Executive Wealth Management LLC bought a new position in shares of Corcept Therapeutics Incorporated (NASDAQ:CORT - Free Report) during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor bought 60,594 shares of the biotechnology company's stock, valued at approximately $2,804,000. Executive Wealth Management LLC owned 0.06% of Corcept Therapeutics at the end of the most recent quarter.

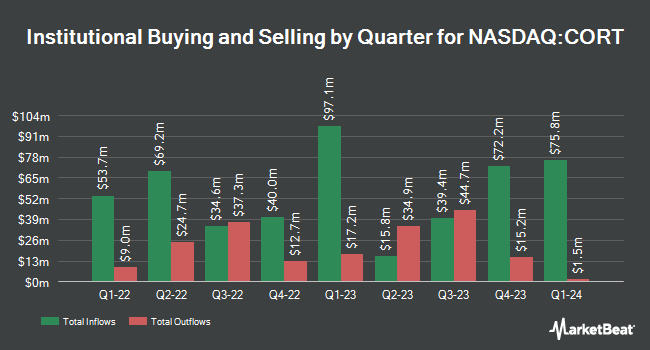

Other large investors have also recently added to or reduced their stakes in the company. State Street Corp raised its holdings in shares of Corcept Therapeutics by 0.6% in the 3rd quarter. State Street Corp now owns 3,519,263 shares of the biotechnology company's stock worth $162,871,000 after purchasing an additional 19,893 shares during the period. Dimensional Fund Advisors LP raised its holdings in shares of Corcept Therapeutics by 4.2% in the 2nd quarter. Dimensional Fund Advisors LP now owns 2,676,335 shares of the biotechnology company's stock worth $86,952,000 after purchasing an additional 108,658 shares during the period. FMR LLC raised its holdings in shares of Corcept Therapeutics by 24.6% in the 3rd quarter. FMR LLC now owns 1,363,922 shares of the biotechnology company's stock worth $63,122,000 after purchasing an additional 269,074 shares during the period. Jacobs Levy Equity Management Inc. raised its holdings in shares of Corcept Therapeutics by 40.5% in the 3rd quarter. Jacobs Levy Equity Management Inc. now owns 1,223,781 shares of the biotechnology company's stock worth $56,637,000 after purchasing an additional 352,947 shares during the period. Finally, Charles Schwab Investment Management Inc. raised its holdings in shares of Corcept Therapeutics by 5.5% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,026,487 shares of the biotechnology company's stock worth $47,506,000 after purchasing an additional 53,191 shares during the period. 93.61% of the stock is currently owned by hedge funds and other institutional investors.

Insider Transactions at Corcept Therapeutics

In other news, insider Gary Charles Robb sold 11,000 shares of Corcept Therapeutics stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $46.28, for a total transaction of $509,080.00. Following the transaction, the insider now directly owns 22,772 shares in the company, valued at approximately $1,053,888.16. This trade represents a 32.57 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, insider William Guyer sold 3,394 shares of Corcept Therapeutics stock in a transaction on Monday, November 4th. The shares were sold at an average price of $48.97, for a total value of $166,204.18. Following the transaction, the insider now owns 5,796 shares in the company, valued at $283,830.12. This represents a 36.93 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 24,611 shares of company stock worth $1,210,548. 20.50% of the stock is currently owned by corporate insiders.

Corcept Therapeutics Stock Down 0.8 %

NASDAQ CORT traded down $0.45 during mid-day trading on Tuesday, reaching $58.81. 446,467 shares of the company's stock traded hands, compared to its average volume of 1,160,138. Corcept Therapeutics Incorporated has a 1-year low of $20.84 and a 1-year high of $62.22. The company has a fifty day simple moving average of $52.35 and a 200-day simple moving average of $40.72. The company has a current ratio of 3.70, a quick ratio of 3.64 and a debt-to-equity ratio of 0.01. The company has a market cap of $6.16 billion, a price-to-earnings ratio of 46.67 and a beta of 0.51.

Corcept Therapeutics (NASDAQ:CORT - Get Free Report) last issued its earnings results on Wednesday, October 30th. The biotechnology company reported $0.41 EPS for the quarter, topping the consensus estimate of $0.27 by $0.14. The company had revenue of $182.55 million during the quarter, compared to analyst estimates of $171.97 million. Corcept Therapeutics had a return on equity of 24.54% and a net margin of 22.35%. The business's revenue was up 47.7% on a year-over-year basis. During the same quarter last year, the firm earned $0.28 EPS. As a group, equities research analysts expect that Corcept Therapeutics Incorporated will post 1.35 EPS for the current year.

Analysts Set New Price Targets

A number of research firms have recently commented on CORT. HC Wainwright restated a "buy" rating and issued a $80.00 price objective on shares of Corcept Therapeutics in a report on Thursday, October 31st. Sandler O'Neill reiterated a "buy" rating on shares of Corcept Therapeutics in a research note on Friday, October 18th. StockNews.com lowered Corcept Therapeutics from a "strong-buy" rating to a "buy" rating in a research note on Monday, November 25th. Piper Sandler increased their target price on Corcept Therapeutics from $38.00 to $67.00 and gave the company an "overweight" rating in a research note on Wednesday, September 18th. Finally, Truist Financial increased their target price on Corcept Therapeutics from $65.00 to $76.00 and gave the company a "buy" rating in a research note on Monday, September 30th. Six equities research analysts have rated the stock with a buy rating, According to MarketBeat.com, the stock presently has an average rating of "Buy" and a consensus target price of $65.25.

View Our Latest Stock Analysis on Corcept Therapeutics

Corcept Therapeutics Company Profile

(

Free Report)

Corcept Therapeutics Incorporated engages in discovery and development of drugs for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States. It offers Korlym tablets medication for the treatment of hyperglycemia secondary to hypercortisolism in adult patients with endogenous cushing's syndrome; and who have type 2 diabetes mellitus or glucose intolerance and have failed surgery or are not candidates for surgery.

Further Reading

Before you consider Corcept Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corcept Therapeutics wasn't on the list.

While Corcept Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.