EyePoint Pharmaceuticals (NASDAQ:EYPT - Free Report) had its price target lowered by HC Wainwright from $30.00 to $22.00 in a research note published on Monday,Benzinga reports. The brokerage currently has a buy rating on the stock.

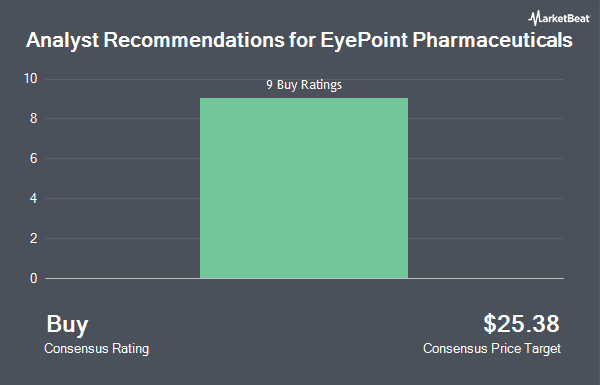

Other analysts also recently issued reports about the company. Scotiabank initiated coverage on shares of EyePoint Pharmaceuticals in a research note on Wednesday, October 16th. They set a "sector outperform" rating and a $18.00 target price for the company. JPMorgan Chase & Co. cut their price target on shares of EyePoint Pharmaceuticals from $32.00 to $29.00 and set an "overweight" rating on the stock in a research note on Tuesday, August 13th. StockNews.com upgraded EyePoint Pharmaceuticals to a "sell" rating in a research note on Saturday, September 21st. Jefferies Financial Group assumed coverage on EyePoint Pharmaceuticals in a research note on Wednesday, August 28th. They set a "buy" rating and a $15.00 price target for the company. Finally, Chardan Capital lifted their price target on shares of EyePoint Pharmaceuticals from $28.00 to $33.00 and gave the company a "buy" rating in a research report on Friday. One investment analyst has rated the stock with a sell rating and nine have given a buy rating to the company's stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $28.00.

View Our Latest Stock Report on EYPT

EyePoint Pharmaceuticals Price Performance

EyePoint Pharmaceuticals stock traded up $0.38 during mid-day trading on Monday, reaching $12.01. 387,666 shares of the stock traded hands, compared to its average volume of 937,755. The business's 50-day moving average is $9.50 and its 200-day moving average is $9.97. The stock has a market capitalization of $642.78 million, a PE ratio of -5.82 and a beta of 1.50. EyePoint Pharmaceuticals has a 12-month low of $5.86 and a 12-month high of $30.99.

Hedge Funds Weigh In On EyePoint Pharmaceuticals

Large investors have recently bought and sold shares of the stock. Vanguard Group Inc. raised its position in shares of EyePoint Pharmaceuticals by 17.8% in the first quarter. Vanguard Group Inc. now owns 2,396,228 shares of the company's stock worth $49,530,000 after buying an additional 362,168 shares in the last quarter. RA Capital Management L.P. purchased a new position in EyePoint Pharmaceuticals in the first quarter valued at about $19,401,000. Deerfield Management Company L.P. Series C grew its stake in shares of EyePoint Pharmaceuticals by 51.4% during the second quarter. Deerfield Management Company L.P. Series C now owns 877,790 shares of the company's stock valued at $7,637,000 after acquiring an additional 298,196 shares in the last quarter. Fiera Capital Corp grew its stake in EyePoint Pharmaceuticals by 0.9% in the second quarter. Fiera Capital Corp now owns 677,038 shares of the company's stock worth $5,890,000 after purchasing an additional 5,920 shares in the last quarter. Finally, Perceptive Advisors LLC lifted its holdings in EyePoint Pharmaceuticals by 8.6% in the second quarter. Perceptive Advisors LLC now owns 640,274 shares of the company's stock worth $5,570,000 after acquiring an additional 50,628 shares during the last quarter. 99.41% of the stock is currently owned by institutional investors.

About EyePoint Pharmaceuticals

(

Get Free Report)

EyePoint Pharmaceuticals, Inc, a clinical-stage biopharmaceutical company, engages in developing and commercializing therapeutics to improve the lives of patients with serious retinal diseases. The company's pipeline leverages its proprietary bioerodible Durasert E technology for sustained intraocular drug delivery.

Featured Stories

Before you consider EyePoint Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EyePoint Pharmaceuticals wasn't on the list.

While EyePoint Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.