Extreme Networks (NASDAQ:EXTR - Get Free Report) was upgraded by StockNews.com from a "hold" rating to a "buy" rating in a research note issued on Thursday.

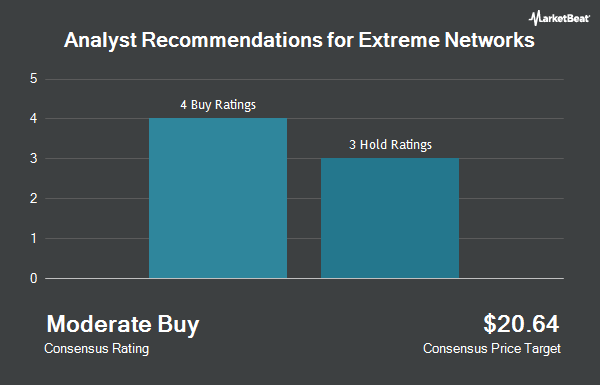

Several other brokerages have also recently weighed in on EXTR. Craig Hallum raised their price target on shares of Extreme Networks from $17.00 to $22.50 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Rosenblatt Securities restated a "buy" rating and set a $21.00 target price on shares of Extreme Networks in a report on Wednesday, November 6th. Finally, B. Riley lifted their price target on shares of Extreme Networks from $18.00 to $21.00 and gave the company a "buy" rating in a research note on Thursday, October 31st. One investment analyst has rated the stock with a hold rating and five have given a buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $19.00.

Get Our Latest Analysis on Extreme Networks

Extreme Networks Stock Up 1.8 %

Shares of EXTR stock traded up $0.32 on Thursday, hitting $17.72. 688,628 shares of the stock were exchanged, compared to its average volume of 1,763,551. The business has a 50-day moving average of $16.20 and a 200 day moving average of $14.66. Extreme Networks has a fifty-two week low of $10.49 and a fifty-two week high of $19.24. The firm has a market capitalization of $2.34 billion, a P/E ratio of -18.27, a price-to-earnings-growth ratio of 3.87 and a beta of 1.76. The company has a current ratio of 0.91, a quick ratio of 0.63 and a debt-to-equity ratio of 5.33.

Insider Transactions at Extreme Networks

In related news, Director Charles Carinalli sold 5,000 shares of the business's stock in a transaction that occurred on Monday, November 25th. The stock was sold at an average price of $16.70, for a total value of $83,500.00. Following the completion of the sale, the director now directly owns 366,793 shares in the company, valued at approximately $6,125,443.10. The trade was a 1.34 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through this link. Also, CEO Edward Meyercord sold 35,725 shares of the firm's stock in a transaction on Friday, November 1st. The stock was sold at an average price of $14.96, for a total value of $534,446.00. Following the transaction, the chief executive officer now owns 1,448,378 shares in the company, valued at approximately $21,667,734.88. This trade represents a 2.41 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 91,450 shares of company stock valued at $1,390,490. 3.70% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On Extreme Networks

Several institutional investors and hedge funds have recently added to or reduced their stakes in the business. Victory Capital Management Inc. increased its stake in shares of Extreme Networks by 318.7% in the 3rd quarter. Victory Capital Management Inc. now owns 4,466,031 shares of the technology company's stock valued at $67,124,000 after purchasing an additional 3,399,288 shares during the last quarter. William Blair Investment Management LLC acquired a new stake in shares of Extreme Networks in the 2nd quarter valued at approximately $25,409,000. Rubric Capital Management LP grew its holdings in shares of Extreme Networks by 52.3% during the 2nd quarter. Rubric Capital Management LP now owns 5,254,744 shares of the technology company's stock valued at $70,676,000 after purchasing an additional 1,804,744 shares during the last quarter. Portolan Capital Management LLC increased its position in Extreme Networks by 194.6% during the 3rd quarter. Portolan Capital Management LLC now owns 1,060,828 shares of the technology company's stock worth $15,944,000 after purchasing an additional 700,724 shares in the last quarter. Finally, Healthcare of Ontario Pension Plan Trust Fund lifted its stake in Extreme Networks by 265.8% in the 2nd quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 731,500 shares of the technology company's stock valued at $9,839,000 after purchasing an additional 531,500 shares during the last quarter. 91.05% of the stock is currently owned by institutional investors.

Extreme Networks Company Profile

(

Get Free Report)

Extreme Networks, Inc delivers cloud-driven networking solutions that leverage the powers of machine learning, artificial intelligence, analytics, and automation.

The company designs, develops, and manufactures wired and wireless network infrastructure equipment and develops the software for network management, policy, analytics, security, and access controls.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Extreme Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Extreme Networks wasn't on the list.

While Extreme Networks currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.