Aigen Investment Management LP raised its stake in Expeditors International of Washington, Inc. (NASDAQ:EXPD - Free Report) by 492.7% during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 13,704 shares of the transportation company's stock after buying an additional 11,392 shares during the period. Aigen Investment Management LP's holdings in Expeditors International of Washington were worth $1,518,000 at the end of the most recent quarter.

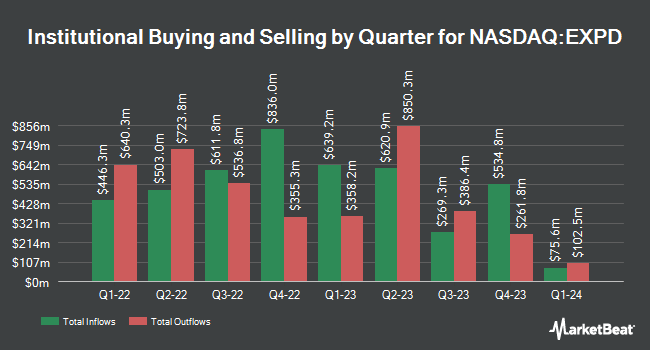

A number of other hedge funds have also recently added to or reduced their stakes in EXPD. Manchester Capital Management LLC raised its stake in shares of Expeditors International of Washington by 3.5% during the fourth quarter. Manchester Capital Management LLC now owns 3,032 shares of the transportation company's stock valued at $336,000 after acquiring an additional 103 shares during the last quarter. Chapman Investment Management LLC raised its stake in shares of Expeditors International of Washington by 0.6% during the fourth quarter. Chapman Investment Management LLC now owns 18,967 shares of the transportation company's stock valued at $2,101,000 after acquiring an additional 112 shares during the last quarter. OLD National Bancorp IN raised its stake in shares of Expeditors International of Washington by 5.3% during the fourth quarter. OLD National Bancorp IN now owns 2,234 shares of the transportation company's stock valued at $247,000 after acquiring an additional 113 shares during the last quarter. Lindenwold Advisors INC raised its stake in shares of Expeditors International of Washington by 0.7% during the third quarter. Lindenwold Advisors INC now owns 16,713 shares of the transportation company's stock valued at $2,196,000 after acquiring an additional 114 shares during the last quarter. Finally, Guardian Wealth Advisors LLC raised its stake in shares of Expeditors International of Washington by 5.9% during the third quarter. Guardian Wealth Advisors LLC now owns 2,050 shares of the transportation company's stock valued at $269,000 after acquiring an additional 115 shares during the last quarter. Institutional investors and hedge funds own 94.02% of the company's stock.

Expeditors International of Washington Stock Performance

EXPD stock traded up $5.90 during mid-day trading on Friday, hitting $126.64. The company had a trading volume of 2,609,565 shares, compared to its average volume of 1,272,180. The firm has a market cap of $17.48 billion, a PE ratio of 22.14, a price-to-earnings-growth ratio of 5.00 and a beta of 1.00. Expeditors International of Washington, Inc. has a 12 month low of $108.36 and a 12 month high of $131.59. The stock's fifty day moving average price is $113.76 and its two-hundred day moving average price is $118.37.

Analyst Upgrades and Downgrades

EXPD has been the subject of several analyst reports. UBS Group dropped their price target on shares of Expeditors International of Washington from $130.00 to $128.00 and set a "neutral" rating for the company in a research note on Wednesday, February 19th. StockNews.com downgraded shares of Expeditors International of Washington from a "buy" rating to a "hold" rating in a research note on Sunday, February 16th. Stifel Nicolaus decreased their price target on shares of Expeditors International of Washington from $122.00 to $117.00 and set a "hold" rating for the company in a research note on Thursday, January 23rd. Benchmark reiterated a "hold" rating on shares of Expeditors International of Washington in a report on Wednesday, February 19th. Finally, JPMorgan Chase & Co. reduced their price objective on shares of Expeditors International of Washington from $114.00 to $108.00 and set an "underweight" rating for the company in a report on Wednesday, February 19th. Four research analysts have rated the stock with a sell rating and eight have issued a hold rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Hold" and a consensus price target of $116.56.

Read Our Latest Stock Analysis on Expeditors International of Washington

Insider Activity

In other news, Director Robert Paul Carlile sold 3,000 shares of the business's stock in a transaction that occurred on Tuesday, December 10th. The shares were sold at an average price of $121.11, for a total value of $363,330.00. Following the sale, the director now owns 9,662 shares of the company's stock, valued at $1,170,164.82. The trade was a 23.69 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Also, VP Jeffrey F. Dickerman sold 1,250 shares of the business's stock in a transaction that occurred on Thursday, February 20th. The shares were sold at an average price of $117.54, for a total transaction of $146,925.00. Following the completion of the sale, the vice president now directly owns 7,296 shares in the company, valued at approximately $857,571.84. This trade represents a 14.63 % decrease in their position. The disclosure for this sale can be found here. Insiders own 0.69% of the company's stock.

Expeditors International of Washington Company Profile

(

Free Report)

Expeditors International of Washington, Inc, together with its subsidiaries, provides logistics services worldwide. The company offers airfreight services, such as air freight consolidation and forwarding; ocean freight and ocean services, including ocean freight consolidation, direct ocean forwarding, and order management; customs brokerage, import, intra-continental ground transportation and delivery, and warehousing and distribution services; and customs clearance, purchase order management, vendor consolidation, time-definite transportation services, temperature-controlled transit, cargo insurance, specialized cargo monitoring and tracking, and other supply chain solutions.

Read More

Before you consider Expeditors International of Washington, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expeditors International of Washington wasn't on the list.

While Expeditors International of Washington currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.