Executive Wealth Management LLC purchased a new stake in shares of BorgWarner Inc. (NYSE:BWA - Free Report) in the third quarter, according to its most recent filing with the Securities & Exchange Commission. The firm purchased 42,589 shares of the auto parts company's stock, valued at approximately $1,546,000.

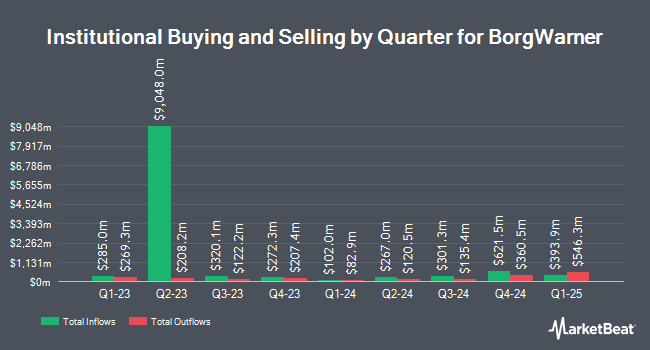

Other institutional investors have also made changes to their positions in the company. Matrix Trust Co acquired a new stake in shares of BorgWarner during the third quarter valued at about $25,000. Brooklyn Investment Group acquired a new position in shares of BorgWarner in the third quarter valued at approximately $32,000. LRI Investments LLC grew its holdings in shares of BorgWarner by 2,685.3% in the second quarter. LRI Investments LLC now owns 947 shares of the auto parts company's stock valued at $31,000 after purchasing an additional 913 shares in the last quarter. Sentry Investment Management LLC acquired a new position in shares of BorgWarner in the second quarter valued at approximately $32,000. Finally, True Wealth Design LLC acquired a new position in shares of BorgWarner in the third quarter valued at approximately $38,000. 95.67% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of brokerages recently weighed in on BWA. Wolfe Research began coverage on shares of BorgWarner in a report on Thursday, September 5th. They issued a "peer perform" rating for the company. JPMorgan Chase & Co. dropped their price objective on shares of BorgWarner from $51.00 to $50.00 and set an "overweight" rating for the company in a report on Monday, October 21st. The Goldman Sachs Group decreased their price target on shares of BorgWarner from $38.00 to $36.00 and set a "neutral" rating for the company in a research note on Tuesday, October 1st. Deutsche Bank Aktiengesellschaft lifted their price target on shares of BorgWarner from $38.00 to $39.00 and gave the stock a "hold" rating in a research note on Monday, November 4th. Finally, Evercore ISI upgraded shares of BorgWarner from an "in-line" rating to an "outperform" rating and lifted their price target for the stock from $39.00 to $43.00 in a research note on Monday, October 14th. Six research analysts have rated the stock with a hold rating and ten have issued a buy rating to the company. According to MarketBeat, BorgWarner currently has a consensus rating of "Moderate Buy" and an average price target of $41.21.

Check Out Our Latest Stock Report on BorgWarner

BorgWarner Stock Performance

BWA traded up $0.31 during trading on Tuesday, hitting $34.61. The stock had a trading volume of 1,778,891 shares, compared to its average volume of 2,641,515. The company has a debt-to-equity ratio of 0.66, a quick ratio of 1.48 and a current ratio of 1.84. The firm has a market capitalization of $7.57 billion, a P/E ratio of 8.78, a PEG ratio of 0.75 and a beta of 1.19. The company's 50-day moving average price is $34.40 and its 200 day moving average price is $33.67. BorgWarner Inc. has a twelve month low of $29.51 and a twelve month high of $38.22.

BorgWarner (NYSE:BWA - Get Free Report) last announced its quarterly earnings data on Thursday, October 31st. The auto parts company reported $1.09 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.92 by $0.17. The company had revenue of $3.45 billion for the quarter, compared to analysts' expectations of $3.50 billion. BorgWarner had a net margin of 6.33% and a return on equity of 15.51%. BorgWarner's revenue was down 4.8% compared to the same quarter last year. During the same period in the previous year, the company posted $0.98 EPS. On average, equities research analysts forecast that BorgWarner Inc. will post 4.22 EPS for the current fiscal year.

BorgWarner Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, December 2nd will be paid a dividend of $0.11 per share. The ex-dividend date is Monday, December 2nd. This represents a $0.44 dividend on an annualized basis and a dividend yield of 1.27%. BorgWarner's dividend payout ratio (DPR) is presently 11.17%.

Insider Transactions at BorgWarner

In related news, CEO Frederic Lissalde sold 154,000 shares of the business's stock in a transaction dated Monday, November 11th. The shares were sold at an average price of $34.61, for a total value of $5,329,940.00. Following the sale, the chief executive officer now directly owns 259,957 shares in the company, valued at $8,997,111.77. The trade was a 37.20 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, VP Stefan Demmerle sold 20,544 shares of the business's stock in a transaction dated Wednesday, November 27th. The stock was sold at an average price of $34.28, for a total transaction of $704,248.32. Following the completion of the sale, the vice president now owns 206,969 shares in the company, valued at $7,094,897.32. This represents a 9.03 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 222,010 shares of company stock valued at $7,678,076 in the last ninety days. 0.63% of the stock is currently owned by company insiders.

About BorgWarner

(

Free Report)

BorgWarner Inc, together with its subsidiaries, provides solutions for combustion, hybrid, and electric vehicles worldwide. It offers turbochargers, eBoosters, eTurbos, timing systems, emissions systems, thermal systems, gasoline ignition technology, smart remote actuators, powertrain sensors, cabin heaters, battery modules and systems, battery heaters, and battery charging.

Recommended Stories

Before you consider BorgWarner, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BorgWarner wasn't on the list.

While BorgWarner currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.