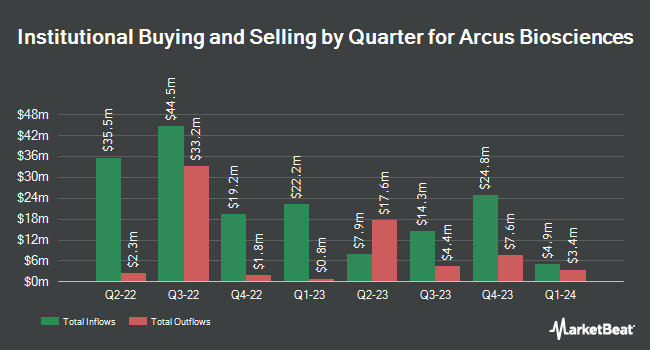

ExodusPoint Capital Management LP bought a new stake in Arcus Biosciences, Inc. (NYSE:RCUS - Free Report) in the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The fund bought 60,193 shares of the company's stock, valued at approximately $896,000. ExodusPoint Capital Management LP owned about 0.07% of Arcus Biosciences at the end of the most recent quarter.

Several other large investors also recently modified their holdings of the business. Trexquant Investment LP boosted its stake in shares of Arcus Biosciences by 241.5% during the 4th quarter. Trexquant Investment LP now owns 300,548 shares of the company's stock valued at $4,475,000 after purchasing an additional 212,552 shares in the last quarter. Jane Street Group LLC boosted its position in Arcus Biosciences by 59.8% during the 3rd quarter. Jane Street Group LLC now owns 217,041 shares of the company's stock valued at $3,319,000 after acquiring an additional 81,193 shares in the last quarter. Connor Clark & Lunn Investment Management Ltd. purchased a new position in shares of Arcus Biosciences during the 4th quarter worth approximately $954,000. Barclays PLC raised its position in shares of Arcus Biosciences by 49.0% in the 3rd quarter. Barclays PLC now owns 118,693 shares of the company's stock worth $1,816,000 after acquiring an additional 39,015 shares in the last quarter. Finally, Raymond James Financial Inc. purchased a new position in shares of Arcus Biosciences in the 4th quarter valued at approximately $531,000. 92.89% of the stock is owned by institutional investors.

Arcus Biosciences Stock Up 2.5 %

RCUS stock traded up $0.19 during midday trading on Tuesday, hitting $7.87. The company's stock had a trading volume of 518,881 shares, compared to its average volume of 1,010,336. The firm's 50-day moving average is $9.58 and its 200-day moving average is $13.53. The company has a current ratio of 5.24, a quick ratio of 5.24 and a debt-to-equity ratio of 0.08. Arcus Biosciences, Inc. has a 12 month low of $6.50 and a 12 month high of $18.98. The company has a market cap of $827.44 million, a PE ratio of -2.50 and a beta of 1.54.

Arcus Biosciences (NYSE:RCUS - Get Free Report) last released its quarterly earnings data on Tuesday, February 25th. The company reported ($1.03) EPS for the quarter, beating the consensus estimate of ($1.17) by $0.14. The company had revenue of $36.00 million for the quarter, compared to analysts' expectations of $29.38 million. Arcus Biosciences had a negative return on equity of 45.59% and a negative net margin of 102.66%. On average, equities research analysts forecast that Arcus Biosciences, Inc. will post -3.15 earnings per share for the current fiscal year.

Insider Transactions at Arcus Biosciences

In other news, CEO Terry J. Rosen acquired 19,800 shares of the business's stock in a transaction that occurred on Thursday, February 27th. The stock was bought at an average price of $10.18 per share, with a total value of $201,564.00. Following the completion of the acquisition, the chief executive officer now directly owns 2,554,160 shares of the company's stock, valued at approximately $26,001,348.80. The trade was a 0.78 % increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Yasunori Kaneko bought 20,000 shares of the stock in a transaction on Thursday, February 27th. The stock was purchased at an average cost of $10.06 per share, for a total transaction of $201,200.00. Following the acquisition, the director now owns 28,400 shares of the company's stock, valued at $285,704. This trade represents a 238.10 % increase in their position. The disclosure for this purchase can be found here. Company insiders own 12.30% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts recently weighed in on the company. HC Wainwright raised Arcus Biosciences from a "neutral" rating to a "buy" rating and upped their price target for the stock from $18.00 to $24.00 in a research note on Wednesday, February 26th. Morgan Stanley reduced their target price on shares of Arcus Biosciences from $36.00 to $25.00 and set an "overweight" rating on the stock in a research report on Tuesday, February 18th. Finally, Bank of America lowered their price target on shares of Arcus Biosciences from $22.00 to $17.00 and set a "neutral" rating for the company in a research report on Wednesday, February 19th. One research analyst has rated the stock with a hold rating, eight have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the company presently has an average rating of "Buy" and a consensus price target of $30.25.

Check Out Our Latest Research Report on Arcus Biosciences

About Arcus Biosciences

(

Free Report)

Arcus Biosciences, Inc, a clinical-stage biopharmaceutical company, develops and commercializes cancer therapies in the United States. The company's pipeline products include Domvanalimab, an anti-TIGIT antibody, which is in Phase 2 and Phase 3 clinical trial; and AB308, an investigational anti-TIGIT monoclonal antibody, which is in Phase 1b clinical trial to study people with advanced solid and hematologic malignancies.

Read More

Before you consider Arcus Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arcus Biosciences wasn't on the list.

While Arcus Biosciences currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.