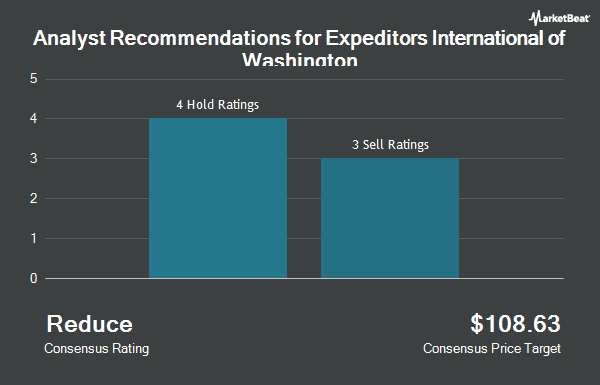

Expeditors International of Washington, Inc. (NASDAQ:EXPD - Get Free Report) has received a consensus recommendation of "Reduce" from the eleven brokerages that are currently covering the firm, MarketBeat Ratings reports. Four equities research analysts have rated the stock with a sell rating and seven have assigned a hold rating to the company. The average twelve-month target price among brokerages that have issued ratings on the stock in the last year is $118.44.

EXPD has been the topic of a number of analyst reports. Benchmark reissued a "hold" rating on shares of Expeditors International of Washington in a research note on Wednesday, August 7th. TD Cowen upped their price target on shares of Expeditors International of Washington from $106.00 to $108.00 and gave the company a "sell" rating in a report on Wednesday, November 6th. Wolfe Research downgraded shares of Expeditors International of Washington from a "hold" rating to a "strong sell" rating in a research note on Wednesday, October 9th. Finally, Barclays increased their price target on Expeditors International of Washington from $105.00 to $110.00 and gave the stock an "underweight" rating in a report on Wednesday, November 6th.

Check Out Our Latest Report on Expeditors International of Washington

Institutional Investors Weigh In On Expeditors International of Washington

Large investors have recently modified their holdings of the business. Black Diamond Financial LLC lifted its holdings in shares of Expeditors International of Washington by 5.4% during the second quarter. Black Diamond Financial LLC now owns 1,748 shares of the transportation company's stock worth $218,000 after purchasing an additional 89 shares during the period. Blair William & Co. IL grew its stake in Expeditors International of Washington by 1.2% in the 2nd quarter. Blair William & Co. IL now owns 7,776 shares of the transportation company's stock valued at $970,000 after acquiring an additional 95 shares during the period. Northwestern Mutual Wealth Management Co. increased its holdings in Expeditors International of Washington by 1.8% in the 2nd quarter. Northwestern Mutual Wealth Management Co. now owns 5,853 shares of the transportation company's stock worth $730,000 after acquiring an additional 104 shares in the last quarter. Values First Advisors Inc. increased its stake in shares of Expeditors International of Washington by 0.7% during the second quarter. Values First Advisors Inc. now owns 16,582 shares of the transportation company's stock worth $2,069,000 after purchasing an additional 112 shares in the last quarter. Finally, Lindenwold Advisors INC raised its holdings in shares of Expeditors International of Washington by 0.7% during the third quarter. Lindenwold Advisors INC now owns 16,713 shares of the transportation company's stock valued at $2,196,000 after acquiring an additional 114 shares during the last quarter. Hedge funds and other institutional investors own 94.02% of the company's stock.

Expeditors International of Washington Stock Up 0.3 %

EXPD traded up $0.39 on Friday, hitting $121.64. The company had a trading volume of 427,478 shares, compared to its average volume of 1,214,357. Expeditors International of Washington has a 12-month low of $111.20 and a 12-month high of $131.59. The business's fifty day simple moving average is $121.68 and its 200 day simple moving average is $121.92. The company has a market cap of $17.03 billion, a PE ratio of 23.71, a PEG ratio of 3.44 and a beta of 0.98.

Expeditors International of Washington (NASDAQ:EXPD - Get Free Report) last announced its earnings results on Tuesday, November 5th. The transportation company reported $1.63 EPS for the quarter, topping analysts' consensus estimates of $1.33 by $0.30. Expeditors International of Washington had a return on equity of 32.12% and a net margin of 7.39%. The firm had revenue of $3 billion during the quarter, compared to analysts' expectations of $2.47 billion. During the same quarter in the previous year, the business earned $1.16 EPS. The company's quarterly revenue was up 37.0% on a year-over-year basis. On average, analysts anticipate that Expeditors International of Washington will post 5.43 earnings per share for the current fiscal year.

Expeditors International of Washington Dividend Announcement

The firm also recently disclosed a semi-annual dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, December 2nd will be given a $0.73 dividend. The ex-dividend date of this dividend is Monday, December 2nd. This represents a dividend yield of 1.2%. Expeditors International of Washington's payout ratio is 28.46%.

Expeditors International of Washington Company Profile

(

Get Free ReportExpeditors International of Washington, Inc, together with its subsidiaries, provides logistics services worldwide. The company offers airfreight services, such as air freight consolidation and forwarding; ocean freight and ocean services, including ocean freight consolidation, direct ocean forwarding, and order management; customs brokerage, import, intra-continental ground transportation and delivery, and warehousing and distribution services; and customs clearance, purchase order management, vendor consolidation, time-definite transportation services, temperature-controlled transit, cargo insurance, specialized cargo monitoring and tracking, and other supply chain solutions.

Read More

Before you consider Expeditors International of Washington, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expeditors International of Washington wasn't on the list.

While Expeditors International of Washington currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.