Expedia Group (NASDAQ:EXPE - Free Report) had its target price increased by Oppenheimer from $155.00 to $210.00 in a research report released on Friday morning,Benzinga reports. The brokerage currently has an outperform rating on the online travel company's stock.

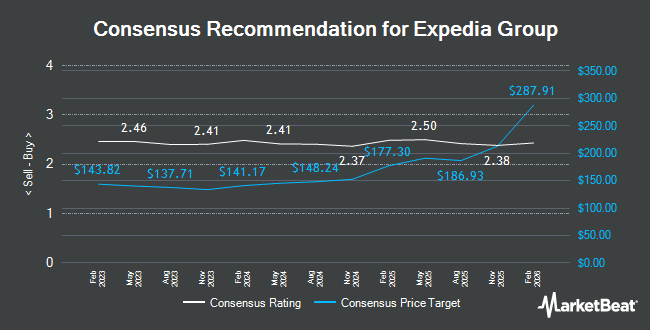

Other analysts have also issued reports about the company. Susquehanna lifted their price objective on Expedia Group from $125.00 to $145.00 and gave the stock a "neutral" rating in a research report on Monday, August 12th. Wells Fargo & Company upped their target price on shares of Expedia Group from $130.00 to $159.00 and gave the company an "equal weight" rating in a research report on Tuesday, October 8th. UBS Group raised their price target on Expedia Group from $137.00 to $156.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 23rd. Citigroup increased their target price on Expedia Group from $140.00 to $145.00 and gave the company a "neutral" rating in a research note on Friday, August 9th. Finally, Deutsche Bank Aktiengesellschaft lowered Expedia Group from a "buy" rating to a "hold" rating in a research report on Friday. Twenty investment analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, the stock has an average rating of "Hold" and an average target price of $159.88.

Get Our Latest Analysis on Expedia Group

Expedia Group Price Performance

Shares of EXPE stock traded up $6.63 during trading hours on Friday, hitting $180.76. 4,870,933 shares of the company's stock were exchanged, compared to its average volume of 2,184,719. Expedia Group has a 52 week low of $107.25 and a 52 week high of $190.40. The stock's 50-day moving average is $149.81 and its 200-day moving average is $133.47. The company has a debt-to-equity ratio of 2.45, a current ratio of 0.76 and a quick ratio of 0.76. The stock has a market cap of $23.53 billion, a price-to-earnings ratio of 23.26, a price-to-earnings-growth ratio of 0.62 and a beta of 1.78.

Expedia Group (NASDAQ:EXPE - Get Free Report) last announced its earnings results on Thursday, August 8th. The online travel company reported $3.51 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $3.17 by $0.34. The company had revenue of $3.56 billion for the quarter, compared to analyst estimates of $3.53 billion. Expedia Group had a net margin of 6.09% and a return on equity of 47.55%. Expedia Group's quarterly revenue was up 6.0% on a year-over-year basis. During the same period in the prior year, the business earned $2.34 earnings per share. As a group, research analysts forecast that Expedia Group will post 8.99 EPS for the current year.

Insider Activity at Expedia Group

In other news, Director Dara Khosrowshahi sold 10,000 shares of the stock in a transaction dated Friday, November 1st. The shares were sold at an average price of $156.87, for a total transaction of $1,568,700.00. Following the completion of the transaction, the director now directly owns 188,505 shares in the company, valued at $29,570,779.35. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. In other Expedia Group news, insider Robert J. Dzielak sold 5,417 shares of the business's stock in a transaction that occurred on Monday, August 19th. The stock was sold at an average price of $134.60, for a total transaction of $729,128.20. Following the transaction, the insider now owns 84,543 shares of the company's stock, valued at $11,379,487.80. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, Director Dara Khosrowshahi sold 10,000 shares of the stock in a transaction on Friday, November 1st. The shares were sold at an average price of $156.87, for a total transaction of $1,568,700.00. Following the completion of the sale, the director now owns 188,505 shares of the company's stock, valued at approximately $29,570,779.35. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 48,019 shares of company stock valued at $6,958,891. Corporate insiders own 6.80% of the company's stock.

Institutional Investors Weigh In On Expedia Group

Institutional investors and hedge funds have recently modified their holdings of the company. Pacer Advisors Inc. boosted its holdings in shares of Expedia Group by 36.8% during the 2nd quarter. Pacer Advisors Inc. now owns 2,654,200 shares of the online travel company's stock worth $334,403,000 after buying an additional 714,229 shares during the period. Acadian Asset Management LLC lifted its stake in Expedia Group by 414.4% during the first quarter. Acadian Asset Management LLC now owns 686,244 shares of the online travel company's stock worth $94,512,000 after purchasing an additional 552,831 shares during the last quarter. Point72 Asset Management L.P. boosted its holdings in shares of Expedia Group by 1,649.4% in the 2nd quarter. Point72 Asset Management L.P. now owns 407,605 shares of the online travel company's stock valued at $51,354,000 after purchasing an additional 384,305 shares in the last quarter. AustralianSuper Pty Ltd increased its stake in shares of Expedia Group by 88.8% in the 2nd quarter. AustralianSuper Pty Ltd now owns 753,260 shares of the online travel company's stock valued at $94,903,000 after purchasing an additional 354,389 shares during the last quarter. Finally, Marshall Wace LLP acquired a new position in shares of Expedia Group during the 2nd quarter worth $39,183,000. 90.76% of the stock is owned by institutional investors.

Expedia Group Company Profile

(

Get Free Report)

Expedia Group, Inc operates as an online travel company in the United States and internationally. The company operates through B2C, B2B, and trivago segments. Its B2C segment includes Brand Expedia, a full-service online travel brand offers various travel products and services; Hotels.com for lodging accommodations; Vrbo, an online marketplace for the alternative accommodations; Orbitz, Travelocity, Wotif Group, ebookers, CheapTickets, Hotwire.com and CarRentals.com.

See Also

Before you consider Expedia Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expedia Group wasn't on the list.

While Expedia Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.