Charles Schwab Investment Management Inc. increased its stake in shares of Extra Space Storage Inc. (NYSE:EXR - Free Report) by 1.8% during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 2,409,330 shares of the real estate investment trust's stock after buying an additional 43,223 shares during the quarter. Charles Schwab Investment Management Inc. owned about 1.14% of Extra Space Storage worth $360,436,000 at the end of the most recent quarter.

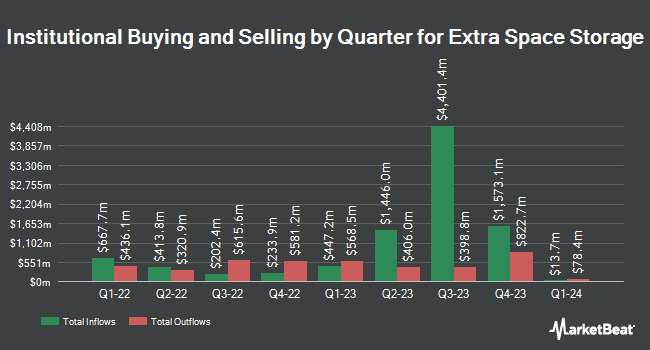

Other institutional investors have also recently added to or reduced their stakes in the company. State Street Corp grew its stake in shares of Extra Space Storage by 1.7% in the 3rd quarter. State Street Corp now owns 13,390,830 shares of the real estate investment trust's stock valued at $2,412,894,000 after purchasing an additional 227,006 shares during the last quarter. Daiwa Securities Group Inc. grew its position in Extra Space Storage by 10.4% in the 3rd quarter. Daiwa Securities Group Inc. now owns 2,020,459 shares of the real estate investment trust's stock valued at $364,066,000 after buying an additional 189,949 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its stake in Extra Space Storage by 724.1% in the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,981,799 shares of the real estate investment trust's stock valued at $357,100,000 after buying an additional 1,741,320 shares during the period. Hamlin Capital Management LLC raised its position in Extra Space Storage by 11.1% during the 4th quarter. Hamlin Capital Management LLC now owns 850,800 shares of the real estate investment trust's stock worth $127,280,000 after buying an additional 84,757 shares during the last quarter. Finally, Sumitomo Mitsui Trust Group Inc. lifted its stake in shares of Extra Space Storage by 1.0% in the 4th quarter. Sumitomo Mitsui Trust Group Inc. now owns 806,509 shares of the real estate investment trust's stock worth $120,654,000 after acquiring an additional 8,090 shares during the period. Institutional investors and hedge funds own 99.11% of the company's stock.

Insider Activity at Extra Space Storage

In other Extra Space Storage news, CEO Joseph D. Margolis sold 7,500 shares of the company's stock in a transaction dated Thursday, January 2nd. The shares were sold at an average price of $148.01, for a total value of $1,110,075.00. Following the transaction, the chief executive officer now directly owns 16,690 shares in the company, valued at approximately $2,470,286.90. This represents a 31.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, EVP William N. Springer sold 1,220 shares of Extra Space Storage stock in a transaction dated Friday, February 28th. The stock was sold at an average price of $152.66, for a total transaction of $186,245.20. Following the sale, the executive vice president now owns 20,158 shares of the company's stock, valued at approximately $3,077,320.28. This trade represents a 5.71 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 1.36% of the company's stock.

Extra Space Storage Stock Performance

NYSE:EXR opened at $157.24 on Thursday. The company has a current ratio of 0.23, a quick ratio of 0.23 and a debt-to-equity ratio of 0.77. The company has a market capitalization of $33.33 billion, a P/E ratio of 41.16, a price-to-earnings-growth ratio of 7.76 and a beta of 0.91. The firm has a 50-day moving average price of $152.63 and a two-hundred day moving average price of $163.21. Extra Space Storage Inc. has a twelve month low of $131.02 and a twelve month high of $184.87.

Extra Space Storage (NYSE:EXR - Get Free Report) last issued its quarterly earnings data on Tuesday, February 25th. The real estate investment trust reported $2.03 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.10 by $0.93. Extra Space Storage had a return on equity of 5.51% and a net margin of 25.35%. The firm had revenue of $821.90 million during the quarter, compared to the consensus estimate of $707.34 million. As a group, research analysts expect that Extra Space Storage Inc. will post 8.1 earnings per share for the current fiscal year.

Extra Space Storage Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, March 31st. Stockholders of record on Friday, March 14th will be given a $1.62 dividend. The ex-dividend date is Friday, March 14th. This represents a $6.48 annualized dividend and a dividend yield of 4.12%. Extra Space Storage's dividend payout ratio is currently 160.40%.

Analyst Upgrades and Downgrades

A number of brokerages have recently issued reports on EXR. Barclays dropped their price target on shares of Extra Space Storage from $192.00 to $184.00 and set an "overweight" rating on the stock in a research note on Monday, January 13th. Scotiabank dropped their target price on Extra Space Storage from $167.00 to $165.00 and set a "sector perform" rating on the stock in a research report on Wednesday. Wells Fargo & Company reduced their price target on Extra Space Storage from $170.00 to $165.00 and set an "equal weight" rating for the company in a report on Friday, February 21st. Royal Bank of Canada dropped their price objective on Extra Space Storage from $167.00 to $163.00 and set a "sector perform" rating on the stock in a report on Thursday, February 27th. Finally, Truist Financial raised their target price on Extra Space Storage from $167.00 to $168.00 and gave the company a "hold" rating in a report on Thursday, December 5th. One equities research analyst has rated the stock with a sell rating, seven have issued a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average price target of $171.36.

Check Out Our Latest Stock Analysis on Extra Space Storage

Extra Space Storage Company Profile

(

Free Report)

Extra Space Storage Inc, headquartered in Salt Lake City, Utah, is a self-administered and self-managed REIT and a member of the S&P 500. As of December 31, 2023, the Company owned and/or operated 3,714 self-storage stores in 42 states and Washington, DC The Company's stores comprise approximately 2.6 million units and approximately 283.0 million square feet of rentable space operating under the Extra Space, Life Storage and Storage Express brands.

See Also

Want to see what other hedge funds are holding EXR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Extra Space Storage Inc. (NYSE:EXR - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Extra Space Storage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Extra Space Storage wasn't on the list.

While Extra Space Storage currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report