Intech Investment Management LLC trimmed its stake in shares of Exxon Mobil Co. (NYSE:XOM - Free Report) by 16.5% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 514,083 shares of the oil and gas company's stock after selling 101,225 shares during the period. Exxon Mobil comprises about 0.7% of Intech Investment Management LLC's holdings, making the stock its 20th biggest position. Intech Investment Management LLC's holdings in Exxon Mobil were worth $60,261,000 at the end of the most recent reporting period.

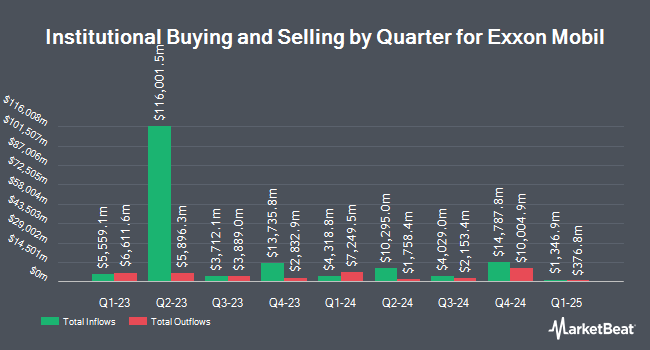

A number of other hedge funds and other institutional investors also recently modified their holdings of XOM. WFA Asset Management Corp increased its stake in shares of Exxon Mobil by 18.2% during the 1st quarter. WFA Asset Management Corp now owns 2,684 shares of the oil and gas company's stock worth $312,000 after purchasing an additional 414 shares in the last quarter. China Universal Asset Management Co. Ltd. purchased a new position in shares of Exxon Mobil during the 1st quarter worth approximately $933,000. Capital Group Private Client Services Inc. increased its stake in shares of Exxon Mobil by 829.7% during the 1st quarter. Capital Group Private Client Services Inc. now owns 124,897 shares of the oil and gas company's stock worth $14,518,000 after purchasing an additional 111,463 shares in the last quarter. Capital International Inc. CA increased its stake in shares of Exxon Mobil by 76.2% during the 1st quarter. Capital International Inc. CA now owns 156,169 shares of the oil and gas company's stock worth $18,153,000 after purchasing an additional 67,531 shares in the last quarter. Finally, Capital International Sarl purchased a new position in shares of Exxon Mobil during the 1st quarter worth approximately $358,000. 61.80% of the stock is currently owned by institutional investors and hedge funds.

Exxon Mobil Stock Performance

NYSE:XOM opened at $120.35 on Thursday. The company has a current ratio of 1.35, a quick ratio of 1.01 and a debt-to-equity ratio of 0.13. The firm has a market capitalization of $528.95 billion, a price-to-earnings ratio of 14.99, a PEG ratio of 4.97 and a beta of 0.90. The firm's fifty day simple moving average is $118.96 and its 200 day simple moving average is $116.47. Exxon Mobil Co. has a twelve month low of $95.77 and a twelve month high of $126.34.

Exxon Mobil (NYSE:XOM - Get Free Report) last posted its earnings results on Friday, November 1st. The oil and gas company reported $1.92 earnings per share for the quarter, beating the consensus estimate of $1.91 by $0.01. The business had revenue of $90.02 billion for the quarter, compared to analyst estimates of $93.98 billion. Exxon Mobil had a net margin of 9.61% and a return on equity of 14.73%. The business's quarterly revenue was down .8% on a year-over-year basis. During the same quarter in the previous year, the business posted $2.27 EPS. As a group, equities research analysts expect that Exxon Mobil Co. will post 7.95 earnings per share for the current fiscal year.

Exxon Mobil Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Thursday, November 14th will be issued a $0.99 dividend. The ex-dividend date of this dividend is Thursday, November 14th. This represents a $3.96 dividend on an annualized basis and a yield of 3.29%. This is a positive change from Exxon Mobil's previous quarterly dividend of $0.95. Exxon Mobil's payout ratio is currently 49.32%.

Wall Street Analyst Weigh In

Several research firms have commented on XOM. Wolfe Research lifted their target price on shares of Exxon Mobil from $137.00 to $138.00 in a research note on Thursday, October 31st. Evercore ISI raised shares of Exxon Mobil to a "strong-buy" rating in a research note on Monday, August 5th. Mizuho lifted their target price on shares of Exxon Mobil from $128.00 to $130.00 and gave the stock a "neutral" rating in a research note on Monday, September 16th. JPMorgan Chase & Co. lifted their target price on shares of Exxon Mobil from $127.00 to $128.00 in a research note on Thursday, October 31st. Finally, Redburn Atlantic reaffirmed a "neutral" rating and issued a $120.00 target price (up from $119.00) on shares of Exxon Mobil in a research note on Tuesday, September 24th. One investment analyst has rated the stock with a sell rating, eight have given a hold rating, ten have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $130.21.

Check Out Our Latest Research Report on XOM

About Exxon Mobil

(

Free Report)

Exxon Mobil Corporation engages in the exploration and production of crude oil and natural gas in the United States and internationally. It operates through Upstream, Energy Products, Chemical Products, and Specialty Products segments. The Upstream segment explores for and produces crude oil and natural gas.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Exxon Mobil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Exxon Mobil wasn't on the list.

While Exxon Mobil currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.