Charles Schwab Investment Management Inc. raised its stake in eXp World Holdings, Inc. (NASDAQ:EXPI - Free Report) by 16.6% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,288,349 shares of the technology company's stock after purchasing an additional 183,823 shares during the period. Charles Schwab Investment Management Inc. owned 0.84% of eXp World worth $18,153,000 as of its most recent SEC filing.

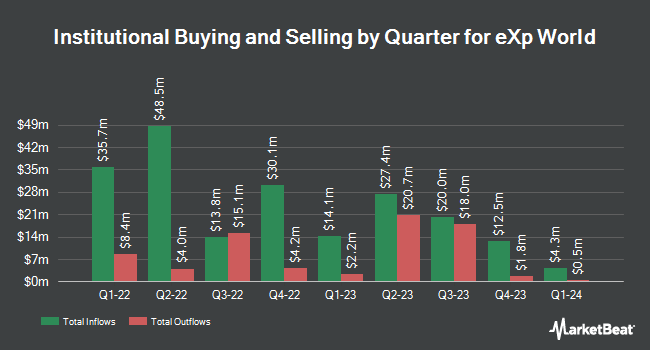

Other institutional investors have also recently made changes to their positions in the company. Point72 DIFC Ltd acquired a new stake in eXp World in the 2nd quarter valued at $26,000. Meeder Asset Management Inc. bought a new stake in shares of eXp World during the second quarter worth about $29,000. Allspring Global Investments Holdings LLC acquired a new stake in shares of eXp World in the 3rd quarter worth about $30,000. nVerses Capital LLC raised its holdings in shares of eXp World by 102.2% in the 2nd quarter. nVerses Capital LLC now owns 9,100 shares of the technology company's stock worth $103,000 after acquiring an additional 4,600 shares during the last quarter. Finally, Financial Advocates Investment Management bought a new position in eXp World in the 2nd quarter valued at about $117,000. Institutional investors and hedge funds own 27.17% of the company's stock.

Insider Buying and Selling at eXp World

In other eXp World news, CEO Glenn Darrel Sanford sold 59,935 shares of the business's stock in a transaction on Tuesday, September 10th. The stock was sold at an average price of $12.41, for a total value of $743,793.35. Following the transaction, the chief executive officer now owns 40,882,685 shares of the company's stock, valued at approximately $507,354,120.85. The trade was a 0.15 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CAO Jian Cheng sold 18,750 shares of the firm's stock in a transaction on Friday, November 22nd. The shares were sold at an average price of $13.81, for a total value of $258,937.50. The disclosure for this sale can be found here. In the last three months, insiders have sold 685,292 shares of company stock worth $9,399,887. Corporate insiders own 35.70% of the company's stock.

eXp World Stock Performance

EXPI traded down $0.08 during midday trading on Friday, reaching $13.28. 726,856 shares of the company were exchanged, compared to its average volume of 821,388. The company has a market cap of $2.04 billion, a price-to-earnings ratio of -60.36 and a beta of 2.26. eXp World Holdings, Inc. has a one year low of $8.91 and a one year high of $17.11. The company's fifty day moving average price is $13.49 and its 200 day moving average price is $12.69.

eXp World Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, December 2nd. Investors of record on Monday, November 18th were given a $0.05 dividend. This represents a $0.20 dividend on an annualized basis and a yield of 1.51%. The ex-dividend date was Monday, November 18th. eXp World's payout ratio is currently -90.91%.

eXp World Profile

(

Free Report)

eXp World Holdings, Inc, together with its subsidiaries, provides cloud-based real estate brokerage services for residential homeowners and homebuyers. The company operates through North American Realty, International Realty, Virbela, and Other Affiliated Services segments. It provides Virbela, a cloud-based technologies that provides data, lead generation, and marketing tools for real estate agents and employees.

Featured Articles

Before you consider eXp World, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and eXp World wasn't on the list.

While eXp World currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.