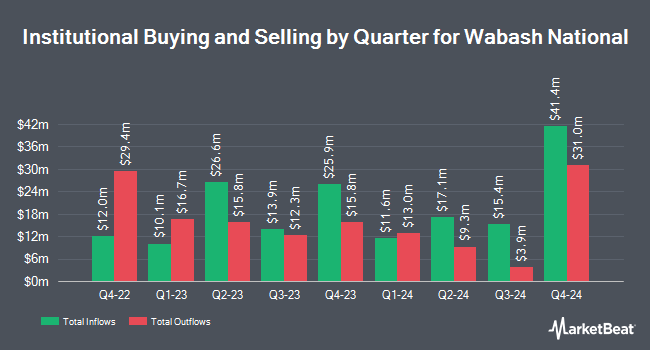

ExodusPoint Capital Management LP trimmed its position in Wabash National Co. (NYSE:WNC - Free Report) by 72.4% during the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 58,602 shares of the company's stock after selling 153,473 shares during the period. ExodusPoint Capital Management LP owned about 0.14% of Wabash National worth $1,004,000 at the end of the most recent reporting period.

Several other hedge funds also recently modified their holdings of WNC. EMC Capital Management increased its stake in Wabash National by 88.1% in the fourth quarter. EMC Capital Management now owns 8,250 shares of the company's stock valued at $141,000 after purchasing an additional 3,864 shares during the last quarter. AlphaQuest LLC grew its holdings in Wabash National by 332,066.7% in the 4th quarter. AlphaQuest LLC now owns 9,965 shares of the company's stock valued at $171,000 after buying an additional 9,962 shares during the period. HighTower Advisors LLC acquired a new position in shares of Wabash National during the 3rd quarter valued at about $192,000. Entropy Technologies LP purchased a new position in shares of Wabash National during the 4th quarter worth about $219,000. Finally, FMR LLC boosted its position in shares of Wabash National by 84.1% in the third quarter. FMR LLC now owns 13,362 shares of the company's stock worth $256,000 after acquiring an additional 6,105 shares during the last quarter. 97.05% of the stock is owned by institutional investors and hedge funds.

Wabash National Trading Down 1.8 %

Wabash National stock traded down $0.17 during midday trading on Tuesday, reaching $9.14. The stock had a trading volume of 303,627 shares, compared to its average volume of 732,454. The stock has a market capitalization of $386.50 million, a PE ratio of -1.40 and a beta of 1.49. The company has a debt-to-equity ratio of 2.10, a quick ratio of 1.09 and a current ratio of 1.93. The stock's 50-day simple moving average is $11.40 and its 200 day simple moving average is $15.62. Wabash National Co. has a twelve month low of $9.00 and a twelve month high of $27.15.

Wabash National (NYSE:WNC - Get Free Report) last issued its earnings results on Wednesday, January 29th. The company reported ($0.02) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.02 by ($0.04). Wabash National had a positive return on equity of 14.72% and a negative net margin of 14.59%. During the same period in the previous year, the firm posted $1.07 EPS. Analysts expect that Wabash National Co. will post 0.94 EPS for the current year.

Wabash National Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Thursday, April 24th. Investors of record on Thursday, April 3rd will be issued a dividend of $0.08 per share. This represents a $0.32 dividend on an annualized basis and a yield of 3.50%. The ex-dividend date of this dividend is Thursday, April 3rd. Wabash National's payout ratio is -4.91%.

Analysts Set New Price Targets

Separately, DA Davidson dropped their price target on shares of Wabash National from $18.00 to $14.00 and set a "neutral" rating for the company in a research report on Monday, February 24th.

Get Our Latest Research Report on Wabash National

Wabash National Profile

(

Free Report)

Wabash National Corporation provides connected solutions for the transportation, logistics, and distribution industries primarily in the United States. The company operates through two segments, Transportation Solutions and Parts & Services. The Transportation Solutions segment designs and manufactures transportation-related equipment and products dry and refrigerated van trailers, platform trailers, tank trailers, and truck-mounted tanks; truck bodies for dry-freight transportation; cargo and cargo XL bodies for commercial applications; refrigerated truck bodies; platform truck bodies; and used trailers, as well as laminated hardwood oak flooring products.

Featured Articles

Before you consider Wabash National, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wabash National wasn't on the list.

While Wabash National currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.