ExodusPoint Capital Management LP lifted its holdings in Argan, Inc. (NYSE:AGX - Free Report) by 141.1% during the 4th quarter, according to its most recent disclosure with the SEC. The institutional investor owned 6,499 shares of the construction company's stock after acquiring an additional 3,803 shares during the period. ExodusPoint Capital Management LP's holdings in Argan were worth $891,000 as of its most recent filing with the SEC.

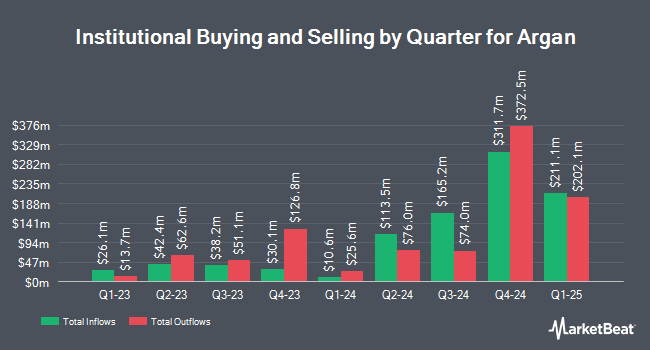

Several other hedge funds also recently made changes to their positions in the business. FMR LLC grew its holdings in shares of Argan by 68.2% during the 3rd quarter. FMR LLC now owns 1,033 shares of the construction company's stock worth $105,000 after purchasing an additional 419 shares in the last quarter. Point72 Asset Management L.P. acquired a new stake in Argan in the third quarter valued at about $471,000. State Street Corp lifted its holdings in shares of Argan by 4.8% in the third quarter. State Street Corp now owns 353,984 shares of the construction company's stock worth $35,905,000 after acquiring an additional 16,055 shares during the last quarter. XTX Topco Ltd acquired a new stake in shares of Argan in the 3rd quarter valued at approximately $631,000. Finally, Barclays PLC grew its holdings in shares of Argan by 46.6% during the 3rd quarter. Barclays PLC now owns 66,341 shares of the construction company's stock valued at $6,728,000 after purchasing an additional 21,094 shares during the last quarter. 79.43% of the stock is owned by institutional investors.

Insider Activity

In other Argan news, Director Peter W. Getsinger sold 7,385 shares of the firm's stock in a transaction on Tuesday, January 14th. The shares were sold at an average price of $165.29, for a total value of $1,220,666.65. Following the sale, the director now owns 11,792 shares of the company's stock, valued at $1,949,099.68. This trade represents a 38.51 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. 11.85% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

Separately, Lake Street Capital raised shares of Argan from a "hold" rating to a "buy" rating and set a $150.00 target price on the stock in a research note on Friday, March 28th.

Read Our Latest Stock Analysis on Argan

Argan Trading Down 0.3 %

NYSE AGX traded down $0.44 during mid-day trading on Monday, hitting $147.73. The company's stock had a trading volume of 427,968 shares, compared to its average volume of 291,482. The company's 50 day simple moving average is $131.41 and its 200 day simple moving average is $138.14. The firm has a market capitalization of $2.01 billion, a price-to-earnings ratio of 30.91 and a beta of 0.45. Argan, Inc. has a twelve month low of $58.00 and a twelve month high of $191.46.

Argan (NYSE:AGX - Get Free Report) last posted its quarterly earnings data on Thursday, March 27th. The construction company reported $2.22 EPS for the quarter, beating the consensus estimate of $1.15 by $1.07. The firm had revenue of $232.47 million during the quarter, compared to analyst estimates of $197.50 million. Argan had a net margin of 8.20% and a return on equity of 21.66%. The business's revenue for the quarter was up 41.3% on a year-over-year basis.

Argan Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, April 30th. Stockholders of record on Tuesday, April 22nd will be paid a dividend of $0.375 per share. The ex-dividend date is Tuesday, April 22nd. This represents a $1.50 dividend on an annualized basis and a dividend yield of 1.02%. Argan's dividend payout ratio (DPR) is currently 24.55%.

Argan Company Profile

(

Free Report)

Argan, Inc, through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market. The company operates through Power Services, Industrial Services, and Telecom Services segments. The Power Services segment offers engineering, procurement, and construction, as well as designing, building, and commissioning of large-scale energy projects to the owners of alternative energy facilities, such as biomass plants, wind farms, and solar fields; and design, construction, project management, start-up, and operation services for projects with approximately 18 gigawatts of power-generating capacity.

Featured Stories

Before you consider Argan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Argan wasn't on the list.

While Argan currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.