemon Athletica in the 3rd quarter valued at approximately $28,517,000. Groupama Asset Managment raised its holdings in Lululemon Athletica by 10.2% in the 3rd quarter. Groupama Asset Managment now owns 7,167 shares of the apparel retailer's stock valued at $1,945,000 after acquiring an additional 664 shares in the last quarter. Anson Funds Management LP acquired a new position in Lululemon Athletica in the 3rd quarter valued at approximately $1,085,000. Finally, Orion Portfolio Solutions LLC raised its holdings in Lululemon Athletica by 63.6% in the 3rd quarter. Orion Portfolio Solutions LLC now owns 11,107 shares of the apparel retailer's stock valued at $3,014,000 after acquiring an additional 4,318 shares in the last quarter. Institutional investors own 85.20% of the company's stock.

Lululemon Athletica Price Performance

Shares of LULU traded down $7.69 during trading hours on Tuesday, hitting $397.10. The stock had a trading volume of 2,261,518 shares, compared to its average volume of 2,130,555. The firm has a 50 day simple moving average of $308.46 and a 200-day simple moving average of $288.72. The firm has a market capitalization of $48.75 billion, a P/E ratio of 28.67, a price-to-earnings-growth ratio of 2.87 and a beta of 1.23. Lululemon Athletica Inc. has a 1-year low of $226.01 and a 1-year high of $516.39.

Lululemon Athletica (NASDAQ:LULU - Get Free Report) last released its quarterly earnings results on Thursday, December 5th. The apparel retailer reported $2.87 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.69 by $0.18. Lululemon Athletica had a return on equity of 42.16% and a net margin of 17.05%. The business had revenue of $2.40 billion during the quarter, compared to the consensus estimate of $2.36 billion. During the same quarter in the previous year, the business earned $2.53 EPS. The company's quarterly revenue was up 9.1% on a year-over-year basis. Equities analysts predict that Lululemon Athletica Inc. will post 14.19 EPS for the current fiscal year.

Analyst Ratings Changes

A number of equities analysts have recently issued reports on LULU shares. Morgan Stanley increased their target price on Lululemon Athletica from $345.00 to $414.00 and gave the stock an "overweight" rating in a report on Friday. TD Securities raised their price target on Lululemon Athletica from $382.00 to $383.00 and gave the company a "buy" rating in a report on Tuesday, December 3rd. Jefferies Financial Group reaffirmed an "underperform" rating and set a $220.00 price target on shares of Lululemon Athletica in a report on Monday, December 2nd. TD Cowen dropped their price target on Lululemon Athletica from $420.00 to $375.00 and set a "buy" rating for the company in a report on Tuesday, August 27th. Finally, Wedbush dropped their price target on Lululemon Athletica from $400.00 to $324.00 and set an "outperform" rating for the company in a report on Wednesday, August 28th. Two analysts have rated the stock with a sell rating, ten have assigned a hold rating and eighteen have given a buy rating to the company. According to MarketBeat.com, Lululemon Athletica presently has an average rating of "Moderate Buy" and a consensus price target of $377.63.

Read Our Latest Analysis on LULU

Insider Buying and Selling

In other news, insider Nicole Neuburger sold 486 shares of the business's stock in a transaction on Thursday, September 26th. The shares were sold at an average price of $269.59, for a total transaction of $131,020.74. Following the completion of the transaction, the insider now directly owns 6,198 shares in the company, valued at $1,670,918.82. The trade was a 7.27 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 0.48% of the stock is currently owned by insiders.

Lululemon Athletica Profile

(

Free Report)

Lululemon Athletica Inc, together with its subsidiaries, designs, distributes, and retails athletic apparel, footwear, and accessories under the lululemon brand for women and men. It offers pants, shorts, tops, and jackets for healthy lifestyle, such as yoga, running, training, and other activities. It also provides fitness-inspired accessories.

Recommended Stories

Before you consider Lululemon Athletica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lululemon Athletica wasn't on the list.

While Lululemon Athletica currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.