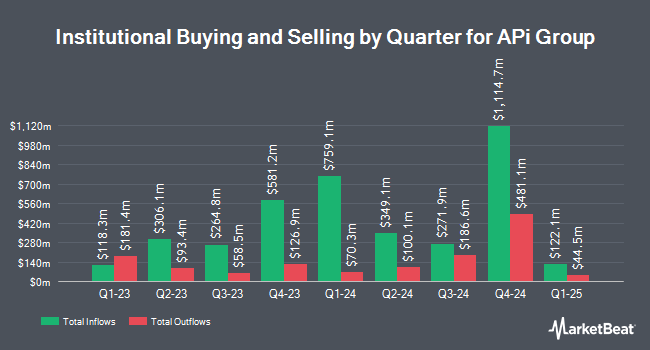

F M Investments LLC purchased a new stake in shares of APi Group Co. (NYSE:APG - Free Report) in the 4th quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm purchased 11,454 shares of the company's stock, valued at approximately $412,000.

Several other institutional investors and hedge funds have also recently modified their holdings of the stock. Vanguard Group Inc. grew its holdings in shares of APi Group by 0.6% during the fourth quarter. Vanguard Group Inc. now owns 23,124,584 shares of the company's stock valued at $831,791,000 after buying an additional 127,038 shares during the last quarter. Cooke & Bieler LP boosted its stake in APi Group by 3.4% during the 4th quarter. Cooke & Bieler LP now owns 4,020,768 shares of the company's stock valued at $144,627,000 after purchasing an additional 132,713 shares during the last quarter. Geode Capital Management LLC boosted its stake in APi Group by 2.9% during the 3rd quarter. Geode Capital Management LLC now owns 3,730,499 shares of the company's stock valued at $123,217,000 after purchasing an additional 106,119 shares during the last quarter. State Street Corp raised its stake in shares of APi Group by 3.7% in the third quarter. State Street Corp now owns 3,723,241 shares of the company's stock worth $122,941,000 after purchasing an additional 132,971 shares during the last quarter. Finally, Artisan Partners Limited Partnership purchased a new position in shares of APi Group in the fourth quarter worth $125,407,000. 86.62% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

APG has been the subject of several research analyst reports. UBS Group reduced their price objective on APi Group from $45.00 to $44.00 and set a "buy" rating for the company in a report on Tuesday, February 18th. Citigroup decreased their price objective on shares of APi Group from $46.00 to $42.00 and set a "buy" rating for the company in a report on Monday. Truist Financial restated a "buy" rating and issued a $48.00 target price (up previously from $45.00) on shares of APi Group in a report on Thursday, February 27th. Robert W. Baird boosted their target price on shares of APi Group from $40.00 to $46.00 and gave the company an "outperform" rating in a research note on Thursday, February 27th. Finally, Barclays dropped their price target on APi Group from $44.00 to $43.00 and set an "overweight" rating on the stock in a research note on Wednesday, March 26th. One investment analyst has rated the stock with a hold rating and seven have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $43.14.

Get Our Latest Report on APG

Insider Buying and Selling

In other news, Director James E. Lillie sold 50,000 shares of the firm's stock in a transaction dated Monday, March 3rd. The stock was sold at an average price of $37.97, for a total value of $1,898,500.00. Following the transaction, the director now owns 1,046,203 shares of the company's stock, valued at $39,724,327.91. This trade represents a 4.56 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. 18.20% of the stock is owned by insiders.

APi Group Stock Performance

Shares of APi Group stock traded up $0.43 on Tuesday, hitting $35.78. 2,059,422 shares of the company's stock were exchanged, compared to its average volume of 1,704,094. APi Group Co. has a 1 year low of $30.76 and a 1 year high of $41.31. The company has a 50-day simple moving average of $36.90 and a 200-day simple moving average of $36.38. The company has a debt-to-equity ratio of 0.96, a quick ratio of 1.42 and a current ratio of 1.51. The stock has a market capitalization of $9.88 billion, a PE ratio of -18.16 and a beta of 1.55.

APi Group Profile

(

Free Report)

APi Group Corporation provides safety and specialty services worldwide. It operates through Safety Services and Specialty Services segments. The Safety Services segment offers solutions focusing on end-to-end integrated occupancy systems, such as fire protection services; heating, ventilation, and air conditioning solutions; and entry systems, which include the design, installation, inspection, and service of these integrated systems.

Featured Articles

Before you consider APi Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and APi Group wasn't on the list.

While APi Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.