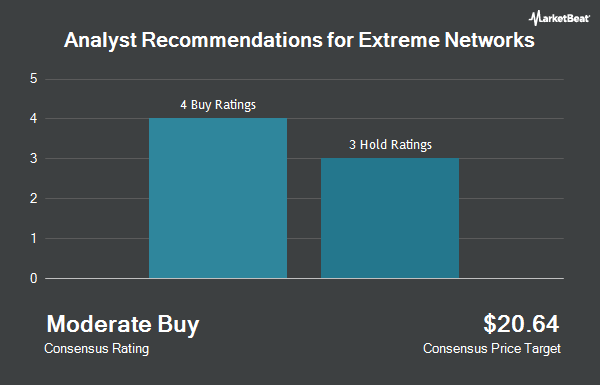

Extreme Networks, Inc. (NASDAQ:EXTR - Get Free Report) has received an average rating of "Moderate Buy" from the six brokerages that are covering the stock, MarketBeat.com reports. Two analysts have rated the stock with a hold rating and four have given a buy rating to the company. The average twelve-month price objective among analysts that have covered the stock in the last year is $19.25.

A number of equities analysts have recently issued reports on EXTR shares. B. Riley increased their target price on Extreme Networks from $18.00 to $21.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Rosenblatt Securities raised their target price on Extreme Networks from $21.00 to $22.00 and gave the company a "buy" rating in a report on Thursday. Needham & Company LLC restated a "buy" rating and set a $20.00 target price on shares of Extreme Networks in a research report on Thursday. Craig Hallum increased their price target on shares of Extreme Networks from $17.00 to $22.50 and gave the company a "buy" rating in a report on Thursday, October 31st. Finally, StockNews.com raised shares of Extreme Networks from a "hold" rating to a "buy" rating in a report on Thursday, December 19th.

Check Out Our Latest Stock Analysis on Extreme Networks

Extreme Networks Stock Performance

NASDAQ:EXTR traded up $0.12 during midday trading on Tuesday, reaching $15.72. The stock had a trading volume of 635,534 shares, compared to its average volume of 960,849. The company has a quick ratio of 0.63, a current ratio of 0.91 and a debt-to-equity ratio of 5.33. The stock has a market cap of $2.08 billion, a P/E ratio of -16.70, a P/E/G ratio of 3.44 and a beta of 1.75. The firm has a fifty day simple moving average of $17.19 and a two-hundred day simple moving average of $15.59. Extreme Networks has a 12-month low of $10.49 and a 12-month high of $19.24.

Extreme Networks (NASDAQ:EXTR - Get Free Report) last issued its quarterly earnings results on Wednesday, January 29th. The technology company reported $0.11 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.18 by ($0.07). Extreme Networks had a negative return on equity of 117.77% and a negative net margin of 11.98%. On average, equities analysts expect that Extreme Networks will post 0.27 EPS for the current year.

Insider Activity

In related news, Director Charles Carinalli sold 5,000 shares of the firm's stock in a transaction that occurred on Monday, November 25th. The shares were sold at an average price of $16.70, for a total transaction of $83,500.00. Following the sale, the director now owns 366,793 shares in the company, valued at approximately $6,125,443.10. This trade represents a 1.34 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Company insiders own 3.70% of the company's stock.

Institutional Investors Weigh In On Extreme Networks

Hedge funds and other institutional investors have recently made changes to their positions in the business. Principal Financial Group Inc. boosted its stake in Extreme Networks by 4.4% in the 4th quarter. Principal Financial Group Inc. now owns 642,531 shares of the technology company's stock worth $10,756,000 after buying an additional 26,853 shares during the last quarter. Rhumbline Advisers increased its position in Extreme Networks by 1.3% during the fourth quarter. Rhumbline Advisers now owns 372,591 shares of the technology company's stock worth $6,237,000 after purchasing an additional 4,610 shares during the last quarter. Legato Capital Management LLC raised its stake in Extreme Networks by 225.2% during the fourth quarter. Legato Capital Management LLC now owns 107,948 shares of the technology company's stock worth $1,807,000 after purchasing an additional 74,758 shares during the period. Louisiana State Employees Retirement System boosted its holdings in shares of Extreme Networks by 1.4% in the 4th quarter. Louisiana State Employees Retirement System now owns 63,900 shares of the technology company's stock valued at $1,070,000 after purchasing an additional 900 shares during the last quarter. Finally, Byrne Asset Management LLC purchased a new stake in shares of Extreme Networks during the 4th quarter valued at $30,000. Hedge funds and other institutional investors own 91.05% of the company's stock.

About Extreme Networks

(

Get Free ReportExtreme Networks, Inc delivers cloud-driven networking solutions that leverage the powers of machine learning, artificial intelligence, analytics, and automation.

The company designs, develops, and manufactures wired and wireless network infrastructure equipment and develops the software for network management, policy, analytics, security, and access controls.

Read More

Before you consider Extreme Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Extreme Networks wasn't on the list.

While Extreme Networks currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.